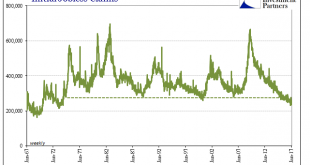

Initial jobless claims fell to just 234k for the week of February 4, nearly matching the 233k multi-decade low in mid-November. That brought the 4-week moving average down to just 244k, which was a new low going all the way back to the early 1970’s. Jobless claims seemingly stand in sharp contrast to other labor market figures which have been suggesting an economic slowdown for nearly two years. Unemployment insurance...

Read More »Great Graphic: How the US Recovery Stacks Up

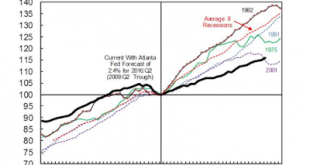

Summary: The US recovery may have surpassed the 2001 recovery in Q2. Though disappointing, the recovery has been faster than average from a balance sheet crisis. Although slow, it is hard to see the secular stagnation in the data. This Great Graphic was tweeted Alan Kruger (@Alan_Kruger). Drawing on official data and the Atlanta Fed’s GDP Now tracker for Q2 GDP (2.4%), it shows the current business cycle in...

Read More »FX Daily, June 28: Markets Stabilize on Turn Around Tuesday

The global capital markets are stabilizing for the first time since the UK referendum. It is not uncommon for markets to move in the direction of underlying trends on Friday’s; see follow-through gains on Monday, and a reversal on Tuesday. That is what is happening today. Turnaround Tuesday after such dramatic price action over the last two sessions has the feel of the proverbial dead cat bounce. Brexit There has...

Read More »The Fed Doomsday Device

Summary: Debt is just the flip side of credit. As debt goes bad, credit disappears. And then the system that created so much credit-money will go into reverse, destroying the nation’s money supply. The money supply (actually, the supply of ready credit) will shrink – suddenly and dramatically. And what should have been a minor, routine pullback in the economy will become a catastrophic panic. Bezzle BALTIMORE – ...

Read More »The Power Elite: Bumbling Incompetents

Geniuses in Charge BALTIMORE, Maryland – Is there any smarter group of homo sapiens on the planet? Or in all of history? We’re talking about Fed economists, of course. Not only did they avoid another Great Depression by bold absurdity…giving the economy more of the one thing of which it clearly had too much – debt. They also carefully monitored the economy’s progress so as to avoid any backsliding into normalcy. And where do we get this penetrating appraisal? From the Fed economists...

Read More »Kuroda-San in the Mouth of Madness

Deluded Central Planners BoJ governor Haruhiko Kuroda Photo credit: Toru Hanai / Reuters Zerohedge recently reported on an interview given by Lithuanian ECB council member Vitas Vasiliauskas, which demonstrates how utterly deluded the central planners in the so-called “capitalist” economies of the West have become. His statements are nothing short of bizarre (“we are magic guys!”) – although he is of course correct when he states that a central bank can never “run out of ammunition”....

Read More »Retirement Torpedoes and Democracy

Trump Is Right PARIS – On Wednesday, brick-and-mortar retailers – such as Macy’s – led U.S. stocks lower. The Dow lost about as much as it had gained the day before. Nothing much to talk about there… Macy’s Inc. NYSE + BATS Macy’s on the way to Zool. Macy’s Inc. NYSE + BATS – click to enlarge. When we left off yesterday, we posed two questions: Shouldn’t your editor (under torture, of course) confess his sins, renounce his apostasy, and register to vote before it is too late? And…...

Read More »GDP: Imperfectly Measured, Often Abused

The Economist recounts the reasons why the quality of GDP measurement is lacking and why GDP measures cannot answer all the questions they are used to address.

Read More »United States: both ISM indices rose in March

Both the ISM Manufacturing index and its Non-Manufacturing counterpart rose m-o-m in March. However, other economic data recently published were rather weak. Our forecast that GDP will grow by 2.0% in Q1 is revised down to 1.5%. However, our forecast for yearly average growth in 2016 remains unchanged at 2.0%. The ISM Manufacturing survey for March 2016 was published on Friday last week. The headline reading bounced back further from 49.5 in February to an eight-month high of 51.8 in...

Read More »Euro area business surveys regain some momentum in March

Hard activity data for the euro area have improved since January, but downside risks still dominate despite the ECB’s support. At the very least, monetary policy looks set to remain exceptionally accommodative for an extended period of time. Euro area business surveys (PMIs and IFO) showed renewed signs of life in March after the drops seen in the first two months of the year. Surveys also highlighted the contrasting trend between the manufacturing sector, dented by a subdued external...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org