Pill-producing in a Santhera factory in canton Aargau. (© Keystone / Christian Beutler) An investigative report by a group of Swiss newspapers has revealed the extent to which pharmaceutical companies are funding hospitals, doctors, and medical centres in the country. CHF458 million ($456.5 million): this was the amount paid by the 60 pharma companies based in Switzerland to various arms of the medical profession...

Read More »Limited room for Swiss franc depreciation

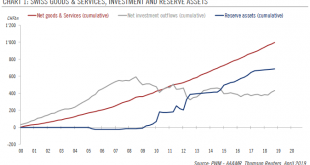

Even should global economic momentum stabilise in the coming months and political risks abate, the franc still has important structural underpinnings. The Swiss franc has been supported by a structural current account surplus and by reduced investment flows out of Switzerland since the 2008 financial crisis. In addition, the decline in global yields since the Fed’s dovish shift early this year has rendered interest...

Read More »Why 2011

The eurodollar era saw not one but two credit bubbles. The first has been studied to death, though almost always getting it wrong. The Great Financial Crisis has been laid at the doorstep of subprime, a bunch of greedy Wall Street bankers insufficiently regulated to have not known any better. That was just a symptom of the first. The housing bubble itself was more than housing. What was going on in the shadows wasn’t...

Read More »Debt and Profit in Russell 2000 Firms

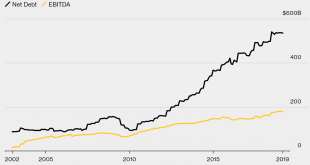

This week, the Supply and Demand Report featured a graph of debt vs profitability in the Russell 2000. Here’s the graph again: This graph shows a theme that we, and practically no one else(!) have been discussing for years. It is the diminishing marginal utility of debt. In this case, more and more debt is required to add what looks like less and less profit (we don’t have the raw data, only the graphic). We do not view...

Read More »More Swiss bankruptcies in 2018 than ever before

Canton Geneva recorded higher than normal bankruptcies and losses. (Keystone) Last year saw a record number of bankruptcy procedures opened in Switzerland, with almost 14,000 cases involving bust businesses and individuals. The record numbers, released on Thursday by the Federal Statistical Office, mark a 5.4% increase on 2017 and translate to overall financial losses of some CHF2 billion ($2 billion). Every canton in...

Read More »FX Daily, April 11: Market Yawns at Latest Brexit Extension

Swiss Franc The Euro has risen by 0.37% at 1.1303 EUR/CHF and USD/CHF, April 11(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The S&P 500 closed higher yesterday for the ninth session in the past ten, but the coattails are short and global equities are trading with a heavier bias today. A firm CPI reading in China took a toll local shares with the...

Read More »Getting ready for tiering

ECB officials have hinted at policy measures aimed at reducing the cost of negative rates for the banking sector, including a tiered system of bank reserves. Although back in 2016 the European Central Bank (ECB) ruled out tiering of bank reserves to mitigate the side effects of negative rates, the situation has since changed, and it could be implemented eventually if policy rates were to remain negative into 2020....

Read More »Gold & Basel 3: A Revolution That Once Again No One Noticed

Via The Saker blog, By Aleksandr Khaldey Translated by Ollie Richardson and Angelina Siard cross posted with https://www.stalkerzone.org/basel-3-a-revolution-that-once-again-no-one-noticed/ source: http://www.iarex.ru/articles/65626.html Real revolutions are taking place not on squares, but in the quiet of offices, and that’s why nobody noticed the world revolution that took place on March 29th 2019. Only a small wave...

Read More »Here’s What It’s Like To Be a Bear in a Rigged Market

Central bankers and media handlers must be laughing at how easy it is to slaughter the Bears and doubters with another fake-news round of trade-deal rumors and another Fed parrot being prompted to repeat some dovish mumbo-jumbo. It’s not just tough being a Bear in a market rigged by trade deal rumors, Federal Reserve dovishness, a tsunami of Chinese liquidity and $270 billion in stock buy-backs in the first quarter–it’s...

Read More »FX Daily, April 10: Be Careful What You Wish For

Swiss Franc The Euro has risen by 0.15% at 1.1276 EUR/CHF and USD/CHF, April 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates There were only a few formal disputes under NAFTA 1.0. It says more about the adjudication process than the underlying issues. It was not binding. The Democrats want stronger enforcement provisions in what the NAFTA 2.0. It is understandable. Still,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org