The big news in gold is two-fold right now; gold hit new all-time highs in several currencies and central bank demand for physical gold remains strong hitting a year-to date record in Q3 this year. Gold at ,000? So whilst the headlines were all about dollar-denominated gold showing us that it’s still destined for levels north of ,000 the real news is about other currencies and gold. Ahead of yesterday’s FOMC announcement the price of the yellow metal hit new all time highs in pretty much most of the major non-dollar currencies. This includes the Euro, British Pound, Chinese Yuan and Japanese Yen. To give more weight to the argument that the dollar is becoming increasingly less significant to the price of gold, the metal barely blinked following

Topics:

Dave Russell considers the following as important: 6a.) GoldCore, 6a) Gold & Monetary Metals, Bank of England, Central Bank, Commentary, commodities, Economics, Featured, Geopolitics, Gold, gold and silver, gold price news, gold prices, inflation, Money, News, newsletter, Precious Metals, silver, silver price, World Trade

This could be interesting, too:

investrends.ch writes Starke Zunahme von Selfmade-Milliardären

investrends.ch writes FT: Investoren warnen vor Kevin Hassett als Fed-Chef

investrends.ch writes SIX will zwei Clearinghäuser zusammen legen

investrends.ch writes Insiderhandel: Fünf SoftwareOne-Kaderleute unter Verdacht auf

The big news in gold is two-fold right now; gold hit new all-time highs in several currencies and central bank demand for physical gold remains strong hitting a year-to date record in Q3 this year.

Gold at $2,000?

So whilst the headlines were all about dollar-denominated gold showing us that it’s still destined for levels north of $2,000 the real news is about other currencies and gold. Ahead of yesterday’s FOMC announcement the price of the yellow metal hit new all time highs in pretty much most of the major non-dollar currencies. This includes the Euro, British Pound, Chinese Yuan and Japanese Yen.

To give more weight to the argument that the dollar is becoming increasingly less significant to the price of gold, the metal barely blinked following the FOMC’s announcement yesterday that it would continue to hold rates.

At the press conference following the FOMC meeting Chairman Powell did confirm the Committee’s bias towards tightening, prompting gold to fall back slightly (to a five-day) low but it quickly recovered to levels seen prior to the announcement.

We continue to see a breakdown in the negative correlation between gold and bond yields. This is most likely because investors are growing increasingly concerned about the fiscal outlook of the U.S. government and its mounting debt, which has topped $33 trillion.

We believe factors beyond the control of the US and Federal Reserve are now placing more weight on gold demand and the price of gold, than previously. Most obvious is events in Gaza but there is also the small issue of central banks everywhere still trying to keep their economies afloat, and another looming energy crisis.

Bank of England – will they? Won’t they? They won’t.

Speaking of economic struggles and central bank decisions, all eyes are poised on Threadneedle Street and the Monetary Policy Committee. Markets are pricing in a no-change announcement from Andrew Bailey and the rest of the MPC. By keeping interest rates unchanged at 5.25%, would be a signal that the Committee is keen to see how the flurry of interest rate rises (14 hikes in a row) are taking their toll on the economy.

Tomorrow marks one year since the MPC predicted the country was on course for its longest-ever recession and agreed on the biggest ever interest-rate hike since 1989. Today, economic signals and data are somewhat mixed but it does seem as though the UK economy is headed for a recession. In September the MPC report stated that, “suggested that activity had remained subdued and that there were growing concerns about the economic outlook”.

Disappointed with silver? Good time to buy

Silver is currently underperforming relative to gold, in the near-term.Both are cited as safe-havens, but in the short-term gold may shine more than silver in this respect. It may well be silver’s industrial aspect that is causing the price to drag somewhat as markets try and get a handle on what the Middle East and poor global economic numbers mean for the metal.

In a note to investors earlier this week, Commerzbank said that silver is not profiting to the same extent as gold from the safe-haven play:

“Clearly, silver is not profiting from the demand for safe havens to the same extent as gold…Industrial use accounts for somewhat more than 50% of total silver demand. As a result, the silver price tends to perform less well than the gold price at times of increased risk aversion and associated economic concerns.”

