Tightening Credit Markets Daylight extends a little further into the evening with each passing day. Moods ease. Contentment rises. These are some of the many delights the northern hemisphere has to offer this time of year. As summer approaches, and dispositions loosen, something less amiable is happening. Credit markets are tightening. The yield on the 10-Year Treasury note has exceeded 3.12 percent. If yields...

Read More »FX Daily, May 23: Dollar and Yen Surge, European Data Disappoints

Swiss Franc The Euro is down by 0.53% to 1.1628 CHF. This is the fifth day in sequence that the Swiss Franc appreciated. Italy political drama is has spurred a significant rally in the Swiss franc. Over the past five days, it has been the strongest of the majors, rising 1.1% against the dollar and 1.8% against the euro. Today, it is the only major currency beside the yen that is gaining ground. Italian assets were...

Read More »Alpine tunnel closure causes major holiday traffic disruption

Tailbacks to enter the Gotthard tunnel going south on Saturday reached a record since 1999, and drivers are being advised to use alternative routes. (Keystone) - Click to enlarge Traffic queues of up to 28 kilometres were reported at the northern entrance to the Gotthard tunnel on Saturday, owing to a long weekend and the closure of another major Alpine road tunnel because of a fire. The San Bernadino...

Read More »Great Graphic: Euro-Swiss Shows Elevated Systemic Risk

Summary: The euro fell every day last week against the Swiss franc. Italian political anxiety is the key development. Speculators in the futures market got caught leaning the wrong way. The Swiss National Bank’s decision in January 2015 to remove the cap on the Swiss franc (floor on the euro) that it has set at CHF1.20 is seared into the memory of a generation of foreign exchange participants. It is not...

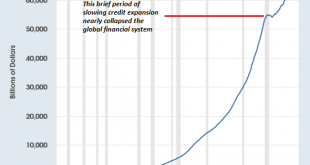

Read More »The Next Recession Will Be Devastatingly Non-Linear

The acceleration of non-linear consequences will surprise the brainwashed, loving-their-servitude mainstream media. Linear correlations are intuitive: if GDP declines 2% in the next recession, and employment declines 2%, we get it: the scale and size of the decline aligns. In a linear correlation, we’d expect sales to drop by about 2%, businesses closing their doors to increase by about 2%, profits to notch down by...

Read More »Why the Fundamental Gold Price Rose – Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Gold Lending and Arbitrage There was no rise in the purchasing power of gold this week. The price of gold fell $22, and that of silver $0.19. One question that comes up is why is the fundamental price so far above the market price? Starting in January, the fundamental price began to move up sharply, and the move...

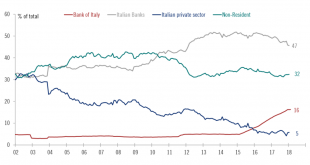

Read More »Eurosceptic Italian government faces a reality check

More than two months after the general election, the Italian political impasse seems close to being broken, with the League and the Five Star Movement (M5S) likely to form a government. M5S and the League together have a majority in both the upper and lower houses. After several document leaks this week, a final common programme was published today. The document needs the approval of party members. The focus will shift...

Read More »Fribourg – moves to axe government pensions for life

Switzerland’s government is working hard to find ways to fix a looming state pension shortfall. © Sang Lei | Dreamstime.com - Click to enlarge Two politicians in the canton of Fribourg have decided to seek savings by attempting to cut lifetime government pensions granted after short stints in the job, according to the newspaper 20 Minutes. In some Swiss cantons, government leaders can work for several years and leave...

Read More »Weekly Technical Analysis: 21/05/2018 – USD/JPY, EUR/USD, GBP/JPY, USD/CAD, USD/CHF

USD/CHF The USDCHF pair reaches the key support 0.9955 now, and as we mentioned in our last report, breaking this level will confirm completing the double top pattern that appears on the chart, to rally towards our negative targets that begin at 0.9900 and extend to 0.9850. Therefore, we will continue to suggest the bearish trend supported by the negative pressure formed by the EMA50, unless the price managed to rally...

Read More »Emerging Markets: Week Ahead Preview

Stock Markets EM FX ended Friday on a weak note and extended the slide. For the week as a whole, the best EM performers were PHP, TWD, and SGD while the worst were ARS, ZAR, and TRY. With US rates continuing to move higher, we believe selling pressures on EM FX will remain in play this week. Our recently updated EM Vulnerability Table supports our view that divergences within EM will remain. Stock Markets Emerging...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org