The German Social Democrats have endorsed the Grand Coalition, ending the period of political uncertainty and paralysis in Germany since the last September’s election. The polls have suggested nearly 60% of the SPD would support joining the government and the actual outcome looks to be closer to 66%. In 2013, when the SPD had a similar vote, three-quarters favored a Grand Coalition. Among the differences is that the SPD...

Read More »FX Daily, March 02: Markets Unanchored?

Swiss Franc The Euro has fallen by 0.18% to 1.1531 CHF. EUR/CHF and USD/CHF, March 02(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The announcement of the US intention to impose tariffs on imported steel and aluminum on national security grounds has sent ripples through the capital markets. Yet there is certainly more going on here than that. The tariffs,...

Read More »FX Daily, March 01: USD Snaps 3-Month Slide, Firm Ahead of Powell Part II

Swiss Franc The Euro has risen by 0.17% to 1.1534 CHF. EUR/CHF and USD/CHF, March 01(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar rebounded last September and October before the downtrend resumed in November, and lasted through January. The dollar gained broadly last month, except against the yen, which rose almost 2.4% in February. This pattern is...

Read More »FX Daily, February 28: It Takes Powell to Convince the Market that Yellen was Right

Swiss Franc The Euro has fallen by 0.19% to 1.1504 CHF. EUR/CHF and USD/CHF, February 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Many market participants think they heard Fed Chair Powell give a fairly strong signal that he favored a more aggressive course. The implied yield on the December Eurodollar futures rose five basis points to 1.535%. The December Fed...

Read More »Great Graphic: Has Position Adjustment Begun in Treasury Futures?

This Great Graphic from Bloomberg shows the net large speculative positioning in the 10-year note futures over the past five years. They began last year with a huge next short position of more than 400k contracts. By May-June, the speculators had reversed themselves and were net long over 350k contracts. In the middle of December 2017, the net position was short again and peaked in early February near 327.5k contracts....

Read More »FX Daily, February 27: Markets Tread Water; Powell is Awaited

Swiss Franc The Euro has fallen by 0.29% to 1.1517 CHF. EUR/CHF and USD/CHF, February 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The capital markets seem unusually subdued. The US dollar is mostly slightly firmer, except against the euro and Swiss franc among the majors. The MSCI Asia Pacific Index managed to eke out a small gain (0.2%), for a third advancing...

Read More »FX Daily, February 26: Dollar Slides as Equities Extend Recovery

Swiss Franc The Euro has risen by 0.14% to 1.1529 CHF. EUR/CHF and USD/CHF, February 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar has begun the new week on heavy footing. It is being sold against virtually all the currencies, major and emerging market currencies. There is one exception, and although the local market is not open, the Mexican peso is...

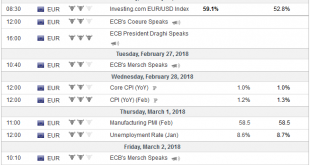

Read More »FX Weekly Preview: Three Drivers in the Week Ahead: Data, Speeches, Politics

There are three distinct classes of drivers in the week ahead. The first is high frequency data. The most important of the economic reports include the preliminary estimate of the February inflation in the euro area, the US January income, and consumption data alongside the Fed’s preferred inflation measure, the core PCE deflator, and Japanese retail sales and industrial production figures. The second group of drivers...

Read More »FX Daily, February 23: Dollar Firms; VIX Set to Close Lower for Second Week

Swiss Franc The Euro has risen by 0.20% to 1.152 CHF. EUR/CHF and USD/CHF, February 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates A light economic schedule in North America may help the markets close the week on a quiet note. Perhaps if there is one number that captures this sense, it may be the VIX. It is soft and barring a new disruption today, it is poised to...

Read More »FX Daily, February 22: All Eyes on Equities

Swiss Franc The Euro has fallen by 0.13% to 1.1515 CHF. EUR/CHF and USD/CHF, February 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The dramatic reversal of US shares yesterday in the last hour of trading has once again pulled the proverbial rug beneath the feet of investors. The turn down, moreover, occurred near important technical levels, seemingly adding to the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org