Divine Powers The Dow’s march onward and upward toward 30,000 continues without a pause. New all-time highs are notched practically every day. Despite Thursday’s 31-point pullback, the Dow is up over 15.5 percent year-to-date. What a remarkable time to be alive. President Donald Trump is pumped! As Commander in Chief, he believes he possesses divine powers. He can will the stock market higher – and he knows it. For example, early Wednesday morning he blasted out the following Tweet: “Stock Market has increased by 5.2 Trillion dollars since the election on November 8th, a 25% increase.” Four minutes later, he sent out another Tweet: “…if Congress gives us the massive tax cuts (and reform) I am asking

Topics:

MN Gordon considers the following as important: Debt and the Fallacies of Paper Money, Featured, newsletter, On Economy, On Politics, The Stock Market

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Divine PowersThe Dow’s march onward and upward toward 30,000 continues without a pause. New all-time highs are notched practically every day. Despite Thursday’s 31-point pullback, the Dow is up over 15.5 percent year-to-date. What a remarkable time to be alive. President Donald Trump is pumped! As Commander in Chief, he believes he possesses divine powers. He can will the stock market higher – and he knows it. For example, early Wednesday morning he blasted out the following Tweet:

Four minutes later, he sent out another Tweet:

Who knows? Maybe President Trump is right. These days even bad reforms – and just about everything else – are good for stocks. And what’s good for stocks is good for everything. For instance, according to President Trump stock market gains reduce the national debt. He even said so this week. President Trump’s logic for how higher stock prices reduce the national debt was unclear. But it certainly sounds good to say. More importantly, it sounds bullish. |

Dow Jones Industrial Average, Nov 2016 - Oct 2017(see more posts on Dow Jones Industrial Average, ) The DJIA keeps surging… but it is running on fumes (US money supply growth is disappearing rapidly). - Click to enlarge The president loves this and has decided to “own” the market by gushing about its record run. During his campaign he professed to worry about the “giant bubble”. We happen to think that it is probably best for a president not to talk about the stock market at all, but the Donald evidently couldn’t resist. One thing that continues to be quite satisfying is this quote by Paul Krugman on election night, when stock market futures plunged after it became clear that the Donald would beat Hillary: “It really does now look like President Donald J. Trump, and markets are plunging. […] I guess people want an answer: If the question is when markets will recover, a first-pass answer is never.” Krugman’s predictions are often devastatingly wrong, but rarely this fast. |

