With effect from 1 October 2018, Gregor Bäurle will assume the function of Swiss National Bank (SNB) delegate for regional economic relations for the Central Switzerland region. He succeeds Walter Näf, who is taking on a new position, representing the SNB in the Swiss delegation to the OECD in Paris as of 1 January 2019. Following a research stay in the US as a visiting scholar, Gregor Bäurle received his doctorate in...

Read More »FX Daily, September 25: Greenback Remains at the Fulcrum

Swiss Franc The Euro has risen by 0.35% at 1.137 EUR/CHF and USD/CHF, September 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The major currencies are mixed in quiet turnover. Most of the European currencies are firmer, while the dollar-bloc currencies, yen and Swiss franc are softer. Emerging market currencies are steady to higher, though there are a few...

Read More »Swiss Health Insurance Costs to Rise Further in 2019

More bad news for Swiss household budgets was released today for residents of all but three Swiss cantons. ©-Hai-Huy-Ton-That-_-Dreamstime.com_ - Click to enlarge Health insurance premiums in 2019 will be on average 1.2% higher than in 2018 across Switzerland as a whole. However, within this figure there are significant cantonal variations. Hardest hit will be residents of Valais (+3.6%) and Neuchâtel (+3.1%), while...

Read More »Monthly Macro Monitor – September 2018

Alhambra Investments CEO Joe Calhoun shares his opinions of the economy and market based on the most recent economic reports. Related posts: Monetary Policy Assessment of 20 September 2018 Monthly Macro Monitor – September FX Daily, September 12: Dollar Chops in Narrow Ranges Global Asset Allocation Update – September 2018 Monthly Macro...

Read More »Why Are Wages So Low, Report 23 Sep 2018

Last week, we talked about the capital consumed by Netflix—$8 billion to produce 700 shows. They’re spending more than two thirds of their gross revenue generating content. And this content has so little value, that a quarter of their audience would stop watching if Netflix adds ads (sorry, we couldn’t resist a little fun with the English language). So it is with wry amusement that, this week, Keith heard an ad for an...

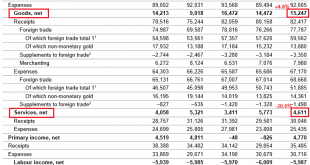

Read More »Swiss Balance of Payments and International Investment Position: Q2 2018

Current Account Key figures: Current Account: Up 27.0% against Q1/2018 to 22.1 bn. CHF of which Goods Trade Balance: Up 4.8% against Q1/2018 to 15.2 bn. of which the Services Balance: Minus 20.6% to 4.6 bn. of which Investment Income: Plus 107.7% to 10.7 bn. CHF. Current Account Switzerland Q2 2018(see more posts on Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account,...

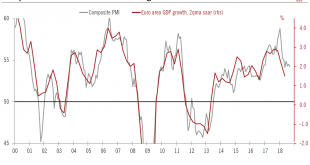

Read More »Business Indicators Present a Contrasting Picture of the Euro Area

The services sector is proving resilient, but manufacturing disappoints. Euro area flash composite PMI dipped slightly to in September and came in slightly below consensus expectations. Activity in services picked up and weakened further in manufacturing, which continued its decline since the start of the year, falling to 53.3 in September from 54.6 in August. New export orders failed to grow for the first time since...

Read More »Thousands demonstrate in Bern for equal pay

Demonstrators gather in front of parliament in Bern (Keystone) A national rally in favour of equal pay and against discrimination has taken place in the Swiss capital, attracting some 20,000 people, according to organisers. Unions, political parties and supporting organisations said in the run-up to the rally on Saturday that although equality was enshrined in the constitution 37 years ago and the law had been in force...

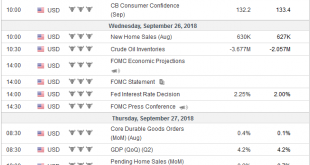

Read More »FX Weekly Preview: Next Week’s Drivers

It is a testament to the Federal Reserves communication and the evolution of investors’ understanding that we can say that the rate hike that the central bank will deliver is not as important as what it says. A rate hike is a foregone conclusion. According to the CME’s model, there is about an 85% chance of December hike discounted as well. The effective Fed funds rate is 1.92% with the target range of 1.75%-2.00%. The...

Read More »The Four Disastrous Presidential Policies That Are Destroying the Nation

The nation is failing as a direct consequence of these four catastrophic policies. It’s admittedly a tough task to select the four most disastrous presidential policies of the past 60 years, given the great multitude to choose from. Here are my top choices and the reasons why I selected these from a wealth of policy disasters. 1. President Johnson’s expansion of the Vietnam War, which set the stage for President Nixon’s...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org