John Hussman on Recent Developments We always look forward to John Hussman’s weekly missive on the markets. Some people say that he is a “permabear”, but we don’t think that is a fair characterization. He is rightly wary of the stock market’s historically extremely high valuation and the loose monetary policy driving the surge in asset prices. As he reminds his readers in this week’s market comment, he altered his...

Read More »Politics and Violence

Preposterous Lies Elizabeth received a strange letter from her congressman. “We have to be on guard against our enemies… and not be afraid to name them.” A brave, forthright stand? But wait, he didn’t name the enemies. That left us wondering: Who are our enemies? Muslims, Jews, Arabs… Russians, Iranians, North Koreans… capitalists, the Deep State, Yankees… liberals, conservatives? And what does he mean by “our”? A...

Read More »FX Weekly Preview: Next Week’s Two Bookends

Germany The start of next week will likely be driven by Deutsche Bank’s travails and dollar funding pressures, which may or may not be related. The end of the week features the US monthly jobs report. Despite being a noisy, high frequency time series subject to significant revisions, this report like none other can drive expectations of Fed policy. Deutsche Bank is faced with two challenges: its business and several...

Read More »FX Daily, September 29: Dollar Quietly Bid, while Market is Skeptical of OPEC Deal

Swiss Franc The EUR/CHF has fallen to 1.0862, the downwards tendency since one day before the SNB monetary assessment meeting has continued. Click to enlarge. FX Rates The US dollar has firmer against most major and emerging market currencies. It remains well within its well-worn ranges, which continue to be narrow. A notable exception today is the yen’s weakness. While the majors are mostly off marginally and now...

Read More »Quick Look at Why the September Jobs Data will Likely Be Strong

Summary: There are several economic data points that suggest a healthy gain in jobs in September. College educated unemployment is 2.5% with high school graduate unemployment at 5.5%. The jobs report we expect is consistent with a Fed hike in December. Let’s admit that the monthly non-farm payroll report is among the most difficult for economists to forecast. The are not many reliable inputs as it is the first...

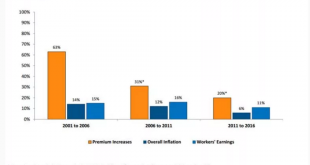

Read More »Great Graphic: Growth in Premiums of Employer-Sponsored Health Insurance

Upward pressure on US consumer prices is stemming from two elements. Rents and medical services. Due to the differences the composition of the basket of goods and services that are used, the core personal consumption deflator, which the Fed targets, typically lags behind core CPI. At is time of year, the concern tends to be on health care costs and premiums. Many US employees are given “open enrollment” when they can...

Read More »You Want to Fix the Economy? Then First Fix Healthcare

We don’t just deserve an affordable, sustainable healthcare system–we’re doomed to bankruptcy without one. What is blindingly obvious to employers but apparently invisible to the average zero-business-experience mainstream pundit is this: if you want to fix the economy, you must first fix healthcare. If you want to pinpoint a primary reason why U.S. enterprises shift jobs overseas, you have to start with skyrocketing...

Read More »Donald’s Electoral Struggle

Wicked and Terrible After touting her pro-labor union record, the Wicked Witch of Chappaqua rhetorically asked, “why am I not 50 points ahead?” Her chief rival bluntly responded: “because you’re terrible.”* No truer words have been uttered by any of the candidates about one of their opponents since the start of this extraordinary presidential campaign! Electoral map, Donald Trump(see more posts on Donald Trump,...

Read More »Switzerland, UBS Consumption Indicator

The Swiss consumption indicator by UBS shows improvements. The indicator is still distant from the highs in 2012. At the time stronger growth in Emerging Markets and the weaker franc helped the Swiss economy. The UBS Consumption Indicator rose to 1.53 points in August from 1.45. This development was fueled by resurging tourism and above-average car sales for the month. However, the situation on the labor market casts...

Read More »FX Daily, September 28: Dollar Mostly Firmer, but Going Nowhere Quickly

Swiss Franc Click to enlarge. FX Rates The US dollar is enjoying a firmer bias today, but it remains narrowly mixed on the week. It is within well-worn ranges. Of the several themes that investors are focused on, there have not significant fresh developments. In terms of monetary policy, both Draghi and Yellen speak today. The former is behind closed doors with a Germany parliamentary committee. While Draghi’s...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org