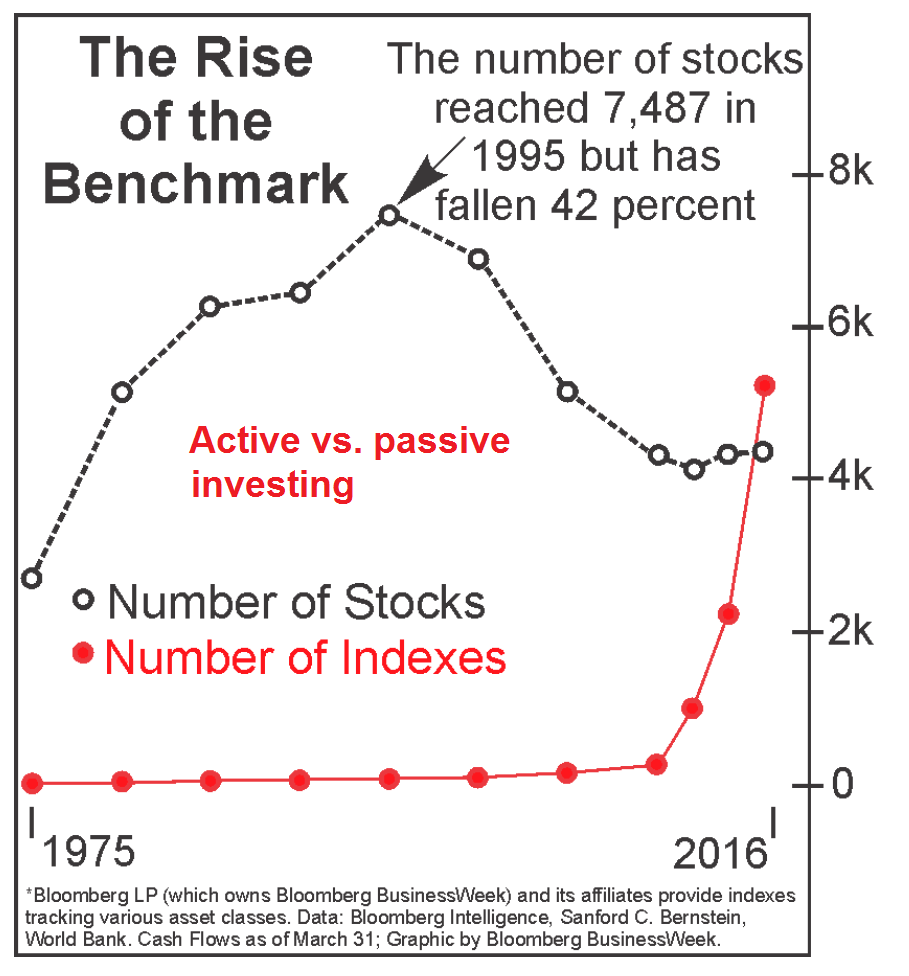

Smart and Savvy InvestorsOn the other hand, obvious risks and hazards no longer matter. Not the prospect of nuclear war with North Korea will stop this bull market. Not the gold backed yuan oil exchange agreements being developed between Beijing, Moscow, and Tehran, and the implications for the petrodollar’s reserve currency status. Not weak jobs numbers. So, too, runaway government debt, consumer debt, and corporate debt haven’t fazed the stock market’s trajectory. Because everyone loves debt. Especially bankers. They want more debt so they can buy more stocks. Nosebleed level valuations don’t matter either. Because, if you haven’t heard, high valuations are no longer high; they’re permanent. Likewise, the beginning of the Fed’s great unwind of its $4.5 trillion balance sheet has hardly elicited a flinch. President Trump’s shoddy tax reform proposal, the proposal that would tax income that’s already confiscated via state and local taxes, hasn’t done a thing to deter today’s smart and savvy investors. Why should they care about taxes when, thanks to The Donald, their portfolio wealth has increased by 25 percent since election day? Of course, smart and savvy investors, particularly buy and hold index investors, have reaped plentiful fruits for mindlessly plowing their capital into low cost S&P 500 index ETFs. Indeed, this strategy has worked well for nearly a decade. Surely it will continue, right? A passively managed S&P 500 Index ETF, such as the SPDR S&P 500 ETF (NYSE: SPY), is up over 279 percent since March 9, 2009. Investors that merely bought and held have been rewarded for their lack of discrimination. Conversely, those who scratched their head, did some homework, and concluded that the market’s fundamentals are deficient, have been sorely punished. |

