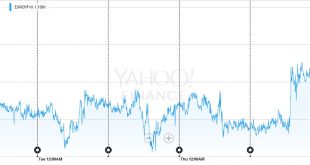

With the dismal jobs reports, speculators had to buy euro to cover their shorts (mostly against USD, but also against CHF). This led to a rising EUR/CHF on Friday. Today fundamental rules were valid again: In times of slow growth, the Swiss franc appreciates. Hence EUR/CHF was down by 49 bips. After the shellacking it took after the shockingly poor jobs data, the US dollar has only managed a shallow recovery...

Read More »FX Weekly Review May 30 to June 3: Dollar’s Rally Ends with a Bang

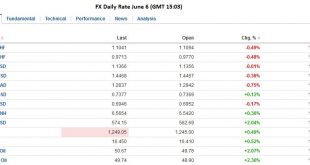

EUR/CHF The massive surprise in the US job report was reflected in currency rates. The EUR/CHF surprisingly increased, despite weak US data. This reflects the fact that the ECB is currently considered the most dovish central bank.Consequently the biggest short speculative position is in the euro, while traders are long CHF against USD. Click to expand USD/CHF After a relatively steady week, the dollar lost 130 bips on Friday. Click to expand Continued by Marc Chandler:...

Read More »FX Daily, June 2: Greenback Mostly Softer Ahead of ECB and ADP

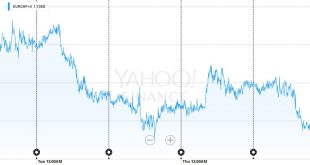

The US dollar remains under pressure. It is off for the third day against the yen and slipped below JPY109 for the first time in a little more than two weeks. The Nikkei struggled to cope with the foreign exchange developments, lost 2.3%, the most in a month, after gapping lower. At JPY108.50, the dollar would have given back 50% of its rally off the May 3 low near JPY105.50. Below there, the JPY107.80 is the 61.8% retracement. The euro is north of $1.12 after having briefly...

Read More »FX Daily, June 1: Swiss SVME PMI strongest PMI

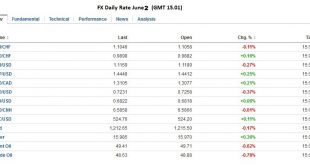

The US dollar is trading with a heavier bias to start the month of June. Weaker stocks and firmer bonds has seen the yen rise the most, while sterling’s losses have been extended after an ICM telephone survey showed a small lead for those favoring Brexit. The Swiss Franc was one of the strongest performers. Click to enlarge. The Nikkei fell 1.6%, the largest loss since May 2 and snaps a five-day advance. The delay in the sales tax was confirmed. This second delay now puts...

Read More »FX Daily, May 31: Sterling Slips and Aussie Pops as Investors Await Fresh Insight into Fed Trajectory

The US dollar is broadly mixed. The main narrative of increased prospects for a Fed hike in June or July has been pushed off center stage as the market reacts to local developments as investors await from US economic data. Ostensibly the data will determine whether the Fed raises rates in June or July. The Swiss Franc lost both against the dollar and versus the euro. Click to enlarge. On the other hand, despite the Fed’s data dependency, we argue that the determining factor is...

Read More »FX Weekly: Dollar Set to Snap Three-Month Decline

EUR/CHF The EUR/CHF moves lower, following the descent of EUR/USD. This happens often, when European and global growth is sluggish. USD/CHF But the Swiss franc weakened against the dollar. Continued by Marc Chandler: The US dollar was mostly firmer over the past week. There were two exceptions among the major currencies: Sterling and the Canadian dollar. GBP/USD Many linked sterling’s outperformance (+0.8%) to a growing sense that the UK will vote to remain in the EU,...

Read More »FX Daily, May 26: Dollar Softer in Consolidation Mode

The US dollar is trading with a softer bias today after the momentum stalled yesterday. The pullback is shallow but could be extended a bit more in the North American session. The US reports weekly jobless claims, durable goods orders and pending home sales. However, the market already appeared to take on board that the US economy is rebounding strongly in Q2 and that the prospects of a Fed hike have increased, but a June/July hike is still not a done deal. The next important step...

Read More »FX Daily, May 19: FOMC Minutes Extend Dollar Gains

We felt strongly that the FOMC minutes would be more hawkish than the statement that followed the meeting, and we were not disappointed. However, our caveat remains: the minutes dilute the signal that emanates from the Fed’s leadership, Yellen, Fischer, and Dudley. The latter two speak in the NY morning. Fischer and Dudley’s comment will be scrutinized for confirmation of the hawkish read of the FOMC minutes. Yellen speaks at Harvard at the end of next week. Her comments at the...

Read More »FX Daily, May 17: The Meaning of Sterling and Aussie’s Advance Today

The US dollar is mostly weaker today. It appears to be consolidating the gains scored since the reversal on May 3. Sterling and the Australian dollar are leading the way early in Europe. The Australian dollar’s gains appear more intuitively clear. The minutes from the recent RBA meeting indicated that it was a closer decision. This means that a follow-up rate cut next month is unlikely, which is what we have argued. While short-term participants may be surprised today, the...

Read More »Are Dollar Fundamentals Lagging the Technical Improvement?

The US dollar extended its recovery that began on May 3. Its technical condition remains constructive, even though up until now, the gains are still consistent with a modest correction rather than a trend reversal. The details of the employment report, if not the headline, coupled with the 1.3% increase in retail sales, have boosted confidence that the US economy is rebounding in Q2 after a six-month slow patch. The average of the Atlanta Fed (2.8%) and NY Fed GDP trackers (1.2%) is...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org