There is a common ploy used by many analysts and reporters that often simply does not stand up to close scrutiny, and would in fact be mocked in the university. The ploy is to take two time series and put them on the same chart but use different scales. Such a ploy often is used to demonstrate a closer relationship between the two variables than is actually the case. A current example is a chart of the dollar-yen rate and Japanese stocks. Here is a Great Graphic that was in the...

Read More »Higher Inflation Lifts Sterling, Yen Stabilizes

There are three highlights to the foreign exchange market today. First, the yen is marginally softer. The yen's strength this month has been the main development. After making a marginal new high yesterday, some semblance of stability emerged in North America yesterday, and this has carried over into today's activity. The greenback largely held above JPY107.90 and rose to JPY108.40 in late Asia. It has been consolidating in the European morning. Japan's Finance Minister appeared...

Read More »Revisiting the CRB Index

The CRB Index is building on last Friday's gains, when it gapped higher. That gap marked the end of the down move we anticipated on March 28. The index fell through the two supports we identified (171.30 and 169.50), before bottoming on April 4 near 164.70. We had thought that a three-legged correction off the January 20 low was complete. However, the recent price action suggest that a five-wave move is more likely. First, the gap higher last Friday has not been filled. It leaves a...

Read More »Is the Dollar Bottoming against the Yen?

The yen's surge may be easing. It made a new marginal high in Asia, but has not been able to sustain it Technically, a hammer candlestick pattern may be traced out by the greenback's recovery today. Supporting the greenback is the movement in interest rate differentials. The US 10-year premium over Japan has widened by nearly 10 bp since last Thursday. Near 184 bp, it is the widest this month. The two-year premium has also widened at 96 bp. It is also the widest this month. The...

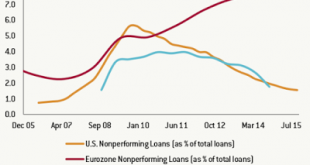

Read More »Great Graphic: Nonperforming Loans, Another Divergence

Early in the financial crisis, the US forced all large banks to take an infusion of capital. This helped put a floor under the US financial system. Regulators and stakeholders encouraged US banks to address the significant nonperforming loan problem. The eurozone banking woes persist. Before the weekend, the shares of the one the largest banks was trading at 25 -year lows. The problem with nonperforming loans though is largely concentrated in the periphery. Italy is moving to...

Read More »Sterling Shines Temporarily in Choppy Start for Foreign Exchange

In an unusual development, sterling is outperforming today. It rose to a four-day high near $1.4230 on what appears to be mostly modest position adjustment in relatively subdued turnover. The $1.40 area held on repeated tests in the second half of last week. Stops were triggered above $1.4160 forcing latest shorts to cover. The news stream was not particularly helpful with the British Chamber of Commerce warning that the economy slowed in Q1 with the balance of services the poorest...

Read More »Emerging Markets: Preview of the Week Ahead

Some dovish signals from the Fed and a bounce in oil prices helped EM end last week on a firm note. This week, the US retail sales report could be important, and the same goes for CPI and PPI data too. The Fed’s Dudley, Kaplan, Harker, Williams, Lacker, Lockhart, Powell, and Evans all speak this week. The Fed releases its Beige Book Wednesday for the upcoming FOMC meeting April 27. Within specific EM countries, risks remain in place. We continue to feel that markets are too...

Read More »Same Drivers, Different Direction

Over the past three months and the past month, the dollar has fallen against all the major currencies but the British pound. Sterling's underperformance can largely be explained by uncertainty created by the Tory government's sponsored referendum on continued EU membership. Most of the polls show those wanting to remain hold on to a slight lead. However, the potential impact is widely understood to be so powerful, that many investors have sought protection. This is being accomplished...

Read More »Specs Shift to Net Long Canadian Dollar and Set New Record Gross Long Yen

Speculators in the futures market were not particularly active in Commitment of Traders reporting week ending April 5. There was only one gross position adjustment which we regard as significant (defined as a 10k contract change), and that was in the yen. Yen bulls extended their gross long position by 13.3k contract to new record of 98.1k contracts. However, the bears are beginning to get itchy and have sold into the yen gains for the second consecutive week. The gross short yen...

Read More »Little Technical Evidence that Greenback’s Slump is Over

Although there is no convincing technical evidence that dollar's retreat in Q1 is over, we suspect it is nearly complete. We will be especially sensitive to reversal patterns, divergences with technical indicators, and other signs that the move is exhausted. The fundamental economic driver of our medium term constructive outlook for the US dollar, the divergence of monetary policy between the major central banks, relative health of the financial sector, and absorption of capacity,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org