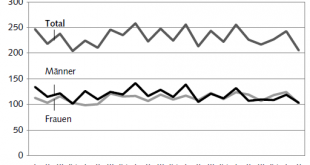

20.08.2019 – The number of employed persons in Switzerland rose by 1.1% between the 2nd quarter 2018 and the 2nd quarter 2019. During the same period, the unemployment rate as defined by the International Labour Organisation (ILO) fell from 4.6% to 4.2%. The EU unemployment rate based on the ILO definition decreased from 6.8% to 6.3%. These are some of the results from the Swiss Labour Force Survey (SLFS). Download press release: 2nd quarter 2019: number of persons...

Read More »USD/CHF technical analysis: 21-DMA exerts downside pressure

USD/CHF pulls back to 23.6% Fibonacci retracement. 21-DMA limits near-term upside. Following its U-turn from the 21-day simple moving average (DMA), USD/CHF confronts 23.6% Fibonacci retracement of April-August declines as it takes the bids to 0.9793 ahead of the European session on Wednesday. While 14-bar relative strength index (RSI) shows normal condition, pair’s sustained run-up beyond 0.9800 enables it to challenge the short-term key DMA level of 0.9811. It...

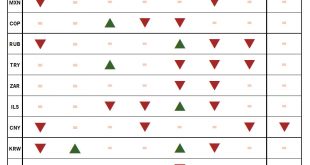

Read More »Brazilian real stands out in EM currency scorecard

Prospects for emerging-market currencies look cloudy. The currencies of countries with sound external buffers and limited exposure to global trade should fare relatively better than others. In recent months, the global environment has become more challenging for EM currencies. Trade tensions have increased and are weighing on economic activity. Commodity prices have also fallen. Such developments tend to weigh on global appetite for relatively risky EM assets. More...

Read More »Nine out of ten Swiss are satisfied with their job

Satisfied men at work The vast majority of Swiss people enjoy going to work. In a survey by consultants EY, 87% said they were satisfied or very satisfied with their job. Although the figure has barely changed since last year, differences between sectors persist. In the construction industry and in mechanical and systems engineering, for example, satisfaction has increased significantly. In the banking and insurance sectors, on the other hand, it has declined,...

Read More »FX Daily, August 20: Marking Time Ahead of PMI and Powell

Swiss Franc The Euro has risen by 0.13% to 1.0856 EUR/CHF and USD/CHF, August 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Global equities and bonds are firmer in quiet turnover, and the dollar is narrowing mixed in narrow ranges. The big events of the week, the eurozone flash PMI and Powell’s speech at Jackson Hole still lie ahead. The MSCI Asia Pacific Index rose for the third consecutive session, led by...

Read More »Philipp Hildebrands Coup: Gratisgeld für EU-Bürger

Vergangene Woche stellte Philipp Hildebrand, der frühere Präsident des Direktoriums der Schweizerischen Nationalbank (SNB), nun Vize-Präsident von Blackrock, auf Bloomberg ein Positionspapier vor. Verfasst hat er dieses zusammen mit anderen Autoren wie Stanley Fischer, ehemaliger stellvertretender Vorsitzender der US Federal Reserve (FED). Hildebrands Vorschlag: Geld- und Fiskalpolitik sollen miteinander verschmelzen. Den Bürgerinnen und Bürgern soll Geld direkt...

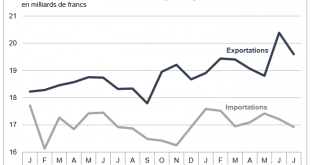

Read More »Swiss Trade Balance July 2019: foreign trade decelerates in July 2019

We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners. Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade partners decided to spend more. This is partially...

Read More »USD/CHF technical analysis: 50 percent Fibo. limits upside to 0.9835/37 resistance-confluence

USD/CHF seesaws near two-week high amid overbought RSI conditions. A confluence of six-day-old rising trend-line, 4H 200MA adds to the resistance. The USD/CHF pair’s one-week-old recovery seems to fade as the quote seesaws near 0.9814 during the Asian session on Tuesday. Not only repeated failures to cross 50% Fibonacci retracement of current month declines but overbought conditions of 14-bar relative strength index (RSI) also increases the odds of its pullback....

Read More »That Can’t Be Good: China Unveils Another ‘Market Reform’

The Chinese have been reforming their monetary and credit system for decades. Liberalization has been an overriding goal, seen as necessary to accompany the processes which would keep the country’s economic “miracle” on track. Or get it back on track, as the case may be. Authorities had traditionally controlled interest rates through various limits and levers. It wasn’t until October 2004, for example, that the upper limit on lending rates was rescinded. In August...

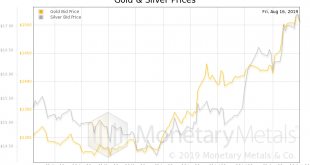

Read More »Deflation Is Everywhere—If You Know Where to Look, Report 18 Aug

At a shopping mall recently, we observed an interesting deal at Sketchers. If you buy two pairs of shoes, the second is 30% off. Sketchers has long offered deals like this (sometimes 50% off). This is a sign of deflation. Regular readers know to wait for the punchline. Manufacturer Gives Away Its Margins We do not refer merely to the fact that there is a discount. We are not simply arguing that Sketchers are sold cheaper—hence deflation. That is not our approach....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org