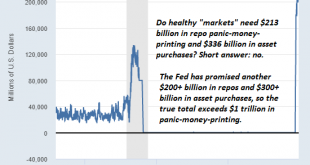

It was all fun and games enriching the super-wealthy but now the karmic cost of the Fed’s manipulation and propaganda is about to come due. A “market” that needs $1 trillion in panic-money-printing by the Fed to stave off a karmic-overdue implosion is not a market: a legitimate market enables price discovery. What is price discovery? The decisions and actions of buyers and sellers set the price of everything: assets, goods, services, risk and the price of borrowing...

Read More »Embrace Unilateral Free Trade with the UK — Right Now

Boris Johnson’s Conservatives won an outright majority in yesterday’s general election, pushing the Tories to an 80-strong Commons majority in what the Daily Mail called a “staggering election landslide.” Given that the Conservatives employed an election slogan of “Get Brexit Done,” it appears the election was largely a referendum on Brexit. The Conservative victory suggests Johnson will now move forward much more quickly on putting a UK-EU agreement in place for UK...

Read More »Banana Republic Money Debasement In America

Addicted to Spending There are many falsehoods being perpetuated these days when it comes to money, financial markets, and the economy. But when you cut the chaff, three related facts remain: Uncle Sam needs your money. He needs a lot of your money. And he needs it bad! The inescapable logic of tax & spend: empty vault… empty pockets… gimme more! PT According to the Congressional Budget Office, the federal budget deficit for the first two months of fiscal year...

Read More »Nationalbank ist vom Nutzen der Negativzinsen überzeugt

Die SNB hält am negativen Leitzins von −0,75% unverändert fest. Die Schweizerische Nationalbank (SNB) belässt den Leitzins und den Zins auf Sichtguthaben bei der SNB unverändert bei -0,75%, wie sie an ihrer geldpolitischen Lagebeurteilung am Donnerstag mitteilte. Sie ist weiterhin bereit, bei Bedarf am Devisenmarkt zu intervenieren und berücksichtigt dabei die gesamte Währungssituation. Die expansive Geldpolitik sei angesichts der Inflationsaussichten in der Schweiz...

Read More »Digitales Zentralbankgeld bringt laut Bundesrat gegenwärtig keinen Zusatznutzen

Der Bundesrat hat in einem am Freitag genehmigten Bericht Möglichkeiten, Chancen und Risiken eines Kryptofrankens oder e-Frankens analysieren lassen. Den Auftrag dazu hatte der Nationalrat mit der Überweisung eines Postulates von Cédric Wermuth (SP/AG) erteilt. Viele zahlen bar Mit dem Begriff “digitales Zentralbankgeld” ist Geld gemeint, dass im konkreten Fall die Schweizerische Nationalbank (SNB) schaffen würde, um es der breiten Bevölkerung zugänglich zu machen....

Read More »Swiss economy tipped to remain stagnant next year

The 2020 Olympic Games is expected to raise the bar for the economy – but only temporarily. (Keystone / Lukas Coch) The Swiss economy is not expected to see any sustainable growth until 2021 at the earliest, according to government forecasters. The Swiss National Bank (SNB) agreed, keeping negative interest rates unchanged. A government expert group concluded that economic growth would rise only 0.9% this year, 1.7% in 2020 and 1.2% in 2021. However, much of the...

Read More »The Most Important UK Election of the Century So Far

There’s only one story in the UK this morning – it’s the day Britain goes to the polls. It’s no exaggeration to say that this election is probably the most important of the century so far. If the ruling Conservative party wins a clear majority, then some form of Brexit is almost certain to go ahead. If the Conservatives fail to win a majority, then, depending on the final makeup of any government, Brexit will likely be delayed or even derailed, with a second...

Read More »Why the Courts Aren’t All They’re Supposed to Be

In the United States, law courts routinely hand out court order mandating payments to victims. And then do little to enforce them. For example, according to the U.S. Census Bureau, in 2015 only 43.5 percent of custodial parents received the full amount of court-ordered child support payments. 25.8 percent received partial payment while 30.7 percent — a figure which is trending higher — received no payments. I live in Canada, where the situation is equally, if not...

Read More »Negativzinsen ab dem ersten Franken?

Hypothekarnehmer können von den Negativzinsen profitieren, während die Sparer bestraft werden. (Bild: Shutterstock.com) Seit fünf Jahren bittet die Schweizerische Nationalbank (SNB) hiesige Banken zur Kasse. Diese bezahlen auf Giroeinlagen ab einer bestimmten Höhe einen Negativzins von 0.75 Prozent. Die Banken belasten diesen «Strafzins» vermehrt Kunden mit hohen Bargeldbeständen – meist erst ab mehreren hunderttausend Franken. Ein Ende des Negativzinsregimes sei für...

Read More »Fritz Zurbrügg – «Wir machen nicht Geldpolitik für irgendwelche Sektoren»

Im Dezember 2014 wurden sie von der Schweizerischen Nationalbank angekündigt, am 15. Januar 2015 dann überfallartig eingeführt: Die Negativzinsen von 0,75 Prozent. Damals ging man davon aus, dass die harte Massnahme der Schweizer Währungshüter zwei, maximal drei Jahre dauern würden. Nun sind es fast fünf Jahre Negativzins. Und die Nationalbank liess den Zinssatz, der weltweit tiefste einer Zentralbank, an ihrer Sitzung am Donnerstag einmal mehr unverändert. Fritz...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org