SkyWork currently serves some 17 destinations from the Swiss capital (Keystone) - Click to enlarge SkyWork Airlines, which flies to various European destinations from Bern Airport, may be forced to cease operations by the end of October due to its unstable financial situation. The Federal Office of Civil Aviation (FOCA) has limited SkyWork’s operating permit to the end of this month because the company is...

Read More »The Gold-Backed-Oil-Yuan Futures Contract Myth

On September 1, 2017, the Nikkei Asian Review published an article titled, “China sees new world order with oil benchmark backed by gold”, written by Damon Evans. Just below the headline in the introduction it states, “China is expected shortly to launch a crude oil futures contract priced in yuan and convertible into gold in what analysts say could be a game-changer for the industry”. Not long after the Nikkei piece...

Read More »Migration of the Tax Donkeys

Dear local leadership: here’s the formula for long-term success. A Great Migration of the Tax Donkeys is underway, still very much under the radar of the mainstream media and conventional economists. If you are confident no such migration of those who pay the bulk of the taxes could ever occur, please consider the long-term ramifications of these two articles: Stanford Says Soaring Public Pension Costs Devastating...

Read More »FX Weekly Preview: The Markets and the Long Shadow of Politics

Summary: Rise in paper asset prices, including so-called cyber currencies, reflects the abundance of capital. Have we forgotten what Minski taught again? Political considerations may dominate ahead of the ECB meeting later this month. Why should we think there is anything amiss by looking at the global capital markets? The S&P 500 and the German Dax are at record levels. The Japanese market is at 20-year...

Read More »Emerging Markets: Preview of the Week Ahead

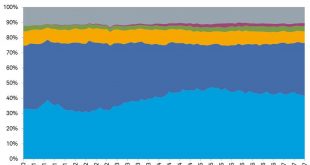

Stock Markets EM FX closed the week on a firm note, as softer than expected US CPI data weighed on the dollar. We continue to believe that investors are underestimating the Fed’s tightening potential. Meanwhile, idiosyncratic political risk remains high for MXN, TRY, and ZAR. Stock Markets Emerging Markets, October 14 Source: economist.com - Click to enlarge China China reports CPI and PPI Monday. The former is...

Read More »Political Focus Shifting in Europe

There was a huge sigh of relief among investors when it became clear that the populist-nationalist wave that ostensibly led to Brexit and Trump’s election was not going to sweep through Europe. The euro gapped higher on April 24, and it has not looked back. We have suggested that with the outcome of the German election, European politics shift from tailwind to headwind. Spain’s most serious constitutional crisis in 40...

Read More »U.S. Mint Gold Coin Sales and VIX Point To Increased Market Volatility and Higher Gold

– US Mint gold coin sales and VIX at weakest in a decade– Very low gold coin sales and VIX signal volatility coming– Gold rises 1.7% this week after China’s Golden Week; pattern of higher prices after Golden Week– U.S. Mint sales do not provide the full picture of robust global gold demand– Perth Mint gold sales double in September reflecting increased gold demand in both Asia and Europe– Middle East demand likely high...

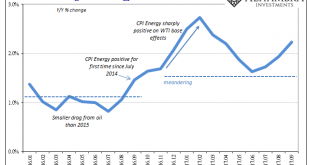

Read More »US CPI: Inflation Still Isn’t About Inflation

The US Consumer Price Index (CPI) rose back above 2% in September 2017 for the first time since April. Boosted yet again by energy prices, consumer prices overall still aren’t where the Fed needs them to be (by its own policies, not consumer reality). In fact, despite a 10.2% gain in the energy price index last month, the overall CPI just barely crossed the 2% mark (though for the Fed it really needs to be closer to 3%...

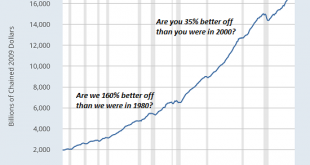

Read More »Are You Better Off Than You Were 17 Years Ago?

We tend to measure what’s easily measured (and supports the status quo) and ignore what isn’t easily measured (and calls the status quo into question). If we use gross domestic product (GDP) as a broad measure of prosperity, we are 160% better off than we were in 1980 and 35% better off than we were in 2000. Other common metrics such as per capita (per person) income and total household wealth reflect similarly hefty...

Read More »The Donald Can’t Stop It

Divine Powers The Dow’s march onward and upward toward 30,000 continues without a pause. New all-time highs are notched practically every day. Despite Thursday’s 31-point pullback, the Dow is up over 15.5 percent year-to-date. What a remarkable time to be alive. President Donald Trump is pumped! As Commander in Chief, he believes he possesses divine powers. He can will the stock market higher – and he knows it. ...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org