Two ministers, two policies, one vote: Alain Berset (left) and Ueli Maurer. (© Keystone / Peter Klaunzer) The Swiss government has launched its campaign in favour of the upcoming national vote on a reform of the corporate tax and pension systems. Ministers for health and finance, Alain Berset and Ueli Maurer, presented their case at a press conference on Monday, urging citizens to vote ‘yes’ on May 19. Berset and...

Read More »China’s Big Money Gamble

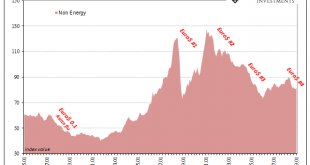

While oil prices rebounded in January 2019 around the world, outside of crude commodities continued to struggle. According to the World Bank’s Pink Sheet, base metal prices fell another 1.8% on average from December. On an annual basis, these commodities as a group are about 16% below where they were in January 2018. The last time they had fallen by that much it was May 2016. World Bank Pink Sheet Commodity Indices...

Read More »FX Daily, February 18: Dollar Drifts Lower

Swiss Franc The Euro has risen by 0.06% at 1.1349 EUR/CHF and USD/CHF, February 18(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: In quiet turnover, the US dollar slipped lower against most of the major currencies to start the new week. The news stream is light and the US markets are closed today. The MSCI Asia Pacific Index was up five of the past six...

Read More »FX Weekly Preview: Drivers, While Marking Time

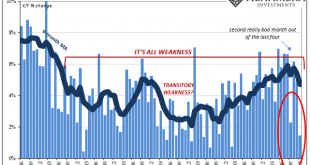

The main issues for investors have not changed. There are three dominant ones: Trade, growth, and Brexit. Unfortunately, there won’t be any closure in the week ahead, and that may make short-term participants reluctant to turn more aggressive. United States The US reported exceptionally poor December retail sales and January industrial output figures. Growth forecasts were adjusted. The St. Louis Fed’s GDP Now tracker,...

Read More »Wabco car systems manufacturer moves HQ to Switzerland

Switzerland – and Bern – will provide a “highly favorable environment for breakthrough innovations”. (© Keystone / Peter Schneider) Car systems manufacturer Wabco Automotive has opted to move its global headquarters from Brussels to the Swiss capital, Bern. The company has plans to set up a competence centre in autonomous driving in collaboration with Swiss universities. “Switzerland is world-renowned for providing a...

Read More »Retail Sales Landmine

Ignore Black Friday and Cyber Monday. Those are merely an appetizer, an intentional preamble to whet the appetite of hungry consumers looking to splurge. The real action comes in December. People look, some buy, after Thanksgiving, but as anyone counts down the actual twelve days of Christmas and celebrates the eight crazy nights of Hanukkah that’s when the retail industry makes its bank. In 2016, the month of December...

Read More »BLS train group to shelve 170 jobs by 2023

A BLS train in Kandersteg station in the Bernese Oberland region. (© Keystone / The BLS train company, which operates several routes in the regions around Bern, is to cut some 170 positions over the coming four years, for reasons of efficiency and automation. In a move criticized on Thursday by rail unions, BLS announced the cuts as part of planned efficiency gains that aim to save between CHF50-60 million ($49.8-59.2...

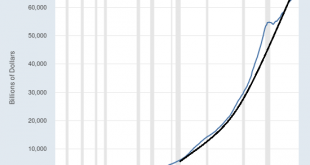

Read More »What Happens When More QE Fails to Reverse the Recession?

The smart money is liquidating assets, paying off debt and moving capital into collateral that isn’t impaired by debt or speculative valuations. The Federal Reserve’s sudden return to “accommodative” dovishness in response to the stock market’s swoon telegraphs its intent to fire up QE once the recession kicks into gear. QE (quantitative easing) are monetary policies designed to ease borrowing and the issuance of...

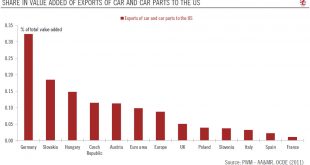

Read More »Euro area : What if car tariffs lie ahead ?

New US auto tariffs may impact the economy significantly more than the previous tariffs on steel and aluminium. Among the key risks for our euro area outlook, the threat of US auto tariffs is of major importance. The US Commerce Department’s investigation on national security threats posed by auto imports is due to be concluded on 17 February. Given the complexity of the global auto supply chain, it is very complicated...

Read More »Swiss unemployment rate rises

© Gunnar3000 | Dreamstime.com There are various ways to measure unemployment. Switzerland’s standard measure looks at the number of people registered with unemployment offices across the country. By this measure Switzerland’s unemployment recently reached a 10 year low of 2.6%. Today, another unemployment measure was published. It shows a 0.1% increase in unemployment over the fourth quarter of 2018 to 4.6% or 227,000...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org