Rajasthan has one of the highest maternal and newborn mortality rates in India (Keystone) - Click to enlarge The Zurich-based UBS Optimus Foundation has announced the launch of the first Development Impact Bond (DIB) in the field of healthcare. If successful, it could save over 10,000 lives in India. The foundation, which is the philanthropic arm of the Swiss bank UBS, will invest a total of $3.5 million...

Read More »Low Cost Gold In The Age Of QE, AI, Trump and War

Key topics in the video: – A bullion dealers view on ‘What will drive the markets in 2018?’– QE, inflation, Fed rates, debt bomb, China, populism, EU cohesion, Brexit, digital disruption, cashless society, demographics, Trump (war), Artificial intelligence (AI)– Solve global debt crisis with humongous amount of debt!?– Inflation – U.S. health insurance has increased 13% per annum since – How Artificial Intelligence...

Read More »Stock Market 2018: The Tao vs. Central Banks

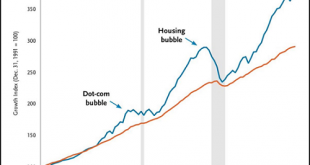

The central banks claim omnipotent financial powers, and their comeuppance is overdue. I will be the first to admit that invoking the woo-woo of the Tao as the reason to expect a reversal of the stock market in 2018 smacks of Bearish desperation. With everything coming up roses in much of the global economy, there is precious little foundation for calling a tumultuous end to the global Bull Market other than variations...

Read More »Emerging Markets: Preview of the Week Ahead

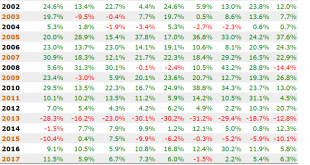

Stock Markets EM FX ended the week on a mixed note. US jobs data may refocus market attention on Fed tightening. Most EM inflation readings this week are expected to show easing price pressures, supporting a dovish EM central bank outlook. The major exceptions are Mexico and Turkey, whose central banks may be forced to tighten policy in the coming weeks. Stock Markets Emerging Markets, November 29 Source:...

Read More »FX Weekly Preview: Politics may Continue to Overshadow Economics

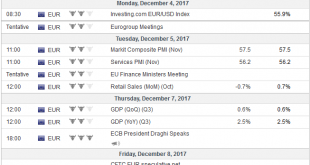

The new monthly cycle of high frequency economic data has begun. The manufacturing PMI shows the synchronized global recovery is continuing. The service sector and composite PMI will be reported in the week ahead. They are unlikely altering the general expectation for robust growth in Q4. Even the disappointing US auto sales (17.35 mln seasonally-adjusted annual pace vs. expectations for 17.5 mln and 18.0 mln in...

Read More »Beer sales slowly dry up in Switzerland

Swiss beer fans can enjoy an increasingly diverse selection (Keystone/Angelika Warmuth) - Click to enlarge The amount of beer consumed in Switzerland declined last year, as it did for wine. Yet the number of specialist craft microbreweries continues to rise. Between October 2016 and September 2017, the Swiss drank 461 million litres of beer (54.5 litres per person) – down 0.2% on the previous reporting...

Read More »Swiss village offering to pay people to live there inundated with applications

After the Swiss mountain village of Albinen hatched a plan to pay parents (CHF 25,000 each) and children (CHF 10,000 each) to move there, it has been inundated with applicants. Articles about the offer have been published by Time, The Sunday Times, The Sun, El Pais, and many other publications. Rather than celebrating, the picturesque town’s administration is unhappy. It published a statement on its website accusing...

Read More »Bitcoin Tops $10,100 – Fed’s Powell Says “Cryptocurrencies Just Don’t Matter”

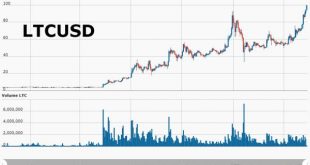

Update: Cryptocurrencies are widely bid tonight with Bitcoin over $10,150, Ether holding $475, and LiteCoin topping $100 for the first time… LiteCoin Price in USD, Mar - Nov 2017(see more posts on Litecoin, ) - Click to enlarge Bitcoin has now soared over 20% since Black Friday’s close, topping $10,000 for the first time in history (rising from $9,000 in just 2 days)… now up over 950% year-to-date. image courtesy...

Read More »Own Gold Bullion To “Support National Security” – Russian Central Bank

– We own gold bullion to “support national security” – Russian Central Bank– Russia warns Washington: Confiscating fx reserves would be “declaration of financial war” – Russia has quadrupled its gold bullion reserves in decade – BRICs discussing ‘the possibility of establishing a single (system of) gold trade’ – Russia, China & maybe Saudi Arabia form alliances to unseat petrodollar – Putin warns state-owned and...

Read More »Did Anyone Do Even a Minimal Check on the Sensationalist Bitcoin Electrical Consumption Story?

Check the context before uncritically accepting sensationalist conclusions. Let’s start with a primer on how to write a sensationalist story that can be passed off as “journalism:” 1. Locate credible-sounding data that can be de-contextualized, i.e. sensationalized. 2. Present the data as “fact” rather than data that requires verification by disinterested researchers. 3. Exaggerate the data as much as possible and set...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org