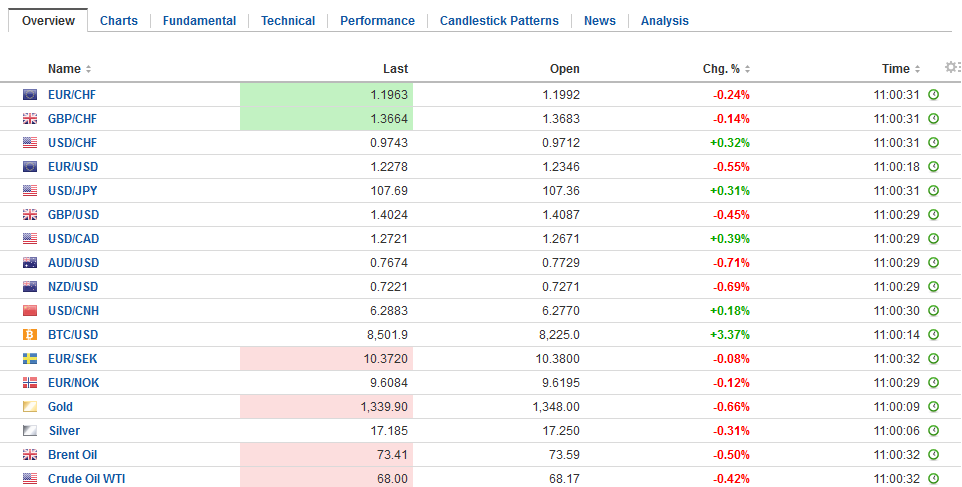

Swiss Franc The Euro has fallen by 0.24% to 1.1961 CHF. EUR/CHF and USD/CHF, April 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is set to finish the week on a firm note. It reflects rising US yields, where the 10-year is above 2.90% for the first time since February and the widening two-year different between the US and Germany, which is holding just below 300 bp. It is the fourth consecutive advancing session for the Dollar Index, which is near a two-week high. The only major currency that may gain against the dollar this week is the Swedish krona. It could eke out a small gain which seems to reflect some position adjusting ahead of next week

Topics:

Marc Chandler considers the following as important: 4) FX Trends, AUD, CAD, Canada consumer price index, Canada Retail Sales, EUR, EUR/CHF, Featured, GBP, Japan National Consumer Price Index, Japan National Core Consumer Price Index, JPY, newslettersent, TLT, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss FrancThe Euro has fallen by 0.24% to 1.1961 CHF. |

EUR/CHF and USD/CHF, April 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

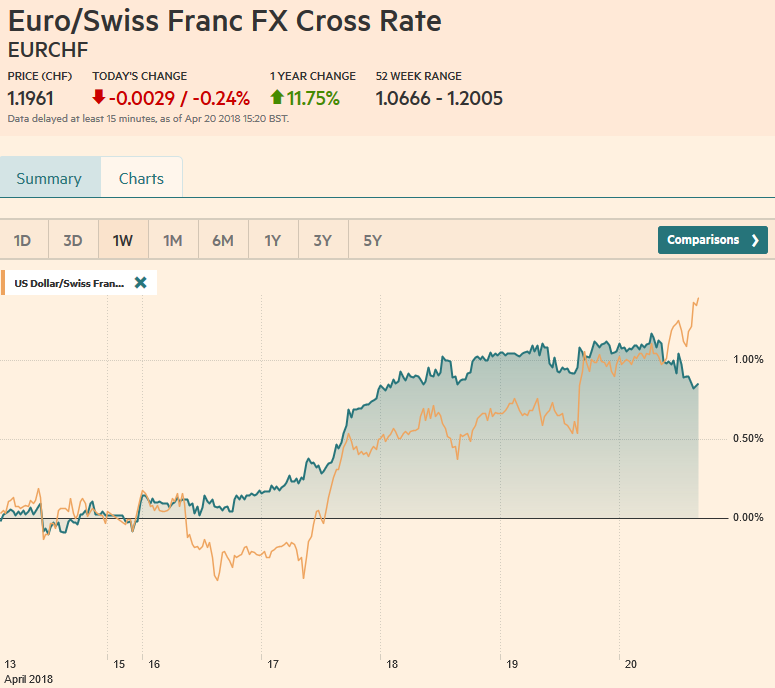

FX RatesThe US dollar is set to finish the week on a firm note. It reflects rising US yields, where the 10-year is above 2.90% for the first time since February and the widening two-year different between the US and Germany, which is holding just below 300 bp. It is the fourth consecutive advancing session for the Dollar Index, which is near a two-week high. The only major currency that may gain against the dollar this week is the Swedish krona. It could eke out a small gain which seems to reflect some position adjusting ahead of next week Riksbank meeting. Although it will likely keep its rath path unchanged, it may revise up its medium-term inflation outlook that may give the hold a hawkish feel. |

