The year 2000 was a transition year in a lot of ways. Though Y2K amounted to mild mass hysteria, people did have to get used to writing the date with 20 in front of the year rather than 19. It was a new millennium (depending on your view of Year 0) that seemed to have started off under the best possible terms. Not only were stocks on fire at the outset, the economy was, too. The idea of this “new economy” leading...

Read More »News conference Swiss National Bank, Thomas Jordan

Thomas Jordan, Chairman of the Governing Board of the Swiss National Bank News conference of the Swiss National Bank, Berne, 14.12.2017 Thomas Jordan - Click to enlarge Introductory remarks by Thomas Jordan Ladies and gentlemen It is a pleasure for me to welcome you to the Swiss National Bank’s news conference. I will begin by explaining our monetary policy decision and our assessment of the economic situation. I will...

Read More »Andréa M. Maechler: Introductory remarks, news conference

Andréa M. Maechler, Member of the Governing Board of the Swiss National Bank News conference of the Swiss National Bank, Berne, 14.12.2017 Complete text: PDF (478 KB) I will begin my remarks with a review of the situation on the financial markets, before going on to discuss the progress made in reference interest rate reform. Situation on the financial markets Let me start with developments on the financial markets....

Read More »News conference Swiss National Bank 2017, Fritz Zurbrügg

Fritz Zurbrügg, Vice Chairman of the Governing Board of the Swiss National Bank News conference of the Swiss National Bank, Berne, 14.12.2017 Fritz Zurbrugg - Click to enlarge Introductory remarks by Fritz Zurbrügg In my remarks today, I would like to address some of the developments currently taking place in the field of financial stability. I shall look at the big banks first before turning to the domestically...

Read More »SNB Monetary policy assessment of 14 December 2017

Swiss National Bank leaves expansionary monetary policy unchanged The Swiss National Bank (SNB) is maintaining its expansionary monetary policy, with the aim of stabilising price developments and supporting economic activity. Interest on sight deposits at the SNB is to remain at –0.75% and the target range for the three-month Libor is unchanged at between –1.25% and –0.25%. The SNB will remain active in the foreign...

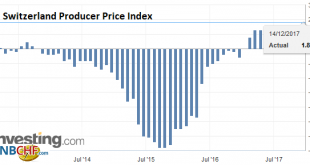

Read More »Swiss Producer and Import Price Index in November 2017: +1.8 YoY, +0.6 MoM

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015...

Read More »The Swiss economy is gaining momentum

Swiss growth was disappointing at the end of 2016 and in the first half of 2017. Consequently, GDP growth this year is likely to be just 1.0%, its lowest level since 2012. However, a wide set of statistics are already painting a considerably more positive picture of strengthening growth as we approach the end of 2017. Of particular note is the increasing contribution of manufacturing to real GDP growth. Switzerland’s...

Read More »FX Daily, December 14: US Rates Bounce Back, but Dollar, Hardly

Swiss Franc The Euro has risen by 0.18% to 1.1673 CHF. EUR/CHF and USD/CHF, December 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates US interest rates have recovered the drop seen after the FOMC yesterday, but the dollar at best has been able to consolidate its losses and at worst, seen its losses extended. The Fed boosted its growth forecasts and lower unemployment...

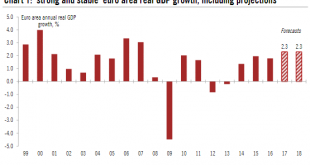

Read More »Euro Area Forecast to Grow 2.3percent in 2018

We have upgraded our growth projection for this year and next. There are upside risks to our forecast that the ECB will start hiking rates in Q3 2019. Taking account of stronger growth momentum, the carryover effect and upward revisions to past data, we have upgraded our euro area annual GDP growth forecasts to 2.3% both in 2017 and 2018. Our forecasts remain consistent with a very gradual slowdown in the quarterly...

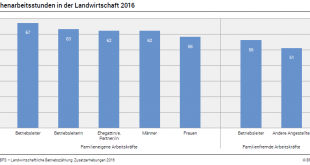

Read More »Farm Census 2016: Swiss farmers work well over 60 hours per week

Neuchâtel, 12.12.2017 (FSO) – For several years the average Swiss farmer has been working well over 60 hours per week. With their off-farm jobs, part-time farmers also work long hours. From 2010 to 2016, however, the hours worked fell by one hour per week. Over the same period, farms greatly increased the direct sale of farm products (+60%). Despite the long working hours, in many cases it is very likely that a family...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org