Swiss Franc The Euro has fallen by 0.20% to 1.174 CHF. EUR/CHF and USD/CHF, January 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar rallied in the North American afternoon yesterday and the timing coincided with the release of the Fed’s Beige Book that saw several districts report wage and price pressures. The US 10-year yield moved toward toward 2.60%,...

Read More »FX Daily, January 17: Dollar Stabilizes After Marginal New Lows

Swiss Franc The Euro has risen by 0.04% to 1.1766 CHF. EUR/CHF and USD/CHF, January 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates After a shallow bounce in Asia and Europe yesterday, the dollar slipped lower in North American yesterday. Asia was happy to extend those dollar losses, and the greenback was pushed to marginal new lower in Asia, but has come back in the...

Read More »FX Daily, January 16: Dollar Given a Reprieve

Swiss Franc The Euro has risen by 0.19% to 1.1783 CHF. EUR/CHF and USD/CHF, January 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates After extending its recent slide yesterday, which the US markets were on holiday, the dollar is firmer against all the major currencies and most of the emerging market currencies. There does not seem to be macroeconomic developments...

Read More »Great Graphic: Euro Monthly

The euro peaked in July 2008 near $1.6040. It was a record. The euro has trended choppily lower through the end of 2016 as this Great Graphic, created on Bloomberg, illustrates. We drew in the downtrend line on the month bar chart. The trend line comes in a little below $1.27 now and is falling at about a quarter cent a week, and comes in near $1.26 at the end of February. The $1.26 area also corresponds to a 61.8%...

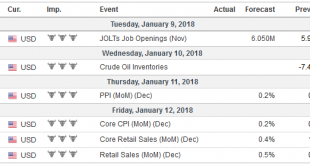

Read More »FX Daily, January 12: Euro Jumps Higher

Swiss Franc The Euro has risen by 0.45% to 1.1735 CHF. EUR/CHF and USD/CHF, January 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates There is one main story today and it is the euro’s surge. The euro began the week consolidating it recent gains a heavier bias, but the record of last month’s ECB meeting surprised the market with its seeming willingness to change the...

Read More »Is the BOJ Tapering?

The G3 central banks are in flux. The Federal Reserve is gradually raising rates and allowing the balance sheet to shrink by not fully reinvesting the maturing proceeds. The ECB will purchase half as many bonds in the first nine months of 2018 as it did in the last nine months of 2017. While some observers are talking about a rate hike late this year, it seems highly unlikely. The ECB has been clear that the...

Read More »FX Daily, January 11: Capital Markets Calmer, Greenback Consolidates

Swiss Franc The Euro has risen by 0.45% to 1.1735 CHF. EUR/CHF and USD/CHF, January 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates As market participants were just getting their sea legs back after the start of the year, it was hit by a one-two punch of ideas that BOJ policy was turning less accommodative and that Chinese officials were wary of adding to their Treasury...

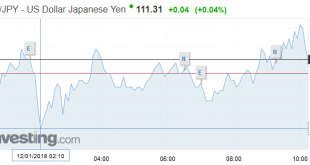

Read More »FX Daily, January 09: Dollar Correction Extended

Swiss Franc The Euro has risen by 0.31% to 1.1725 CHF. EUR/CHF and USD/CHF, January 09(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar’s upside correction that began before the weekend has been extended in Asia and Europe today. The main exception is the Japanese yen. The yen’s modest gains have been registered despite the firmness in US rates and continued...

Read More »FX Daily, January 08: Dollar Posts Modest Upticks to Start the New Week

Swiss Franc The Euro has risen by 0.04% to 1.1753 CHF. EUR/CHF and USD/CHF, January 08(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is enjoying modest but broad-based gains after trading firmly at the end of last week despite the slightly disappointing jobs report. The dollar’s upticks are understood to be corrective in nature. The Canadian dollar appears...

Read More »FX Weekly Preview: Accommodative Officials and Synchronized Upturn Drive Markets

The investment climate is being shaped by two powerful forces. First is the very accommodative policy stance. This includes the United States, where despite delivering the fifth rate hike in the cycle, adjusted by headline CPI, remains negative. The balance sheet has begun being reduced, financial conditions in the US are easier now than a year ago. The ECB’s bond purchase program, which has been cut in half to 30 bln...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org