FX Daily Rates, April 20 |

| The euro is being sold below $1.23 today for the first time in two weeks. It is the midpoint of the two-cent range which has confined the euro for the past several weeks. There are about 1.45 mln euros in options struck between $1.2300 and $1.2305 that expire today. Widening short-term interest rate differentials mean that it is increasingly expensive to hold the euro when the currency appreciation is not sufficient to compensate.

Sterling’s losses have been extended. It had already fallen for two days before BOE Carney’s comments yesterday sent it down further. Today is the fourth consecutive session that sterling is falling against the US dollar. Carney’s recognition of recent disappointing data spurred speculation that maybe next month’s anticipated rate hike is not a done deal. The odds of a hike next month were downgraded from the mid-to-higher 85% chance to closer 57% today. There is a GBP326 mln option struck at $1.40 that expires today. |

FX Performance, April 20 |

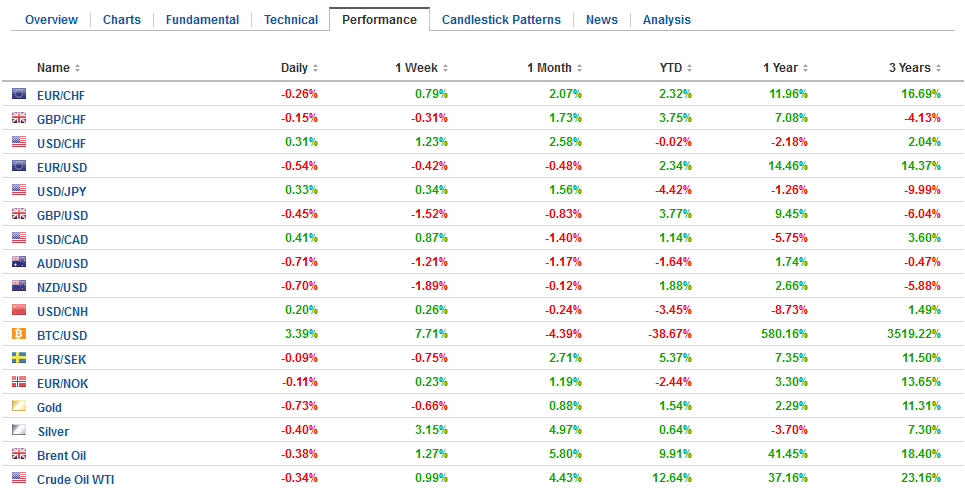

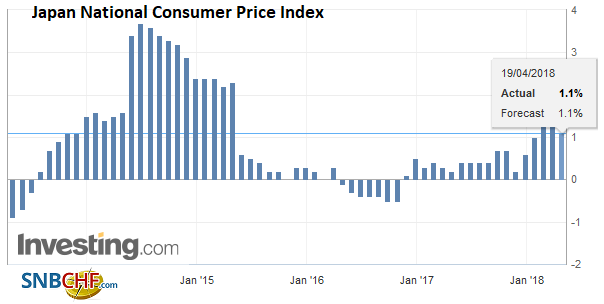

JapanThe main economic data of note has been the Japanese March CPI. It was spot expectations for a slight downtick in price pressures. The headline pace slowed to 1.5% from 1.1%. |

Japan National Consumer Price Index (CPI) YoY, May 2013 - Apr 2018(see more posts on Japan National Consumer Price Index, ) Source: Investing.com - Click to enlarge |

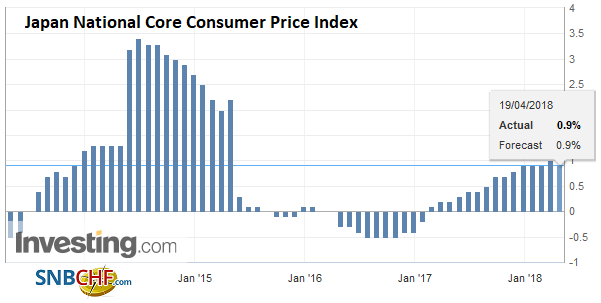

| The core rate, which excludes fresh food, slipped to 0.9% from 1.0%. Soft furniture and household goods prices weighed on the core rate, while slower increases in energy (5.7% vs. 7% in February) and fresh food prices (halved to 6.3%) account for the bulk of the headline decline. |

