USD/CHF The USDCHF pair attempted to breach 0.9581 level yesterday but it returns to move below it now, which keeps the bearish trend scenario valid until now, supported by stochastic move within the overbought areas, waiting to head towards 0.9488 as a first target. We reminding you that confirming breaching 0.9581 will push the price to visit 61.8% Fibonacci correction level at 0.9675 before any new attempt to...

Read More »Swiss Retail Sales, February: Stable Nominal and +0.6 Percent Real

The Used Goods Question Retail sales in several countries like Germany, Japan and Switzerland continue to fall or they remain steady for years. In the United States they have strongly risen recently. We should remind readers, that used goods sold via Ebay or similar, are not contained in this statistics. Still they create economic value for the purchases. By mentality, Swiss, Germans or Japanese pay more attention so...

Read More »FX Daily, April 03: Markets in Search of Footing

Swiss Franc The Euro has risen by 0.04% to 1.1754 CHF. EUR/CHF and USD/CHF, April 03(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The sell-off in US tech shares dragged the market lower. The S&P 500 fell for the sixth session of the past eight and closed below the 200-day moving average for the first time in a couple of years. The sell-off in Asia and Europe is...

Read More »Cool Video: Bloomberg Double Feature

Many are still celebrating the Easter holiday today, but not Tom Keene and Lisa Abramowicz and the Bloomberg team. They hosted me on Bloomberg TV today. As is often the case, the discussion was broad, covering the pressing economic and financial issues. In the first clip, which runs about 2.5 minutes, I sketch out the argument for the US economy being in a late-stage expansion. I cite the 12-month moving average of...

Read More »Food consumes far less of Swiss budgets than it did 25 years ago

Comparing the most recent statistics on Swiss consumer inflation to those in 1993 reveals a steep drop in the percentage of spending allocated to food. © Tero Vesalainen | Dreamstime.com - Click to enlarge When statisticians calculate consumer price rises they look at the prices of a standard basket of goods. In 1993, food and non-alcoholic beverages made up 14.3% of the value of this standard basket. By 2018, the...

Read More »Gold Outperforms Stocks In Q1, 2018

Gold Outperforms Stocks In Q1, 2018 – Gold signs off Q1 2018 with best run since 2011 – Gold price supported by safe haven demand, interest-rate concerns and inflation – Trade wars and concerns over equity market have sent investors towards gold – ETF holdings highest in nearly a decade – Goldman Sachs: ‘The dislocation between the gold prices and U.S. rates is here to stay’ Gold ended March with it’s best performance...

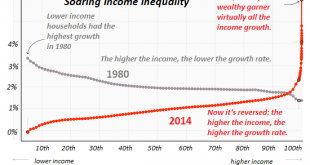

Read More »The Problem with a State-Cartel Economy: Prices Rise, Wages Don’t

The vise will tighten until something breaks. It could be the currency, it could be the political status quo, it could be the credit/debt system–or all three. The problem with an economy dominated by state-enforced cartels and quasi-monopolies is that prices rise (since cartels can push higher costs onto the consumer) but wages don’t (since cartels can either dominate local labor markets or engage in global wage...

Read More »FX Daily, April 02: Monday Blues

Swiss Franc The Euro has fallen by 0.03% to 1.1746 CHF. EUR/CHF and USD/CHF, April 02(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar drifted a little lower in Asia to start the week while equities had a slightly heavier bias. The MSCI Asia Pacific Index slipped 0.1%. European bourses are mostly closed for the extended Easter holiday, while the S&P is...

Read More »EasyJet foresees Swiss market growth

Swedish businessman Lundgren has been EasyJet's chief executive since December 2017. (Keystone) - Click to enlarge In an interview given to the SonntagsZeitung on Sunday, EasyJet CEO Johan Lundgren described the company’s strategy for increasing its already-growing share of passengers in the Swiss market. Lundgren told the German-language paper than in recent years, the low-cost British airline has counted...

Read More »Emerging Markets: Preview of the Week Ahead

Stock Markets EM FX was mostly stronger last week, despite the dollar’s firm tone against the majors. Best EM performers on the week were MXN, KRW, and COP while the worst were ZAR, INR, and PEN. US jobs data poses the biggest risk to EM this week, as US yields have been falling ahead of the data. Indeed, the current US 10-year yield of 2.74% is the lowest since February 6. We remain cautious on EM FX, and do not think...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org