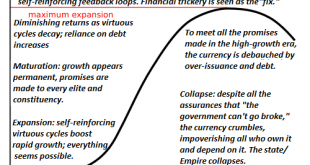

There are no extreme “fixes” to secular declines in sales, profits, employment, tax revenues and asset prices. The saying “never let a crisis go to waste” embodies several truths worth pondering as the stock market nears new highs. One truth is that extreme policies that would raise objections in typical times can be swept into law in the “we have to do something” panic of a crisis. Thus wily insiders await (or trigger)...

Read More »Switzerland: Lower growth, lower inflation

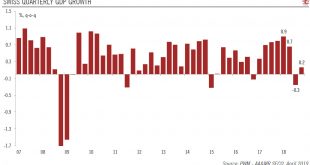

Growth and price rises should moderate in 2019. The Swiss economy posted impressive GDP growth in 2018, although there was significant divergence between strong growth in the first half and stagnation in the second. Overall, we expect Swiss GDP to expand by 1.3% in 2019, down substantially from 2.5% in 2018. Risks to our growth outlook for Switzerland are tilted to the downside. Looking ahead, we expect the Swiss...

Read More »Holiday traffic jams build at Gotthard tunnel

A controversial second tunnel will not be ready until at least 2030. (Keystone) The start of the Easter holidays in many Swiss cantons is causing long tailbacks at the Gotthard tunnel in central Switzerland, with waits of more than two hours at the northern end. Just before midday on Saturday, the traffic queue to enter the tunnel going south stretched for 14 kilometres, according to the Touring Club of...

Read More »Swiss unemployment above northern european average

© Miklmakmagnitka | Dreamstime.com Switzerland is often assumed to have low unemployment. However, there are many countries in Europe with lower rates. There are several ways to measure unemployment. The official measure in Switzerland is focused on those officially registered as unemployed still collecting unemployment benefits, a measure that delivers a lower figure than the one calculated by the International Labour...

Read More »Swiss test finds toxic substances in e-cigarettes

© Ilona Tymchenko _ Dreamstime.com Testing commissioned by Blue Cross, a Swiss organisation focused on helping those with addictions, found toxic substances in the Iqos electronic cigarette produced by Philip Morris, according to the newspaper 20 Minutes. Toxic isocyanates were released when the polymer filter in the device was heated to 100 degrees, a temperature significantly lower than the maximum of 350 degrees...

Read More »Assange and the Unforgivable Sin of Disemboweling Official Narratives

The entire global status quo is on the cusp of the S-Curve decline phase. There is really only one unforgivable sin in the political realm, and that’s destroying the official narrative by revealing the facts of the matter. This is why whistleblowers who make public the secret machinery of the elaborately artful lies underpinning all official narratives are hounded to the ends of the Earth. Employees of state entities...

Read More »Blind Faith vs. the Bottom Line

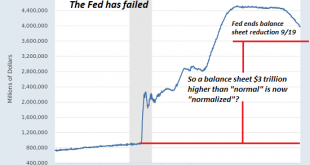

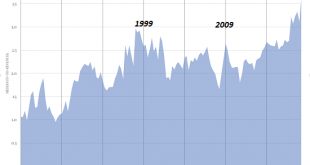

There is more than a little “let them eat brioche” in the blind faith that the masses’ patience for pillage is infinite. We’ve reached an interesting moment in history where we each have a simple choice: we either go with blind faith or we go with the bottom line, i.e. the facts of the matter. So far, 2019 is the year of Blind Faith, as the charts below illustrate: the bottom line no longer matters. Let’s start with...

Read More »Swisscom forges ahead with 5G amid safety fears

Some in Switzerland fear the health effects of increased radiation from 5G antennas. (Keystone) Telecoms operator Swisscom says it plans to cover 90% of Switzerland with “5G” fifth-generation mobile communications by the end of this year. “As soon as we have the concession for the new mobile frequencies, we will activate our networks,” Swisscom director Urs Schaeppi told the media on Wednesday. The networks were put in...

Read More »Monthly Macro Chart Review – April 2019 (VIDEO)

Alhambra CEO Joe Calhoun discusses the charts from the past month and what they indicate. [embedded content] Related posts: Monthly Macro Chart Review: April 2019 Monthly Macro Chart Review – March (VIDEO) Monthly Macro Monitor – March 2019 (VIDEO) Monthly Macro Monitor – February (VIDEO) Monthly Macro Chart Review – March Monthly Macro Monitor –...

Read More »FX Daily, April 12: Euro Bid Above $1.13 for the First Time this Month

Swiss Franc The Euro has risen by 0.29% at 1.1317 EUR/CHF and USD/CHF, April 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The consolidative week in the capital markets is drawing to a close. Equity markets are narrowly mixed. In Asia, most indices outside of the greater China (China, Taiwan, and Hong Kong) edged higher, leaving the MSCI Asia Pacific Index...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org