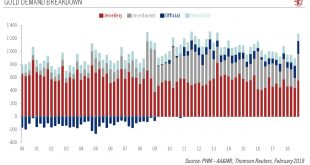

Some recent factors supporting gold are fading. However, while gold could sag in the short term, medium-term prospects look better.Last year ended on a very strong note for gold demand, with a significant increase in jewellery and investment demand in the fourth quarter (see chart), leading to strong price performance (7.7% in US dollar terms in Q4). There was also a sharp increase in central bank demand in 2018, continuing a structural trend in place for the past decade.It is worth...

Read More »Gold $10,000 In Currency Reset as Russia, China Gold Demand To Overwhelm Futures Manipulation (GOLDCORE VIDEO)

Is the currency reset or global monetary reset (GMR) upon us? Russia dumped half their US Treasuries in April ($47.4 billion out of the $96.1 billion it had held) and bought 600k ozs of gold worth less than $800 million in May Has the IMF “pegged” gold to SDRs at 900 SDR per ounce? China stops buying US Treasuries and quietly accumulates gold China has over $3 trillion in fx reserves and Russia has $461 billion...

Read More »Gold and Gold Stocks – Conundrum Alert

Moribund Meandering Earlier this week, the USD gold price was pushed rather unceremoniously off its perch above the $1300 level, where it had been comfortably ensconced all year after its usual seasonal rally around the turn of the year. For a while it seemed as though the $1,300 level may actually hold, but persistent US dollar strength nixed that idea. Previously many observers (too many?) expected gold to finally...

Read More »Gold price to remain trendless

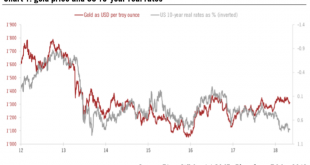

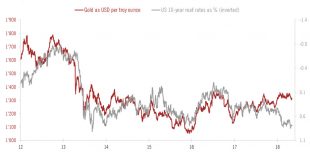

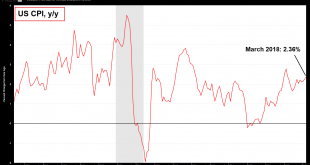

The recent strength of the US dollar coupled with the rise of the US 10-year Treasury yield has weighed on the price of gold and silver. Since 19 April, gold has lost roughly 2.3%, while silver lost almost 4.5% in USD terms. At the start of the year, these two drivers were sending conflicting signals: higher US real rates were weighing on non-yielding gold, but the decline in the greenback was acting as a tailwind for...

Read More »Gold price to remain trendless

Recent dollar strength coupled with rising US rates have weighed on gold and silver. The latter looks attractive but there are few obvious catalysts for gold.The recent strength of the US dollar coupled with the rise of the US 10-year Treasury yield has weighed on the price of gold and silver. Since 19 April, gold has lost roughly 2.3%, while silver lost almost 4.5% in USD terms.At the start of the year, these two drivers were sending conflicting signals: higher US real rates were weighing...

Read More »Gold Price Increasingly Influenced By Declining Dollar Rather Than Interest Rates

Gold Price Gains Due To Declining Dollar Rather Than Interest Rates – Investors should not be put off by higher interest rates, World Gold Council research finds they do not always have a negative impact on gold – Only short-term movements in gold are ‘heavily influenced by US interest rates’ – Correlation between US interest rates and gold is waning, with US dollar a better indicator of short-term gold price – New...

Read More »Flight of the Bricks – Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. The Lighthouse Moves Picture, if you will, a brick slowly falling off a cliff. The brick is printed with green ink, and engraved on it are the words “Federal Reserve Note” (FRN). A camera is mounted to the brick. The camera shows lots of things moving up. The cliff face is whizzing upwards at a blur. A black painted brick...

Read More »Gold Out Performs Stocks In 2018 and This Century By Ratio Of Two To One

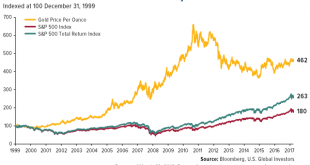

– Gold outperforming stocks in 2018 and this century (see chart) – Gold up close to 2% in 2018 while S&P 500 is down 2%– Trump trade wars and Kudlow as Trump chief economic advisor is gold bullish – Given gold’s performance, Kudlow’s dismissal of gold as “end of the world insurance” is “irrational”– Market volatility could drive gold to $1,500/oz in 2018 – Holmes Editor: Mark O’Byrne In a January post, I showed how...

Read More »No Revolution Just Yet – Precious Metals Supply and Demand Report

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Irredeemably Yours… Yuan Stops Rallying at the Wrong Moment The so-called petro-yuan was to revolutionize the world of irredeemable fiat paper currencies. Well, since its launch on March 26 — it has gone down. It was to be an enabler for oil companies who were desperate to sell oil for gold, but could not do so until the...

Read More »Prices and Predictions – Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Smoke Signals Gold went up by 33 of the Master’s Notes, but silver went up only 22 of the His Cents. The rising gold-silver ratio is one thing we add to others that signal the not-good economy. Silver has industrial uses, but gold basically does not. So a rising ratio shows rising monetary demand relative to industrial...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org