Following the mini-devaluation in August, the yuan appreciated in September and October. It began depreciating again in November and this has continued through the first half of December. The dollar finished the local session at new multi-year highs against the yuan. Many observers see in the pre-weekend announcement about monitoring the yuan against a basket an indication of the intentions of officials to push their currency down further against the dollar. We suggest that China...

Read More »Emerging Markets: Week Ahead Preview

(from my colleague Dr. Win Thin) EM starts the FOMC week off on a soft footing. Besides the prospects of Fed liftoff Wednesday, oil prices are making new cycle lows. Uncertainty about China’s FX policy is also making markets nervous, though we think this concern is misplaced. Overall, the global backdrop for EM remains very negative and we do not see much chance for a rebound after Fed lift-off is seen. In recent days, USD has made new all-time highs against COP, MXN, and ZAR. ...

Read More »Outlook for Spain’s Election

Spain goes to the polls on December 20. The country's political and economic dynamics are different than other EMU countries that have held elections this year. The economy is among the strongest performers in eurozone, though unemployment remains stubbornly high. Today is the last day that election polls can be published. El Pais and El Mundo papers published the results of surveys today. They confirm what many have come to expect. The ruling center-right Popular Party will remain...

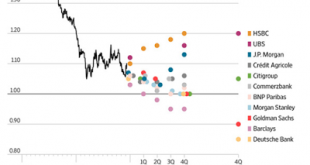

Read More »Great Graphic: Euro Forecast by Global Banks

The dollar-euro is the most actively traded currency pair in the world. It is often what is meant when people ask where is the dollar trading. Dollar bullish sentiment prevailed in 2015, but many large banks doubt that it will continue in 2016. This Great Graphic from the Wall Street Journal shows the euro forecasts of eleven major banks. Indeed, it appears that only one of the eleven banks expect the euro to finish next year below parity ($1.00). Three banks, HSBC, UBS and JP...

Read More »Slow Start to Important Week, though Rand Jumps Back

The US dollar is firmer against the euro, sterling and yen, but within the ranges seen before the weekend. The greenback is softer against the dollar-bloc currencies after early gains were unwound. The biggest mover has been the South African rand, which is up a little more than 5%, retracing nearly half of last week's losses. Under strong pressure, President Zuma reinstated former Finance Minister Gordhan. Gordhan had been Finance Minister from 2009 until 2014. The macroeconomic...

Read More »After ECB’s Hawkish Cut, Is the Fed about to Deliver a Dovish Hike?

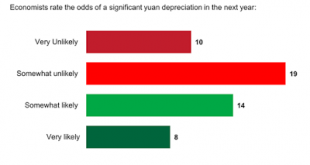

After much hemming and hawing since mid-year, the Federal Reserve is finally poised to raise rates for the first time in nearly a decade. Indeed, given the speeches by the leadership and the economic data, especially the labor market readings, the failure to raise rates would likely be more destabilizing at this juncture than lifting them. Surveys of market participants suggest that a Fed hike is as done of a deal as such an event can be. A recent Reuters survey found all but one...

Read More »Limited Speculative Position Adjustment Warns USD Correction may not be Over

1. Activity increased during the Commitment of Traders reporting week ending 8 December. There were four significant (10k+ contracts) gross currency adjustments by speculators. Given that this period covers the second largest gain in the euro's history, it is surprising that it did not meet the threshold. It is astounding that only that speculators added only 1.8k contracts to their gross long position 2. The bears covered 11.7k short yen contracts, leaving them 94.5k. Both the...

Read More »Technical Condition of the Greenback on the Eve of Lift-Off

The US dollar turned in a mixed performance in the week following the ECB's surprise and the healthy US jobs report. In some ways, the greenback was like a fulcrum, not the driver. The dollar-bloc currencies and the Norwegian krona were on one side, and the euro, Swiss franc, yen, and sterling were on the other. The continued, and sharp drop in energy prices and commodity prices more generally, coupled with risk-off impulses spurred by equity market declines, and year-end position...

Read More »Emerging Markets: What has Changed

1) South African President Jacob Zuma fired Finance Minister Nene and replaced him with little-known ANZ lawmaker David Van Rooyen 2) S&P revised the outlook on South Africa’s BBB- rating from stable to negative 3) People’s Bank of China announced the publication of a new CNY basket on its website 4) Moody’s put Brazil’s Baa3 rating on review for possible downgrade 5) Brazil’s Supreme Court suspended for a week the creation of the congressional impeachment committee 6) Relations...

Read More »Insight into the ECB

Investors, fellow central bankers, and the media continue to try to make sense of last week's ECB surprise. We had argued that given the market positioning, especially the dramatic accumulation of speculative short euro positions since the middle of October, that the market was prone to a correction. The issue was really one of timing. Was it going to materialize after the ECB meeting or after the US jobs data? Or could it wait until after the FOMC meeting. This means that there...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org