(The sporadic updates continue while I am on a two-week business trip. Now in Barcelona, participating in TradeTech FX Europe) Several developments have attracted our attention, but the key take away is that the global capital markets have stabilized after appearing downright frightful at the end of last week, as stocks, yields, and the dollar plummeted. Equities rallied om Monday and there was follow through buying in...

Read More »Red Cross launches new bond to tap private money

The ICRC is the world's largest provider of physical rehabilitation services in developing countries. (Keystone) - Click to enlarge The Swiss-run International Committee of the Red Cross (ICRC) has launched the world’s first ‘Humanitarian Impact Bond’, which encourages private sector investment in humanitarian programmes. The innovative “payment-by-results” model centres on a five-year private placement programme...

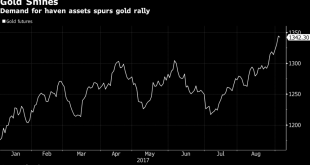

Read More »Safe Haven Gold Rises To $1338 as U.S. Warns of ‘Massive’ Military Response

– Safe haven gold extends rally to 11-month high after North Korea nuke test and U.S. warns of ‘massive’ response– Asian and European stocks fall, bonds flat, gold, silver, palladium, Swiss franc rise as Korea tensions flare as North Korea tests ‘hydrogen bomb’– North Korea prepares for possible ICBM launch says S. Korea– U.S. warns of ‘massive,’ ‘overwhelming’ military response to North Korea after meeting with Trump...

Read More »The Government Debt Paradox: Pick Your Poison

Lasting Debt “Rule one: Never allow a crisis to go to waste,” said President Obama’s Chief of Staff Rahm Emanuel in November of 2008. “They are opportunities to do big things.” At the time of his remark, Emanuel was eager to exploit the 2008 financial crisis to raid the public treasury. With the passage of the American Recovery and Reinvestment Act in February 2009, Emanuel’s wish was granted. The Obama administration...

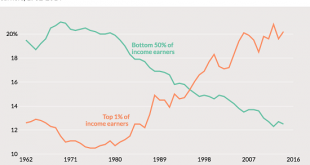

Read More »The Insanity of Pushing Inflation Higher When Wages Can’t Rise

In an economy in which wages for 95% of households are stagnant for structural reasons, pushing inflation higher is destabilizing. The official policy goal of the Federal Reserve and other central banks is to generate 3% inflation annually. Put another way: the central banks want to lower the purchasing power of their currencies by 33% every decade. In other words, those with fixed incomes that don’t keep pace with...

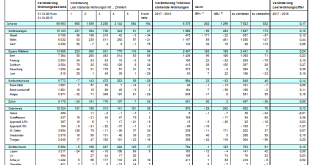

Read More »Swiss Real Estate: The Empty Dwellings Rate Continues to Increase

The Swiss Real Estate Bubble and Rents The number of empty dwellings is an important indicator for the Swiss real estate bubble. Prices of Swiss real estate had risen by 5%-8% per year between 2009 and 2014, while rents for existing contracts are regulated and have not followed this path yet. Landlords can only introduce higher prices levels for new buildings or new contracts. The reader should bear in mind that the...

Read More »“Things Have Been Going Up For Too Long” – Goldman CEO

– “Things have been going up for too long…” – Goldman Sachs’ CEO – Lloyd Blankfein, Goldman CEO “unnerved by market” (see video) – Bitcoin bubble is no outlier says Bank of America Merrill Lynch– Bubbles are everywhere including London property– $14 trillion of monetary stimulus has pushed investors to take more risks– We are now in a new era of bigger booms and bigger busts – BAML– “Seeing signs of bubbles in more and...

Read More »Chiasso accepts tax payments in bitcoin

Chiasso is establishing itself as a rival to Zug's Crypto Valley for fintech start-ups (Keystone) - Click to enlarge Switzerland ramped up its bid to become a global hub for financial technology (fintech) and cryptocurrency start-ups with the decision by a town on the Italian border to accept tax payments in bitcoin. Chiasso announced that it would take bitcoin to settle up to CHF250 ($265) of tax bills from the...

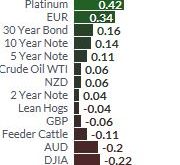

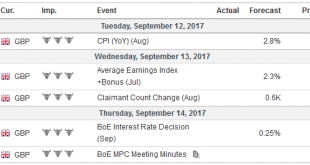

Read More »FX Weekly Preview: Forces of Movement in FX: The Week Ahead

Summary: The dollar has been declining since the start of the year, but the causes have changed. The drag from US politics may be exaggerated, while European and Japanese politics are worrisome. The economic data may continue to be a drag on US yields, especially if core CPI slips again. The US dollar’s sell-off accelerated. It has been selling off since the start of the year. The first phase of the decline at...

Read More »Emerging Markets: Preview for the Week Ahead

Stock Markets EM FX ended the week on a mixed note, but still capped off a strong week overall. US data this week could challenge the market’s dovish take on the Fed. For now, though, the global liquidity outlook still seems to favor further gains in EM. Stock Markets Emerging Markets, September 11 Source: economist.com - Click to enlarge China China should report August new loan and money supply data this...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org