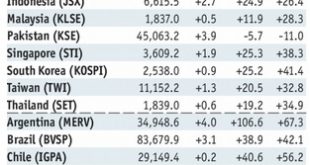

Stock Markets EM FX ended Friday mixed, and capped off a mixed week overall as the dollar’s broad-based rally was sidetracked. EM may start the week on an upbeat after PBOC cut reserve requirements over the weekend. Best EM performers last week were ARS, MXN, and TRY while the worst were THB, IDR, and BRL. Stock Markets Emerging Markets, June 20 - Click to enlarge Indonesia Indonesia reports May trade Monday....

Read More »Emerging Market Preview: Week Ahead

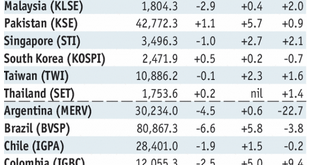

Stock Markets EM FX has started the week mixed. Some relief was seen as US rates stalled out last week, but this Friday’s jobs number could be key for the next leg of this dollar rally. On Wednesday, the Fed releases its Beige book for the upcoming June 13 FOMC meeting, where a 25 bp hike is widely expected. We believe EM FX remains vulnerable to further losses. Stock Markets Emerging Markets, May 23 Source:...

Read More »Emerging Markets: Week Ahead Preview

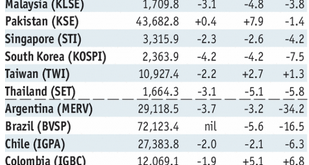

Stock Markets EM FX ended Friday on a weak note and extended the slide. For the week as a whole, the best EM performers were PHP, TWD, and SGD while the worst were ARS, ZAR, and TRY. With US rates continuing to move higher, we believe selling pressures on EM FX will remain in play this week. Our recently updated EM Vulnerability Table supports our view that divergences within EM will remain. Stock Markets Emerging...

Read More »Emerging Markets: Preview of the Week Ahead

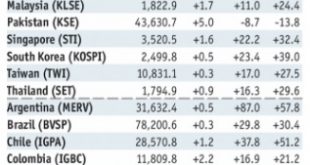

Stock Markets EM FX was mostly stronger last week, despite the dollar’s firm tone against the majors. Best EM performers on the week were MXN, KRW, and COP while the worst were ZAR, INR, and PEN. US jobs data poses the biggest risk to EM this week, as US yields have been falling ahead of the data. Indeed, the current US 10-year yield of 2.74% is the lowest since February 6. We remain cautious on EM FX, and do not think...

Read More »FX Daily, March 27: Global Equities Follow US Lead, Dollar Steadies

Swiss Franc The Euro has fallen by 0.07% to 1.1755 CHF. EUR/CHF and USD/CHF, March 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates We argued that the talk of trade war was exaggerated. The confrontation, strong demands and a climb down is the Art of the Deal, and is part of the way the Trump Administration negotiates. We see striking parallels between the policymakers...

Read More »FX Daily, March 26: Equity Meltdown Aborted, Dollar Eases

Swiss Franc The Euro has risen by 0.43% to 1.1747 CHF. EUR/CHF and USD/CHF, March 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates After a poor start in Asia, equities recovered. The MSCI Asia Pacific initially extended last week’s losses and fell to its lowest level since February 12 before recovering to finish near its highs, 0.4% above last week’s close. European...

Read More »Emerging Markets: Week Ahead Preview

Stock Markets EM FX ended Friday on a mixed note, capping off a largely softer week. Best performers last week for MYR and TWD while the worst were ZAR and ARS. US stocks clawed back early losses and ended the week on a firmer note but we think further market turbulence is likely. Stock Markets Emerging Markets, March 03 Source: economist.com - Click to enlarge Malaysia Malaysia reports January...

Read More »Emerging Markets: What Changed

Summary China plans to change its constitution to eliminate term limits for President Xi Jinping. Bank Indonesia Deputy Governor Perry Warjiyo was nominated by President Widodo to be the next Governor. Bank of Korea Governor Lee was reappointed by President Moon for a second term. Hungary ruling party candidate lost the mayoral vote in Hodmezovasarhely. S&P upgraded Russia to BBB- with stable outlook. South Africa...

Read More »Emerging Markets: What Changed

Summary Korea policymakers have asked state-owned banks and companies to limit the issuance of global bonds. Malaysia’s central bank hiked rates for the first time in four years. Pakistan’s central bank unexpectedly hiked rates for the first time in over four years. Moody’s raised its outlook on Russia’s Ba1 rating from stable to positive. Argentina’s central bank surprised markets with its second straight 75 bp rate...

Read More »Emerging Markets: What Changed

Summary China State Administration of Foreign Exchange (SAFE) disputed press reports that it was slowing or halting purchases of US Treasury bonds. Korean officials warned that it will take stern steps to prevent one-sided currency moves. Bulgaria is talking “intensively” with the ECB and other EU representatives about entering the Exchange Rate Mechanism by mid-year. Hungary announced general elections on April 8....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org