Summary: Fed made mostly minor changes in the statement as it hiked the Fed funds rate for the third time in the cycle. The average and median dot for Fed funds crept slightly higher. There was only one dissent to the decision. The Federal Reserve delivered the much-anticipated rate hike. There was one dissent, the Minneapolis Fed President Kashkari. In the first paragraph of the FOMC statement tweaked the...

Read More »Global Asset Allocation Update

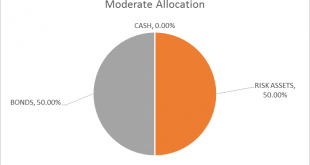

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. The Fed spent the last month forward guiding the market to the rate hike they implemented today. Interest rates, real and nominal, moved up in anticipation of a more aggressive Fed rate hiking cycle. Post meeting, a lot of the rise came out of the market. Nominal and...

Read More »Global Asset Allocation Update

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. The Fed spent the last month forward guiding the market to the rate hike they implemented today. Interest rates, real and nominal, moved up in anticipation of a more aggressive Fed rate hiking cycle. Post meeting, a lot of the rise came out of the market. Nominal and...

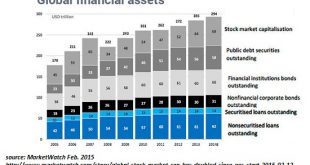

Read More »Now That Everyone’s Been Pushed into Risky Assets…

A funny thing happened on the way to a low-risk environment: loans in default (non-performing loans) didn’t suddenly become performing loans. If we had to summarize what’s happened in eight years of “recovery,” we could start with this: everyone’s been pushed into risky assets while being told risk has been transformed from something to avoid (by buying risk-off assets) to something you chase to score essentially...

Read More »FX Daily, March 15: Greenback Softens Ahead of FOMC

Swiss Franc Switzerland Producer Price Index (PPI) YoY, February 2017(see more posts on Switzerland Producer Price Index, ) Source: Investing.com - Click to enlarge GBP/CHF Today is crucial for Swiss Franc exchange rates with a number of economic releases and political events happening around the world which are likely to have a direct bearing on the direction of the Swiss Franc. The US Federal Reserve...

Read More »Vaud Discusses Extending Winter School Holiday to 2 Weeks

In Switzerland, this ski season has been disappointing, particularly if you have school aged children. During the Vaud school holiday this season, the fourth week of February, there was limited snow. Even at high resorts like Verbier, snow conditions were fairly average across the week. The week before there was good snow. But then everyone was still at school. A two-week school holiday in February would increase the...

Read More »China’s NPC Ends with New Initiatives

Summary: China will make its mainland bond market more accessible. As China’s portfolio of patents grows it will likely become more protective of others’ intellectual property rights. PRC President Xi will likely visit US President Trump early next month. The market’s immediate focus is on today’s FOMC meeting and Dutch elections. However, China’s annual legislative session (National People’s Congress) ended...

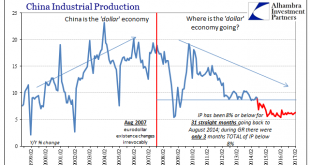

Read More »China Starts 2017 With Chronic, Not Stable And Surely Not ‘Reflation’

The first major economic data of 2017 from China was highly disappointing to expectations of either stability or hopes for actual acceleration. On all counts for the combined January-February period, the big three statistics missed: Industrial Production was 6.3%, Fixed Asset Investment 8.9%, and Retail Sales just 9.5%. For retail sales, the primary avenue for what is supposed to be a “rebalancing” Chinese economy,...

Read More »Swiss Producer and Import Price Index in February 2017: -0.2 percent

The Producer Price Index (PPI) or officially named "Producer and Import Price Index" describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015...

Read More »FX Daily, March 14: Brexit Takes Fresh Toll on Sterling, While Dollar Firms more Broadly

Swiss Franc EUR/CHF - Euro Swiss Franc, March 14(see more posts on EUR/CHF, ) - Click to enlarge FX Rates UK Prime Minister May got the parliamentary approval the courts ruled was necessary to formally trigger Article 50. It is not clear what UK she will lead out the EU. Scotland is beginning the legal proceedings to hold another referendum on independence. There is some talk that Northern Ireland, which...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org