Summary Bank of Korea hiked rates by 25 bp to 1.50%, the first hike in six years. Egypt central bank lifted the last remaining currency controls. S&P cut South Africa’s foreign currency rating one notch to BB with stable outlook. Turkey President Erdogan was implicated in an alleged plot to help Iran evade US sanctions. Moody’s upgraded Argentina one notch to B2 with stable outlook. The IMF approved a new $88 bln...

Read More »Emerging Market Preview: Week Ahead

Stock Markets EM FX ended the holiday-shortened week on a soft note. While most were up on the entire week, notable laggards were TRY, CLP, and ZAR. All three currencies underperformed due to rising political risks, and we suspect that will continue. We believe MXN and BRL are likely to rejoin the laggards in the coming days. Stock Markets Emerging Markets, November 22 Source: economist.com - Click to enlarge...

Read More »Emerging Market Preview: Week Ahead

Stock Markets EM FX ended the week firm, and capped off a good week overall. Best performers last week for ZAR and KRW, while the worst were TRY and IDR. Until we get higher US rates, the dollar may remain under modest pressure. This would help EM maintain some traction, though we remain cautious. Stock Markets Emerging Markets, November 15 Source: econnomist.com - Click to enlarge Chile Chile will hold...

Read More »Emerging Markets: What has Changed

Summary Moody’s raised India’s sovereign debt rating for the first time since 2004 by a notch to Baa2. Nigerian officials are on a global roadshow to support plans to issue its longest-dated Eurobonds ever The head of South Africa’s budget office resigned. President Robert Mugabe was placed under house arrest by the Zimbabwe military. Turkey’s central bank will introduce FX hedges for domestic companies with FX...

Read More »Emerging Markets: Week Ahead Preview

Stock Markets EM FX closed the week on a soft note. For the week as a whole, best performers were MYR, PLN, and COP, while the worst were BRL, ZAR, and INR. US inflation and retail sales data will likely set the tone for EM. Also, the US fiscal debate is set to continue this week, so expect lots of choppy trading across many markets. Stock Markets Emerging Markets, November 13 Source: economist.com - Click to...

Read More »Emerging Markets: What has Changed

Summary China announced that it will remove foreign ownership limits on banks and other measures to open up the financial sector. Central Bank of Turkey lowered commercial bank FX reserve requirements in an effort to support the lira. US-Turkey relations appear to be thawing slightly. Middle East tensions are rising on a variety of fronts. Argentina central bank unexpectedly hiked rates again. Former President Cardoso...

Read More »Emerging Markets: Week Ahead Preview

Stock Markets EM FX ended the week under pressure. News of the Venezuela debt restructuring was digested well, but sentiment went south as the day wore on. Weakness was concentrated in the weakest links TRY, BRL, RUB, and ZAR, while MXN and COP were dragged along for the ride. We see EM selling pressures persisting into 2018. Stock Markets Emerging Markets, November 04 Source: economist.com - Click to enlarge...

Read More »Global Asset Allocation Update

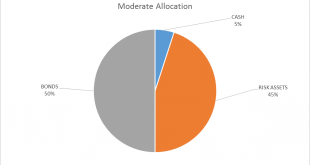

The risk budget this month shifts slightly as we add cash to the portfolio. For the moderate risk investor the allocation to bonds is unchanged at 50%, risk assets are reduced to 45% and cash is raised to 5%. The changes this month are modest and may prove temporary but I felt a move to reduce risk was prudent given signs of exuberance – rational, irrational or otherwise. Moderate Allocation - Click to enlarge No...

Read More »Emerging Markets: What has Changed

Summary Russia’s Finance Ministry announced plans to increase its dollar. purchases in November Bahrain has reportedly asked its Gulf allies for financial assistance. S&P upgraded Argentina a notch to B+ with stable outlook. Brazil raised BRL6.15 bln ($1.9 bln) by auctioning off the rights to explore 6 of the 8 deep-water oil blocks. Venezuela bowed to the inevitable, announcing that it would have to restructure...

Read More »Emerging Markets: What has Changed

Stock Markets EM FX gained some limited traction Friday but still capped off another awful week. So far this quarter, the worst EM performers are TRY (-6%), MXN (-5%), ZAR (-4%), COP, and BRL (both -2.5%). We expect these currencies to remain under pressure as political concerns are unlikely to dissipate anytime soon. Stock Markets Emerging Markets, October 30 Source: economist.com - Click to enlarge South...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org