Summary: China’s share of global reserves is in line with expectations prior to its inclusion in the SDR. Three factors influencing allocated reserves – valuation, portfolio decisions, and China’s gradual inclusion in allocated reserves. The Swiss franc’s as a reserve asset diminished, but the “other” category appeared robust. The inclusion of the Chinese yuan in the SDR basket at the start of Q4 16 did not...

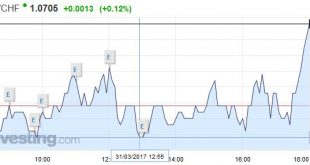

Read More »FX Daily, March 31: Greenback Finishing Weak Quarter in Mixed Fashion

Swiss Franc EUR/CHF - Euro Swiss Franc, March 31(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The US dollar fell against all the major currencies in the first three months of 2017. The weakness initially seemed to be a correction to the rally, which began before the US election last year. The dollar recovered in February, in anticipation of a hawkish Fed in March. The Fed did hike rates, but the...

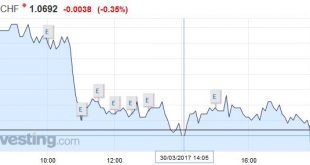

Read More »FX Daily, March 30: Euro breaks down against CHF and USD

EUR/CHF The SNB is intervening for 3 bn. CHF per week, this is far too much at these elevated Euro and Dollar levels. With two times positive economic data (here and here) about good news on internal demand, she might be finally be ready to let the euro fall. EUR/CHF - Euro Swiss Franc, March 30(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF The Pound to Swiss Franc exchange rate has opened up flat...

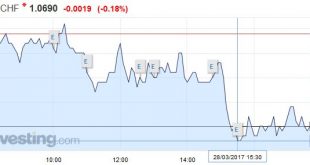

Read More »FX Daily, March 28: Prospects for Turnaround Tuesday?

Swiss Franc EUR/CHF - Euro Swiss Franc, March 28(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF The Swiss Franc continues to hold the higher ground as global uncertainty continues to dominate the markets. UBS Consumption Indicator is released tomorrow morning which should give some further clues to as the health of the Swiss economy. The numbers are important as the consumption is the most important...

Read More »FX Weekly Preview: After US Health Care, Now What?

United States The first quarter winds down. The dollar moved lower against all the major currencies. The best performer in the first three months of the year has been the Australian dollar’s whose 5.8% rally includes last week’s 1% drop. The worst performing major currency has been the Canadian dollar. It often underperforms in a weak US dollar environment. It’s almost 0.5.% gain is less than half the appreciation...

Read More »FX Daily, March 24: Dollar Trying to Stabilize Ahead of the Weekend

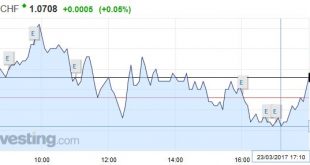

Swiss Franc EUR/CHF - Euro Swiss Franc, March 24(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF With just a few days to go before Article 50 is triggered the currency markets are waiting with baited breath for what may happen to the value of the Pound against all major currencies including against the Swiss Franc. Yesterday we saw a brief respite for the Pound vs the Swiss Franc with the release of...

Read More »FX Daily, March 23: Some Thoughts about the Recent Price Action

Swiss Franc EUR/CHF - Euro Swiss Franc, March 23(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The gains the US dollar scored last month have been largely unwound against the major currencies. The dollar’s losses against the yen are a bit greater, and it returned to levels not seen late last November. The down draft in the dollar appears part of a larger development in the capital markets that has...

Read More »FX Daily, March 21: Euro Recovery Continues, Posts New Six Week High Other Currencies Mixed

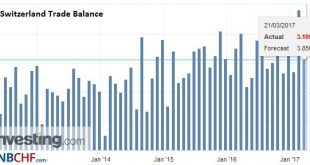

Swiss Franc Switzerland Trade Balance, February 2017(see more posts on Switzerland Trade Balance, ) Source: Investing.com - Click to enlarge GBP/CHF The Swiss Franc continues to remain incredibly strong as it maintains its status as a safe haven currency in these uncertain economic times globally. The Swiss National Bank quarterly bulletin is released tomorrow afternoon at 14pm which is produced by the...

Read More »FX Weekly Preview: Divergence Theme Questioned

Recent developments have given rise to doubts over the divergence theme, which we suggested have shaped the investment climate. There are some at the ECB who suggest rates can rise before the asset purchases end. The Bank of England left rates on hold, but it was a hawkish hold, as there was a dissent in favor of an immediate rate hike, and the rest of the Monetary Policy Committee showed that their patience with both...

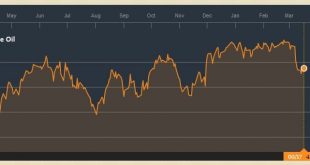

Read More »Oil Supply Remains Resilient, Prices Heavy

Summary: Nearly half of OPEC’s intended cuts are being offset by an increase in US output. The contango rewards the accumulation of inventories. The drop in oil prices probably weighs more on European reflation story than the US. Oil prices are lower for the seventh consecutive session. Light sweet crude prices had fallen 10.3% over the past two weeks, and with today’s losses are off another 1.6% already...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org