Tom Keene and Francine Lacqua gave me a most appreciated opportunity to present my dollar views on Bloomberg TV earlier today. They also let me opine about current events, like Catalonia’s push for independence and May’s troubled speech at the Tory Party Conference. Bloomberg made two clips of the discussion available. The first is about the dollar’s outlook broadly. I suggest a combination of technical and fundamental...

Read More »Incomes Are What Matters, So Bad Month, Bad Year, Bad Decade

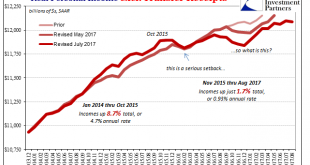

Sometimes economics can be complicated, such as why the labor market has slowed in such lingering fashion since early 2015. Sometimes economics can be easy, such as why there is so much less to the economy this year than thought. The easy part relates to the hard part. The labor market slowed and so did national income. Though so much of official focus is on debt supplementation, it’s always, always about income. US...

Read More »What If the Tax Donkeys Rebel?

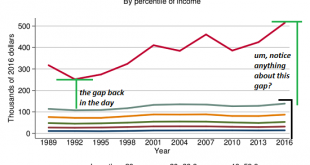

I would hazard a guess that an increasing number of tax donkeys are considering dropping out as a means of increasing their happiness and satisfaction with life. Since federal income taxes are in the spotlight, let’s ask a question that rarely (if ever) makes it into the public discussion: what if the tax donkeys who pay most of the tax rebel? There are several likely reasons why this question rarely arises. 1. Most...

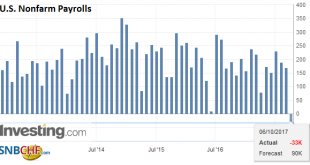

Read More »US Storm-Skewed Report Means Nothing about Anything

United States US interest rates and the dollar rose in response to the data. It was firm before the report. The US Dollar Index is up for a fourth consecutive week. It is the longest streak since Q1. US 10-year yields are near 2.40%, an area that has blocked stronger gains for nearly six months. Nonfarm payrolls The storms that hit the US had a greater impact on the US labor market than many expected. The recorded a...

Read More »Dollar Surge Continues Ahead Of Jobs Report; Europe Dips As Catalan Fears Return

World stocks eased back from record highs and fell for the first time in eight days, as jitters about Catalonia’s independence push returned while bets on higher U.S. interest rates sent the dollar to its highest since mid August; S&P 500 futures were modestly in the red – as they have been every day this week before levitating to record highs – ahead of hurricane-distorted nonfarm payrolls data (full preview here)....

Read More »Bi-Weekly Economic Review: Maximum Optimism?

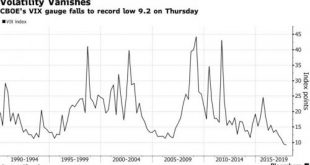

The economic reports of the last two weeks were generally of a more positive tone. The majority of reports were better than expected although it must be noted that many of those reports were of the sentiment variety, reflecting optimism about the future that may or may not prove warranted. Markets have certainly responded to the dreams of tax reform dancing in investors’ heads with US stock markets providing a steady...

Read More »Swiss blue-chip CEOs dominate European wage ranking

Sergio Ermotti, CEO of Swiss bank UBS, took home €12.3 million last year, the survey said (Keystone) - Click to enlarge The chief executive officers of Switzerland’s top firms take home almost double the median salaries of Europe’s 100 biggest companies, according to a study by consultants Willis Towers Watson. The Eurotop 100 study, presented on Thursday, studied the direct remuneration – not including...

Read More »Yahoo Hacking Highlights Cyber Risk and Increasing Importance of Physical Gold

– Yahoo admits every single one of 3 billion accounts hacked in 2013 data theft– Equifax hacking and security breach exposes half of the U.S. population– Some 143 million people vulnerable to identity theft– Deloitte hack compromised sensitive emails and client data– JP Morgan hacked and New York Fed hacked and robbed– International hacking group steals $300 million– Global digital banking and financial system not...

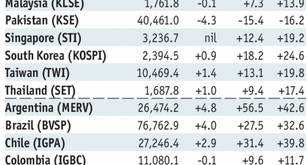

Read More »Emerging Markets: What has Changed

Stock Markets In the EM equity space as measured by MSCI, China (+4.1%), South Africa (+3.2%), and Hungary (+2.4%) have outperformed this week, while Egypt (-2.8%), Qatar (-2.7%), and Mexico (-1.7%) have underperformed. To put this in better context, MSCI EM rose 1.9% this week while MSCI DM rose 0.6%. In the EM local currency bond space, Argentina (10-year yield -13 bp), Nigeria (-5 bp), and Thailand (-4 bp) have...

Read More »FX Daily, October 6: Look Through the US Jobs Report

Swiss Franc The Euro has risen by 0.27% to 1.1485 CHF. EUR-CHF and USD-CHF, October 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Traders are putting the final touches on another strong weekly performance for the US dollar. Strong economic data, including the PMIs, auto sales, and factory orders have surprised to the market. The ADP report warns that the storms that...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org