Japan National Core Consumer Price Index (CPI) YoY, Apr 2013 - 2018(see more posts on Japan National Core CPI, ) Source: Investing.com - Click to enlarge |

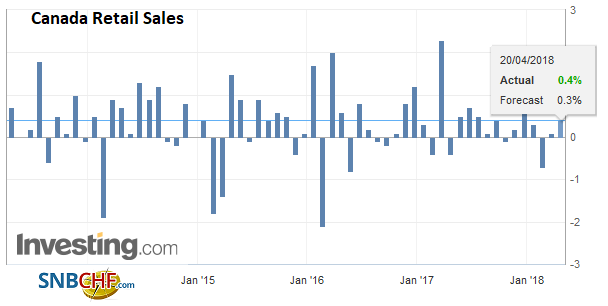

CanadaCanada reports retail sales and CPI. The Bank of Canada met earlier this week and left rates on hold as widely expected, Today’s data is unlikely to change expectations, which favor a hike in Q3. Headline retail sales are expected to rise 0.4% after a 0.3% increase in January. Retail sales rose an average of 0.5% a month in both 2016 and 2017. |

Canada Retail Sales, Apr 2013 - 2018(see more posts on Canada Retail Sales, ) Source: Investing.com - Click to enlarge |

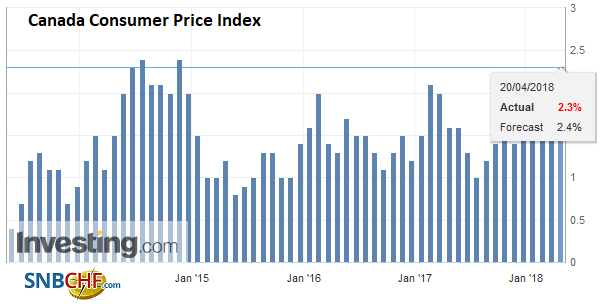

| March CPI is expected to edge higher (2.4% from 2.2%, headline), with core measures also ticking up. |

Canada Consumer Price Index (CPI) YoY, May 2013 - Apr 2018(see more posts on Canada Consumer Price Index, ) Source: Investing.com - Click to enlarge |

The combination of rising 10-yield and the decline in inflation has helped the dollar edge closer to the JPY108 area. There is a $636 mln option struck there that expires today. The greenback has quietly strung together a four-week advance against the yen, the longest such streak since last October. The technical bottoming pattern we have been monitoring projects toward JPY110.

The Australian dollar posted a potential key reversal yesterday by making a new high for the move (poked above $0.7800) but then proceeded to sell-off and close at a week and a half low. Follow-through selling has pushed it below $0.7700 today. Note that there is an A$1 bln option struck at $0.7700 that will be cut today. The next important support area is seen in the $0.7630-$0.7650 area.

The US has a light economic calendar. Only Chicago Fed Evans speech on the economy and monetary policy shortly after the equity market opens is of note, and even there the views are well known. The Fed is widely expected to hike rates in June, though Bloomberg continues to insist that there is risk of a May move.

Consider that the effective Fed funds are averaging 1.69%. The May contract implies 1.695% next month. We suggest this is consistent with a no hike, which is consistent too with the Fed’s behavior since the rate hike cycle began in 2015. Does that really translate into 30% chance that Bloomberg say?

Powell may choose to change that pattern. We suggest it would be preferable to have a press conference after every meeting. That is what the BOJ and ECB do, for example. However, we do not think Chairman Powell will do this at his second meeting, after hiking rates at his first meeting.

The Canadian dollar is little changed now after weakening since the Bank of Canada meeting. The US dollar lost above 4.6% against the Canadian dollar since the middle of March and the low set earlier this week. The loss of the downside momentum has spurred some position adjustments, and a move now above CAD1.2690 would see a near-term test on CAD1.2730-CAD1.2740.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,$TLT,Canada Consumer Price Index,Canada Retail Sales,EUR/CHF,Featured,Japan National Consumer Price Index,Japan National Core Consumer Price Index,newslettersent,USD/CHF