Submitted by Thorstein Polleit via The Mises Institute, The US is by far the biggest economy in the world. Its financial markets — be it equity, bonds or derivatives markets — are the largest and most liquid. The Greenback is the most important transaction currency. Many currencies in the world — be it the euro, the Chinese renminbi, the British pound or the Swiss franc — have actually been built upon the US dollar. The...

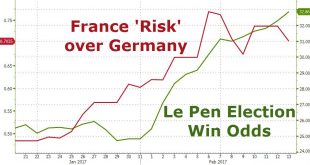

Read More »Here Are The Best Hedges Against A Le Pen Victory

On Friday, after it emerged that as part of Marine Le Pen’s strategic vision for France, should she win, is a return to the French franc as well as redenomination of some €1.7 billion in French (non-international law) bonds, both rating agencies and economists sounded the alarm, warning it would “amount to the largest sovereign default on record, nearly 10 times larger than the €200bn Greek debt restructuring in 2012,...

Read More »FX Weekly Review, February 06 – 11: Further Dollar and CHF Strength versus Euro weakness ahead?

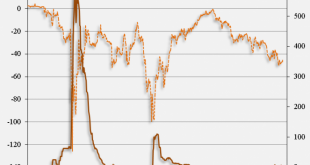

Swiss Franc Currency Index The major information about the Swiss economy since the beginning of the year were: New record in exports and in the trade surplus, albeit mostly driven by a few sectors: pharmaceuticals and chemicals. Considerable improvement of the consumer sentiment Improvement of the UBS consumption indicator. While in 2015, the trade surplus still expanded, we see clear tendencies that in 2017 the...

Read More »Re-Denomination Risk in France and Italy

On the FT Alphaville blog, Mark Weidemaier and Mitu Gulati argue that re-denomination risk in the Euro zone is most prominent in France and Italy. Bonds with CACs trade at higher prices. Most French and Italian [but not Greek] debt is governed by local law. … the governments could pass legislation redenominating their bonds from euros to francs or lira. … [But] some French and Italian bonds — bonds issued after January 1, 2013, with maturities over a year — have Collective Action Clauses...

Read More »FX Weekly Review, January 30 – February 04: Reversal of Trump Reflation Trade Continues

Swiss Franc Currency Index The Swiss Franc index remained around the 2% gain that for the last month, the recovery from the Trump reflation trade. In this trade, investors preferred U.S. against European stocks. This tendency, however, is reversing now – and with it the franc recovered. Trade-weighted index Swiss Franc, February 04(see more posts on Swiss Franc Index, ) Source: market.ft.com - Click to...

Read More »Re-denomination Constitutes Default

In a letter to the editor of The Economist, Moritz Kraemer, sovereign chief ratings officer of S&P Global Ratings, clarifies what it would mean for France to re-denominate French debt: Buttonwood wondered whether Marine Le Pen’s plan to re-denominate French government euro bonds into new francs might constitute a sovereign default (January 14th). There is no ambiguity here: it would. If an issuer does not adhere to the contractual obligations to its creditors, including payment in the...

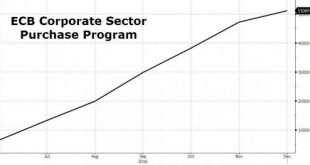

Read More »ECB Assets Rise Above 36 percent Of Eurozone GDP; Draghi Now Owns 10.2 percent Of European Corporate Bonds

The ECB’s nationalization of the European corporate bond sector continues. In the ECB’s latest update, the six central banks acting on behalf of the Euro system provided an update on the list of corporate bonds they bought. They bought into 810 issuances with a total of €573bn in amount outstanding. For the week ending 27th January, the bond purchases stood at €1.9bn across sectors. This increases the number of...

Read More »FX Weekly Review, January 23 – 28: Dollar Downwards and CHF Upwards Correction, for how long?

Swiss Franc Currency Index The Swiss Franc index has a solid performance of 2.5% in the last month, while the dollar index is down nearly 3%. Trade-weighted index Swiss Franc, January 28(see more posts on Swiss Franc Index, ) Source: markets.ft.com - Click to enlarge Swiss Franc Currency Index (3 years) The Swiss Franc index is the trade-weighted currency performance (see the currency basket)On a three...

Read More »FX Weekly Review, January 16 – 21: Dollar Still Appears to Carving out a Bottom

Swiss Franc Currency Index During the last month the Swiss Franc index recovered some of the losses since the election of Donald Trump. Its performance is +2%, while the dollar index is 2% down. Trade-weighted index Swiss Franc, January 21(see more posts on Swiss Franc Index, ) Source: markets.ft.com - Click to enlarge Swiss Franc Currency Index (3 years) The Swiss Franc index is the trade-weighted...

Read More »FX Weekly Review, January 09 – 14: Dollar Correction may be Over or Nearly So

Swiss Franc Currency Index For the first week since the election of Trump, the Swiss Franc index had a clearly better performance than the dollar index. It improved by 1.5% in the last ten days. Trade-weighted index Swiss Franc, January 14(see more posts on Swiss Franc Index, ) Source: markets.ft.com - Click to enlarge Swiss Franc Currency Index (3 years) The Swiss Franc index is the trade-weighted...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org