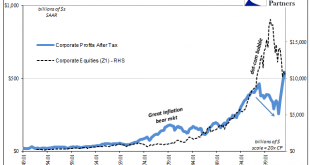

What makes a stock bubble is really two parts. Most people might think those two parts are money and mania, but actually money supply plays no direct role. Perceptions about money do, even if mistaken as to what really takes place monetarily from time to time. In fact, for a bubble that would make sense; people are betting in stocks on one monetary view that isn’t real, and therefore prices don’t match what’s really...

Read More »Bi-Weekly Economic Review: Extending The Cycle

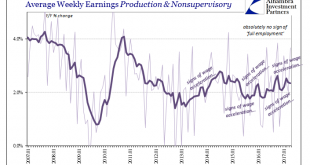

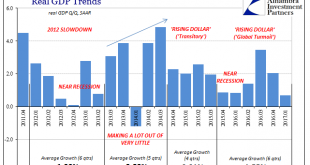

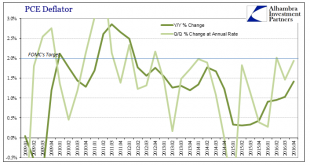

This economic cycle is one of the longest on record for the US, eight years and counting since the end of the last recession. It has also been, as almost everyone knows, a fairly weak expansion, one that has managed to disappoint both bull and bear. Growth has oscillated around a 2% rate for most of the expansion, falling at times perilously close to recession while at others rising tantalizingly close to escape...

Read More »Simple (economic) Math

.The essence of capitalism is not strictly capital. In the modern sense, the word capital has taken on other meanings, often where money is given as a substitute for it. When speaking about things like “hot money”, for instance, you wouldn’t normally correct someone referencing it in terms of “capital flows.” Someone that “commits capital” to a project is missing some words, for in the proper sense they are “committing...

Read More »Hopefully Not Another Three Years

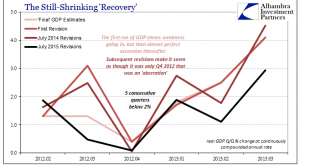

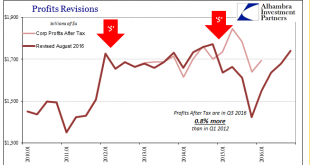

The stock market has its earnings season, the regular quarterly reports of all the companies that have publicly traded stocks. In economic accounts, there is something similar though it only happens once a year. It is benchmark revision season, and it has been brought to a few important accounts already. Given that this is a backward looking exercise, that this season is likely to produce more downward revisions...

Read More »This Is Not Expansion

Back in October, the Bureau of Economic Analysis released GDP figures that suggested what those behind “reflation” had hoped. After a near miss to start 2016, the economy had shaken off the effects of “transitory” weakness, mainly manufacturing and oil, poised to perform in a manner consistent with monetary policy rhetoric. The Federal Reserve had been since 2014 itching to “raise rates” if for no other reason than to...

Read More »Assessing China’s Economic Risks

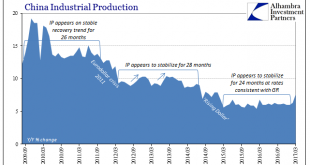

First quarter GDP in China rose 6.9%, better than expected and above the government’s target (6.5%) for 2017. It stands to reason, however, that if Communist officials thought they could get 6.9% to last for the whole year they would have made it their target, especially since 6.5% would be less than the GDP growth rate for 2016 (6.7%). In only that one way is China’s GDP statistic meaningful. Due to unanswered...

Read More »Ending The Fed’s Drug Problem

Gross Domestic Product was revised slightly higher for Q4 2016, which is to say it wasn’t meaningfully different. At 2.05842%, real GDP projects output growing for one quarter close to its projected potential, a less than desirable result. It is fashionable of late to discuss 2% or 2.1% as if these are good numbers consistent with a healthy economy. This level of advance, however, factors none of the imbalances and...

Read More »China Starts 2017 With Chronic, Not Stable And Surely Not ‘Reflation’

The first major economic data of 2017 from China was highly disappointing to expectations of either stability or hopes for actual acceleration. On all counts for the combined January-February period, the big three statistics missed: Industrial Production was 6.3%, Fixed Asset Investment 8.9%, and Retail Sales just 9.5%. For retail sales, the primary avenue for what is supposed to be a “rebalancing” Chinese economy,...

Read More »Some Notes On GDP Past And Present

The second estimate for GDP was so similar to the first as to be in all likelihood statistically insignificant. The preliminary estimate for real GDP was given as $16,804.8 billion. The updated figure is now $16,804.1 billion. In nominal terms there was more variation, where the preliminary estimate of $18,860.8 billion is now replaced by one for $18,855.5 billion. Therefore, to net out with no change in real terms a...

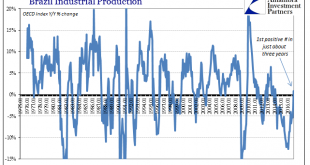

Read More »Brazil: Continuing Problems

The cruelest part, perhaps, of this economic condition globally is how it plays against type. In all prior cycles, economies of all kinds and orientations all over the globe would go into recession and then bounce right of it once at the bottom. It was often difficult to see the bottom, of course, but once recovery happened there was no arguing against it. Since the Great “Recession”, which was global, no matter what...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org