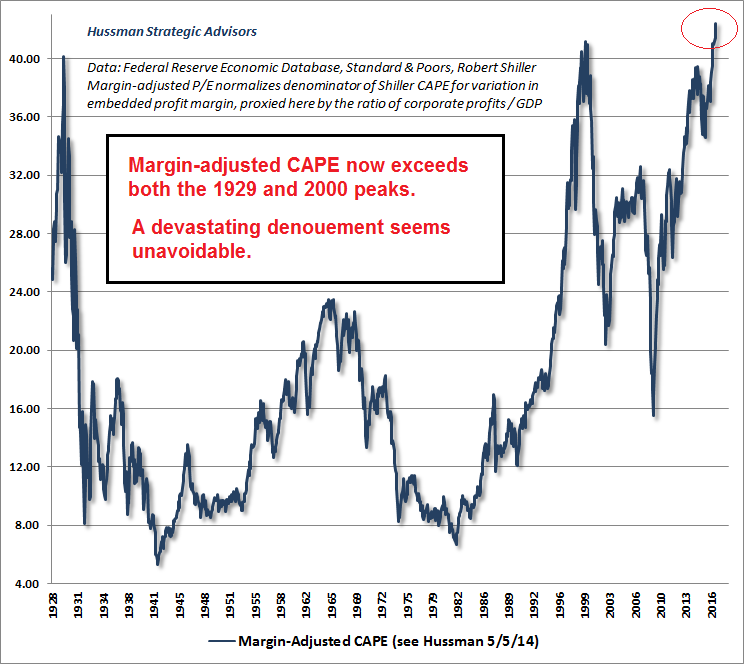

Margin Adjusted Cape, 1928 - 2016 The margin-adjusted version of the Shiller P/E ratio (a.k.a. CAPE or PE-10) via John Hussman. - Click to enlarge The Shiller P/E looks at valuations over the span of a decade, which is intended to filter out cyclical effects. Mr. Hussman has taken this a step further by adjusting it for profit margins, which tend to be mean-reverting in the long term (discussed in detail here). Looked at in this way, markets are now more overvalued than ever (there are other ratios suggesting the same, such as median price/sales). As to the president’s remark about the effect the market may exert on the budget, he was probably thinking of capital gains tax windfalls… which happened to be quite supportive for Clinton’s budget. Of course such inflationary gains are illusory – once the bubble bursts, the deficits will simply pile up all the faster. |

The Donald Can’t Stop ItYet, while SPY investors have experienced the delightful sensation that comes with a burgeoning investment portfolio, they’ve also been handicapped. The extended bull market has lulled them into believing that investing is easy. All you need to know are several simple rules. Buy and hold the SPY. Dollar cost average. Eschew individual stocks. You’ll always come out ahead over the long-run. A SPY buyer doesn’t need to study businesses to understand which ones are profitable and which aren’t. They don’t need to bother with the tedious task of analyzing a company’s financial statement and making inferences about its growth prospects and risks. They don’t have to read footnotes. They don’t have to do any work. They don’t even have to think. But not only has the bull market made the SPY popular for individual investors. It has also made it a popular investment for funds and institutions. This combination has served to relentlessly push the market higher, even though there’s no fundamental rhyme or reason to justify it. Certainly, buying SPY has been a great strategy over the last eight years. Who can argue with 279 percent returns? However, it’s unlikely to be a good strategy over the next eight years. You see, passively managed ETFs that simply mirror the movement of the S&P 500 are a fantastic investment vehicle when the stock market rises over an extended period. On the other hand, in a bear market, when there’s a protracted stock market decline, these passively managed index tracking ETFs are terrible investments. When the stock market crashes by 50 percent – which it likely will, these ETFs will also crash by 50 percent. No doubt, with each passing day, the bull market moves closer to the next bear market. That’s when the trajectory will no longer be up. But, rather, it’ll be down. That’s when SPY portfolios will vaporize as the herd attempts to panic out of the market at precisely the same moment. What’s more, when push comes to shove, The Donald can’t stop it. |

Active vs Passive Investing, 1975 - 2016 There are now more ETFs, ETNs and other trackers than there are individual stocks. - Click to enlarge This is undoubtedly distorting asset prices. For instance, most modern-day indexes are cap-weighted, and the ETFs tracking them simply buy stocks according to their weighting when new baskets are created. This buying is just mindless, which suggests it isn’t going to end well (a tracking ETF cannot decide to e.g. forego purchase of a stock with an obscenely high P/E ratio). In fact, the Nasdaq’s decline between 2000 – 2002 already gave us a preview of what happens when the trend turns down. |

Tags: Featured,newsletter,On Economy,On Politics,The Stock Market