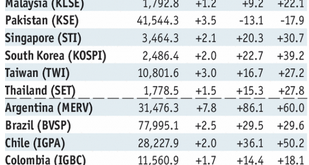

Stock Markets EM FX was mostly firmer last week, but ended on a mixed note Friday. Best performers on the week for COP, MXN, and BRL while the worst were ARS, PHP, and CNY. We continue to warn investors against blindly buying into this broad-based EM rally, as we believe divergences will once again assert themselves in the coming weeks. Stock Markets Emerging Markets, January 03 Source: economist.com - Click...

Read More »Italian Election–Two Months and Counting

- Click to enlarge Germany does not have a government, though the election was more than three months ago. Spain, Portugal, and Ireland have minority governments. Austria is the first government since the financial crisis to include the populist right. The EU is trying to press the Visegrad group of central European countries to conform to the values of Western European members. And yet it is Italian politics...

Read More »Palladium Prices Surge To New Record High Over $1,100 On Supply Crunch Concerns

– Palladium prices surge to new record high over $1,100/oz today – Palladium surges past record nominal price seen in 2001 after 55% surge in 2017– Best-performing precious metal and commodity of 2017 is palladium – Palladium prices top platinum prices for first time in 16 years– Strong Chinese car demand and switch from diesel to petrol cars sees demand surge– Supply crunch as six year supply deficit & 2017...

Read More »If Bitcoin Is A Bubble…

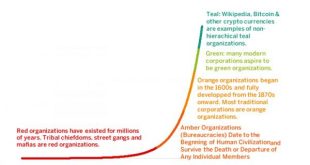

Our earlier articles on bitcoin discuss the crypto asset as a currency and a commodity. Both papers focused on the consequences of bitcoin’s defining feature: the asymptotic supply limit of 21 million coins. This gives it an unusual juxtaposition of demand uncertainty and supply certainty (as well as inelasticity). As a currency, it gives rise to a tension between its use as a store of value and as medium of exchange....

Read More »The Great Risk of So Many Dinosaurs

The Treasury Borrowing Advisory Committee (TBAC) was established a long time ago in the maelstrom of World War II budgetary as well as wartime conflagration. That made sense. To fight all over the world, the government required creative help in figuring out how to sell an amount of bonds it hadn’t needed (in proportional terms) since the Civil War. A twenty-person committee made up of money dealer bank professionals...

Read More »It’s A Wonderful Life Is A Wonderful Lesson To Hold Gold Outside of The Banking System

It’s A Wonderful Life Is A Wonderful Lesson To Hold Gold Outside of The Banking System – Christmas film serves as reminder that savings are not guaranteed protection by banks – Savers are today more exposed to banking risks than ever before – Gold and silver investment reduce exposure to counterparty risks seen in financial system – Basket of Christmas goods has climbed since 2016 thanks to 11% climb in gold price...

Read More »Swiss court stops handover of bank employee details to US

Unlocked boxes: Swiss banking secrecy is not what it used to be. (Keystone) - Click to enlarge Switzerland’s highest court has ruled against the transfer of details of third parties such as bank employees or solicitors in cases of information handovers involving tax dodgers. Wednesday’s ruling by the Federal Court upheld an earlier decision in a case brought by a US expat in Switzerland who disputed the...

Read More »Emerging Markets: What Changed

Summary Tensions on the Korean peninsula appear to be easing. Relations between Pakistan and the US have worsened. The Philippine central bank is tilting more hawkish. The ANC may consider removing Zuma from the presidency at the January 10 meeting of its National Executive Committee. Turkish banker Atilla was convicted of helping Iran evade US financial sanctions. Argentina sold $9 bln of dollar-denominated external...

Read More »Why the Financial System Will Break: You Can’t “Normalize” Markets that Depend on Extreme Monetary Stimulus

Central banks are now trapped. In a nutshell, central banks are promising to “normalize” their monetary policy extremes in 2018. Nice, but there’s a problem: you can’t “normalize” markets that are now entirely dependent on extremes of monetary stimulus. Attempts to “normalize” will break the markets and the financial system. Let’s start with the core dynamic of the global economy and nosebleed-valuation markets:...

Read More »FX Daily, January 05: Dollar Given Reprieve Ahead of Employment Report

Swiss Franc The Euro has risen by 0.04% to 1.1753 CHF. EUR/CHF and USD/CHF, January 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates As the US dollar finished last year, so too did it begin the New Year, and after extending its losses, the bears have paused. Technical factors had been stretched, but it appears to have been old-fashioned macroeconomic considerations to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org