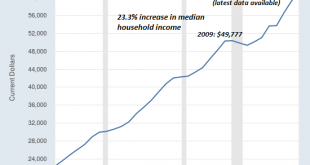

The cold truth is homelessness and soaring rents are the only possible outputs of central bank policies that inflate asset bubbles. It’s been a long, strange economic boom since the nadir of the Global Financial Meltdown in 2009. A 10-year long boom that saw the S&P 500 rise from 666 in early 2009 to 2,780 and GDP rise by 43% has been slightly more uneven for most participants. First and most importantly, household...

Read More »FX Daily, February 22: Markets Ending Week with A Whimper

Swiss Franc The Euro has fallen by 0.09% at 1.1333 EUR/CHF and USD/CHF, February 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The global capital markets are winding down what appears to be an inconclusive week quietly and on a mixed note. The MSCI Asia Pacific Index is poised to snap a four-day advance but held on to a nearly 2% gain for the week. European...

Read More »What’s Up With Australia’s 80 Tonnes Of Gold At The Bank Of England?

Recently, news network RT.com asked for comments on the question of the 80 tonnes of the Reserve Bank of Australia’s (RBA) gold reserves and their supposed storage location at the Bank of England’s gold vaults in London. Based on some of those comments I made, RT has now published an article in its English language news website at www.rt.com about this Australian gold that the RBA claims is held in London. The RT.com...

Read More »Declining trend of cross-border workers continues

At the end of 2018, 314,000 cross-border workers were working in Switzerland. The number of cross-border workers in Switzerland – except those from France – has dropped for the second consecutive quarter. This marks the second year-on-year decline by quarter in 20 years. According to numbers released by the Federal Statistical Officeexternal link on Thursday, the fourth quarter of 2018 saw 2,000 fewer people commuting...

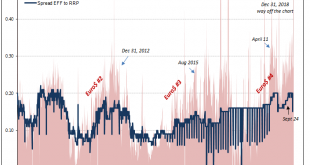

Read More »FOMC Minutes: The New Narrative Takes Shape

Nothing the Fed did today, or has done up to today, has changed the curves. Eurodollar futures and UST’s, they are both still inverted. The former sharply inverted. The only thing that has changed since early January is the narrative – and not in a charitable way. It is treated as a positive when it is a pretty visible signal about deteriorating circumstances. Interpretations matter. Conventional wisdom seems settled...

Read More »Something Different About This One

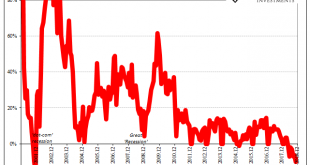

In Japan, they call it “powerful monetary easing.” In practice, it is anything but. QQE with all its added letters is so authoritative that it is knocked sideways by the smallest of economic and financial breezes. If it truly worked the way it was supposed to, the Bank of Japan or any central bank would only need it for the shortest of timeframes. That would be powerful stuff. Instead, in June last year the narrative...

Read More »FX Daily, February 21: Aussie Slammed by Dalian Coal Embargo, While Firmer Flash PMI does Euro Little Good

Swiss Franc The Euro has risen by 0.04% at 1.1347 EUR/CHF and USD/CHF, February 21(see more posts on EUR/CHF, USD/CHF, ) Source: merkets.ft.com - Click to enlarge FX Rates Overview: The US dollar is firm against most major and emerging market currencies. There is more optimism on US-Chinese trade as a series of understandings are drafted, and an extension past March 1 of the tariff freeze is reportedly in the...

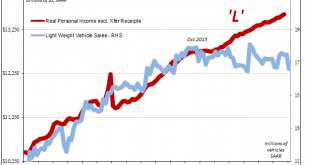

Read More »Cool Video: Fox Business–Stocks and the US Consumer

Varney and Company on Fox Business TV - Click to enlarge I joined Varney and Company on Fox Business TV earlier today. Varney had liked by bullish call on stocks from the end of last year, but seemed dismayed that I have turned cautious. I suggested that the S&P are approaching a key area a little above 2800 that has capped in Q4 18. In addition to these chart points, I am concerned that the S&P 500 has rallied...

Read More »UBS to appeal record €3.7 billion French tax fraud fine

France’s national financial crimes unit estimates around €10 billion went unreported to French tax authorities from 2004 to 2012. (Keystone) A French court on Wednesday found Swiss bank UBS guilty of illicit solicitation and laundering of the proceeds of tax fraud, imposing a hefty fine of €3.7 billion (CHF4.2 billion). The bank was convicted of illegally helping wealthy French clients evade tax authorities in France....

Read More »Getting Back Up To Speed On Loss Of Speed in US Economy

For much of 2018, the idea of “overseas turmoil” lived up to its name. At least in economic terms. Market-wise, there was a lot domestically to draw anyone’s honest attention. Warnings were everywhere by the end of the year. And that was what has been at issue. Some said Europe and China are on their own, the US is cocooned in a tax cut-fueled boom. Decoupling, only now the other way around. The Bureau of Economic...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org