Gold Down $100? This Really Shouldn’t Be A Surprise

This may be the case in the short-term, but this is a great opportunity to buy for the long-term. No one buys silver expecting it to keep their blood pressure stable, but they do so because it is both an industrial metal and a good inflation hedge. Silver is hugely in demand across a number of necessary technological sectors, as well as acting as a store of value. Given its price increase of around 30% since the summer, this isn’t something to give up on just yet.

Central Banks Go All In On Gold

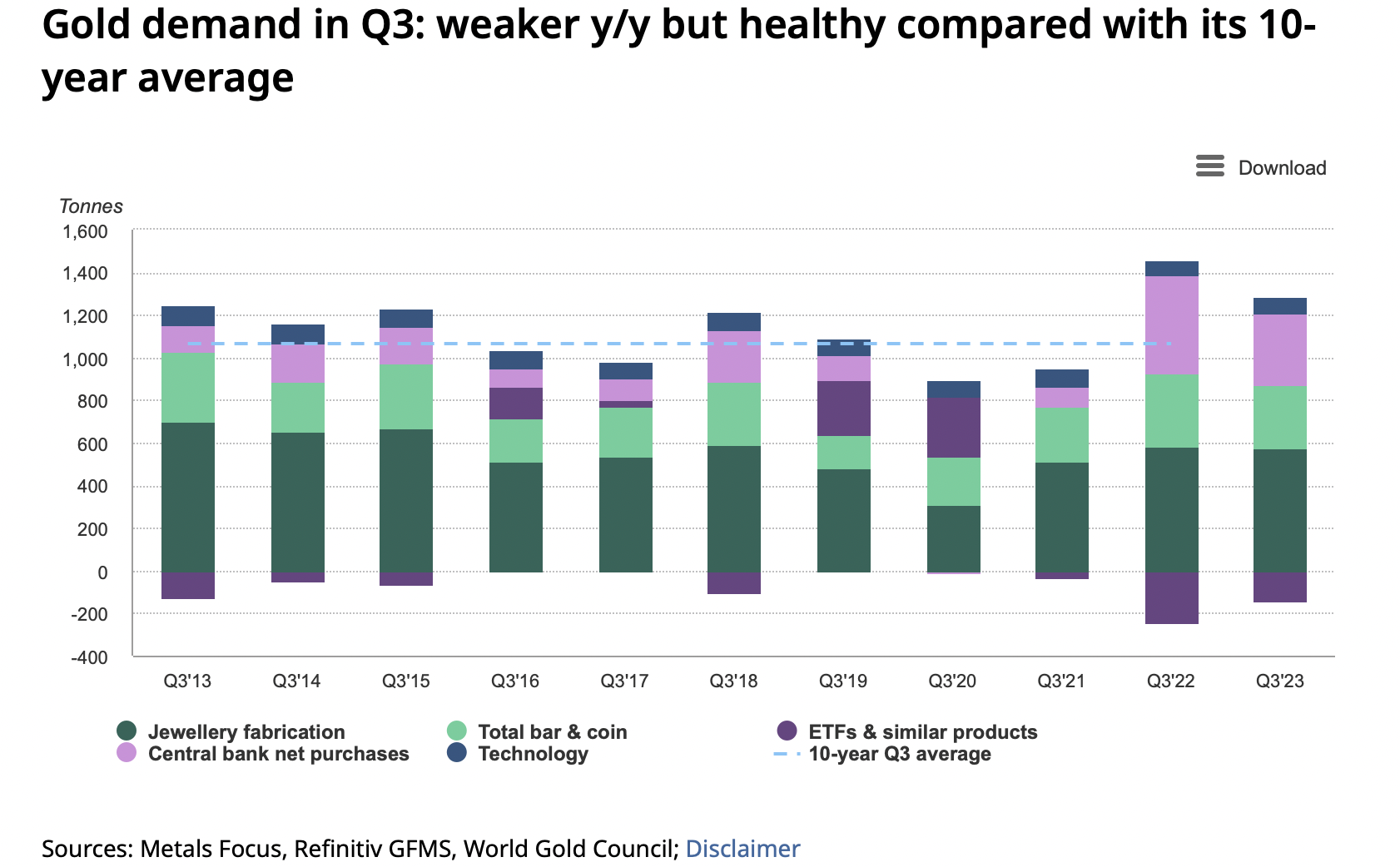

Central bank gold purchases continue to defy naysayers. According to the World Gold Council, Q3 net central bank buying was 337t, and even though this is lower than the same period last year, “demand from central banks y-t-d is 14% ahead of the same period last year at a record 800t.’ China and Poland were the most notable buyers. China added 78t to its reserves bringing its total purchases this year to 181t. Poland added 57t bringing its purchases this year to 105t. Gold now represents 11% of the NBP’s reserve. This is just over half of the 20% NBP President Adam Glapiński said the bank was aiming for.

China has been on an 11 month buying spree, theirs and others’ gold demand is flying the flag for physical gold demand, which declined across other sectors (jewellery, technology etc). This is despite gold prices remaining strong, across currencies. This suggests that these purchases are strategic and tactical.

Download Your Free Guide

Interestingly gold sales were very minimal this year with Kazakhstan’s 4t sale being the ‘only one of note’.

They explained their surprise at the impressive figures:

“Taking stock and looking ahead, it now seems all but certain that central banks are on course for another colossal year of buying. The strength of buying has, to some degree, exceeded our expectations. While we were confident that central banks would remain net purchasers in 2022, we thought it unlikely that it would match last year’s record buying volume.”

