See the introduction and the video for the terms gold basis, co-basis, backwardation and contang Reasons to Buy Gold The price of gold went up $19, and the price of silver 42 cents. The price action occurred on Monday, Wednesday and Friday though so far, only the first two price jumps reversed. We promise to take a look at the intraday action on Friday. File under “reasons to buy gold”: A famous photograph by Henri...

Read More »Gold Price Reacts as Central Banks Start Major Change

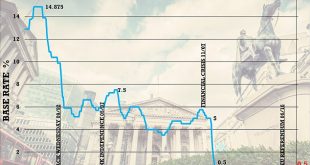

– Bank of England raised interest rates for the first time in ten years – President Trump announces Jerome Powell as his choice to lead the U.S. Federal Reserve – Most investors outside the US Dollar and Euro see gold prices climb after busy week of central bank news – Inflation now at five-year high of 3% – Inflation, low-interest rate, debt crises and bail-ins still threaten savers and pensioners Gold Price in...

Read More »Precious Metals Supply and Demand Report

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Fat-Boy Waves The prices of the metals dropped $17 and $0.35, and the gold-silver ratio rose to 77. A look at the chart of either metal shows that a downtrend in prices (i.e. uptrend in the dollar) that began in mid-April reversed in mid-July. Then the prices began rising (i.e. dollar began falling). But that move ended...

Read More »Precious Metals – Backwardation Profit Taking

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Big News The big news this week is that Donald Trump was elected to be the next president of the United States. Whether due to his comments about restructuring the government debt, tariffs on imported goods, or other economic concerns, many expected news of his election to push up the price of gold. They were wrong....

Read More »Gold loses some of its lustre

While gold prices may not fall back to their end-2015 levels, there are few compelling reasons for a fresh acceleration in the near term. After a strong performance in the first half of this year, gold has been moving within a range of USD1300- USD1375 per troy ounce. While physical supply and demand favour a gradual rise in gold prices over time, some of the main drivers of investment demand (financial stress, inflation, real interest rates, the USD) do not suggest significant upside...

Read More »Gold and Silver Aren’t Getting Stronger

The buck. The Dollar Increases in Value The dollar moved up, though most people would say gold fell about $40, and silver 32 cents. In the mainstream view, the value of the dollar is 1/N (N is the quantity). So how could the dollar go up? Certainly, the quantity keeps on increasing. Our view is different. If you borrow dollars to buy an asset, and the asset doesn’t generate enough yield to pay the interest, you have to sell or default. It should go without saying that it is an...

Read More »What prospects for gold prices?

Macroview After hitting a low point at the end of 2015, fundamentals point to a rise in gold prices--but market conditions suggest the upside potential remains limited Read the full report here After the hefty gains made by gold this year, the attached Flash Note examines what might lie ahead for the precious metal by analysing the five key underlying drivers of gold prices: financial stress, inflation, real interest rates, the US dollar and supply and demand. Our conclusions are as...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org