Swiss Franc The Euro has fallen by 0.02% to 1.1544 CHF. EUR/CHF and USD/CHF, February 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The economic data stream is picking up, but there is an uneasy calm in the markets. It is almost as if the dramatic drop in stocks has left many with a sense of incompleteness, like waiting for another shoe to drop. The price action has...

Read More »Great Graphic: S&P 500 vs Euro Stoxx 600 and Exchange Rates

Summary: S&P 500 stalled near 61.8% retracement of decline. Dow Jones Stoxx 600 stopped at 38.2% retracement. U.S. corporate earnings growth has been much more impressive than that of Europe. The different performance does not appear to be a function of FX rates. Today is an important day for equities. After a sharp sell-off earlier this month, stocks staged a recovery last week. The recovery has stalled...

Read More »Cool Video: Bloomberg Interview-Rates, Dollar, and Equites

- Click to enlarge In large gatherings of people, from airplanes to theater to conferences, we are often told to know the closest exit. The same is true for investing. No matter one’s confidence when they buy a security, someone is just as convinced on the other side who is selling the security. Well into this 4.5-minute interview (click here for the link) on Bloomberg’s “What’d You Miss” show, Lisa Abramowicz...

Read More »FX Daily, February 20: Dollar Trades Higher, but Stocks Challenged at Key Chart Point

Swiss Franc The Euro has risen by 0.13% to 1.154 CHF. EUR/CHF and USD/CHF, February 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The dollar is finding better traction today, building on the upside reversal seen before the weekend. The news stream has been light and it seems like primarily an issue of positioning rather than a change in sentiment or the consensus...

Read More »Weekly Technical Analysis: 20/02/2018 – USD/JPY, EUR/USD, GBP/USD, USD/CAD, USD/CHF

USD/CHF The USDCHF pair approached our waited target yesterday, represented by the bearish channel’s resistance that appears on the above chart, noticing that the price faces good resistance at the EMA50, which forms negative pressure that we expect to push the price to resume its main bearish track again. Therefore, the bearish bias will be suggested in the upcoming sessions, and the waited targets begin at 0.9254...

Read More »FX Daily, February 19: Monday Market Update

Swiss Franc The Euro has risen by 0.09% to 1.152 CHF. EUR/CHF and USD/CHF, February 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is narrowly mixed in uneventful turnover. Of note, the dollar selling seen in Asia last week slacken today and the greenback moved above the pre-weekend highs seen in the US. It is the first time in eight sessions, the dollar...

Read More »FX Weekly Preview: Four Key Numbers in the Week Ahead

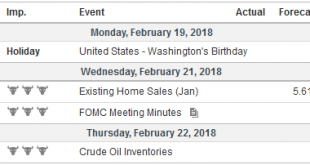

The US markets are closed on Monday, and many parts of Asia will continue to celebrate the Lunar New Year. The economic schedule is fairly light, and market psychology appears fragile after the dramatic activity in equities and what appears to be shifting macro-relationships. To help navigate the challenging investment climate, we identify four “numbers” that can illuminate the path ahead. The equity market is center...

Read More »FX Daily, February 16: Worst Week for the Dollar since 2015-2016, While Stocks Continue to Recover

Swiss Franc The Euro has fallen by 0.13% to 1.1513 CHF. EUR/CHF and USD/CHF, February 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Nearly all the major currencies have risen at least two percent against the US dollar this week. The Canadian dollar is an exception. It has risen one percent this week ahead of today’s local session. Sterling is becoming another...

Read More »Great Graphic: Bears Very Short US 10-Year Ahead of CPI

Summary: Speculators have a large net short 10-year Treasury position. The gross short position is a record. CPI is likely to be softer, while retail sales may show a still robust consumer. The US reports January CPI figures tomorrow. The market seems especially sensitive to it. The main narrative is that it is an inflation scare spurred by the jump in January average hourly earnings that pushed yields higher...

Read More »FX Daily, February 15: Stocks Jump, Bonds Dump, and the Dollar Slumps

Swiss Franc The Euro has fallen by 0.24% to 1.1535 CHF. EUR/CHF and USD/CHF, February 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The significant development this week has been the recovery of equities after last week’s neck-breaking drop, while yields have continued to rise. The dollar has taken is cues from the risk-on impulse from the equity market and the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org