Since gold was first discovered it has held intrinsic value for mankind. But, that value is seemingly increasing as the risks in the geopolitical sphere continue to grow. Gold purchases at these levels are basically central Banks metaphorically jumping up and down with the signal of global distress and saying ‘we need to own gold, we do not trust that the global system will be stable in the near-future’.

When will everyone else catch on?

Buy Gold Coins

GOLD PRICES ( AM/ PM LBMA FIX– USD, GBP & EUR )

| USD $ AM | USD $ PM | GBP £ AM | GBP £ PM | EUR € AM | EUR € PM | |

|---|---|---|---|---|---|---|

| 01-11-2023 | 1982.50 | 1986.35 | 1633.38 | 1634.17 | 1879.61 | 1881.47 |

| 31-10-2023 | 1997.60 | 1996.90 | 1638.43 | 1645.05 | 1873.55 | 1883.48 |

| 30-10-2023 | 1996.15 | 1997.60 | 1645.83 | 1644.82 | 1886.56 | 1883.14 |

| 27-10-2023 | 1987.60 | 1982.90 | 1636.99 | 1631.93 | 1881.26 | 1873.64 |

| 26-10-2023 | 1991.45 | 1975.00 | 1647.13 | 1630.96 | 1888.09 | 1874.67 |

| 25-10-2023 | 1970.15 | 1983.30 | 1625.18 | 1635.03 | 1864.16 | 1876.20 |

| 24-10-2023 | 1967.40 | 1963.65 | 1605.99 | 1610.78 | 1848.18 | 1849.95 |

| 23-10-2023 | 1980.95 | 1973.00 | 1627.94 | 1620.62 | 1866.65 | 1860.14 |

| 20-10-2023 | 1984.20 | 1988.50 | 1637.76 | 1636.93 | 1875.27 | 1879.33 |

| 19-10-2023 | 1948.65 | 1953.55 | 1610.95 | 1608.16 | 1849.07 | 1847.08 |

Buy gold coins and bars and store them in the safest vaults in Switzerland, London or Singapore with GoldCore.

Learn why Switzerland remains a safe-haven jurisdiction for owning precious metals. Access Our Most Popular Guide, the Essential Guide to Storing Gold in Switzerland here

Receive Our Award Winning Market Updates In Your Inbox – Sign Up Here

The post Gold Hits New All Time Highs appeared first on GoldCore Gold Bullion Dealer.

Tags: Bank of England,Central Bank,Commentary,commodities,Economics,Featured,Geopolitics,Gold,gold and silver,gold price news,Gold prices,inflation,money,News,newsletter,Precious Metals,silver,silver price,World Trade