Most investments went to Europe (Keystone / A3250/_oliver Berg) Companies in Switzerland invested double the amount abroad in 2018 than the previous year, figures show. But foreign investors withdrew capital from Switzerland due to a US tax reform. In 2018, companies domiciled in Switzerland invested CHF 61 billion abroad ($62 billion) (compared to CHF30 billion in 2017). Around three-quarters of the direct investment were from firms in the services sector, the Swiss...

Read More »ECB: Preview of the review

We see the ECB remaining on hold throughout next year although we believe it could tweak some of the technical parameters of its toolkit. The first press conference of any new ECB President is an event in itself, and this time will be no different. Christine Lagarde’s debut this week will understandably attract a lot of attention as the media and market participants scrutinise both form and substance. Indeed, the ECB’s ‘transition’ goes beyond the change in...

Read More »Retail digital franc remains taboo for Switzerland

Switzerland has no plans to launch a centralised Swiss franc version of bitcoin. (© Keystone / Christian Beutler) Switzerland has ruled out the possibility of a central bank-issued digital franc for the general public in the foreseeable future. The government has backed up the Swiss National Bank’s (SNB) fears that this would lead to financial instability. Responding to a parliamentary question, the Federal Council on Friday said an ongoing project to produce a...

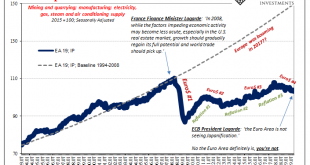

Read More »Lagarde Channels Past Self As To Japan Going Global

As France’s Finance Minister, Christine Lagarde objected strenuously to Ben Bernanke’s second act. Hinted at in August 2010, QE2 was finally unleashed in November to global condemnation. Where “trade wars” fill media pages today, “currency wars” did back then. The Americans were undertaking beggar-thy-neighbor policies to unfairly weaken the dollar. The neighbor everyone though most likely to be sponged off of was Europe. The day after the Fed’s second launch,...

Read More »Risk Assets Rally as Major Tail Risks Ease

The biggest tail risks impacting markets this year have cleared up; risk assets are rallying, while safe haven assets are selling off During the North American session, US November retail sales will be reported Russia central bank cut rates 25 bp to 6.25%, as expected Bank of Japan released a mixed Q4 Tankan report The dollar is broadly lower against the majors as tail risk evaporates. Nokkie and sterling are outperforming, while Aussie and yen are...

Read More »FX Daily, December 13: Stunning Tory Victory and US-China Trade Boosts Risk Assets

Swiss Franc The Euro has risen by 0.21% to 1.0964 EUR/CHF and USD/CHF, December 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The combination of a US-China trade deal and exit polls showing the Tories securing a majority in the House of Commons boosted risk assets, sent sterling flying, and the euro sharply higher. Separately, the Fed stepped up its efforts to make as smooth as possible funding over the...

Read More »Referenzzins – SNB-Direktorin Maechler drängt auf rasche Saron-Umstellung

Andréa M. Maechler, Mitglied des Direktoriums der Schweizerischen Nationalbank. Die Schweizerische Nationalbank hat vor einem halben Jahr den SNB-Leitzins eingeführt, weil der zuvor verwendete Referenzzins Libor ein Ablaufdatum hat. Seither haben die Währungshüter den Saron im Fokus. Dieser soll von den Marktteilnehmern nun konsequenter verwendet werden. Für die Finanzmärkte sei diesbezüglich insbesondere ein Saron-basierter Swapmarkt wichtig, sagte...

Read More »Geldpolitik – Trotz steigender Kritik: Schweizerische Nationalbank lässt Negativzins unverändert

[caption id="attachment_362313" align="alignleft" width="400"] Thomas Jordan, Präsident der SNB. Bild: Bloomberg[/caption] Die Schweizerische Nationalbank (SNB) belässt den Leitzins auf dem seit fast fünf Jahren geltenden Rekordtief von minus 0,75 Prozent. Das gab die SNB am Donnerstag an ihrer vierteljährlich stattfindenden geldpolitschen Lagebeurteilung bekannt. Die Sichteinlagen von Banken bei der Notenbank ab einem gewissen Freibetrag werden...

Read More »Can Swiss business and human rights co-exist?

Swiss President Ueli Maurer meets Russian leader Vladimir Putin, November 2019. (Keystone / Alexei Druzhinin / Sputnik / Kre) Switzerland performs a delicate dance when it comes to promoting business interests, maintaining neutrality and defending human rights. Daniel Warner looks at recent examples and the stakes at play. Doing business with other countries and promoting human rights can and do go hand in hand, Swiss State Secretary for Foreign Affairs Pascale...

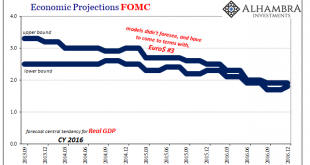

Read More »The FOMC Channels China’s Xi As To Japan Going Global

The massive dollar eruption in the middle of 2014 altered everything. We’ve talked quite a lot about what Euro$ #3 did to China; it sent that economy into a dive from which it wouldn’t escape. And in doing so convinced the Chinese leadership to give growth one more try before changing the game entirely once stimulus inevitably failed. In many other places around the world it has been the same. Not just developing economies, either. You wouldn’t have known from how...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org