It is largely irrelevant, but still the political theater is fascinating. As is now standard operating procedure, whatever comes out of the Trump administration immediately is conferred as the standard for awful. This is not my own determination, mind you, but that of the mainstream, whatever that is these days. And so it is with the first set of budget figures that include very robust growth projections, a point of...

Read More »No Acceleration In Industry, Either

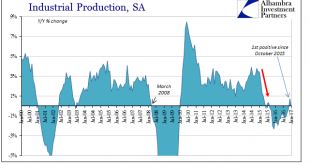

Industrial Production in the United States was flat in January 2017, following in December the first positive growth rate in over a year. The monthly estimates for IP are often subject to greater revisions than in other data series, so the figures for the latest month might change in the months ahead. Still, even with that in mind, there is no acceleration indicated for US industry. After suffering through a more than...

Read More »Their Gap Is Closed, Ours Still Needs To Be

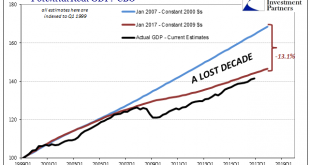

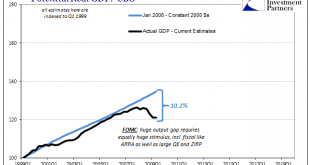

There are actually two parts to examining the orthodox treatment of the output gap. The first is the review, looking backward to trace how we got to this state. The second is looking forward trying to figure what it means to be here. One final rearward assessment is required so as to frame how we view what comes next. As I suggested earlier this week, the so-called output gap started at the trough of the Great...

Read More »Why Aren’t Oil Prices $50 Ahead?

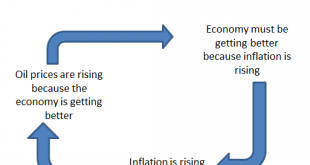

Right now there are two conventional propositions behind the “reflation” trade, and in many ways both are highly related if not fully intertwined. The first is that interest rates have nowhere to go but up. The Fed is raising rates again and seems more confident in doing more this year than it wanted to last year. With nominal rates already rising in the last half of 2016, and with more (surveyed) optimism than even...

Read More »U.S. CPI after the energy push

The Consumer Price Index for January 2017 rose 2.5%, pulled upward by its energy component which thanks to oil prices now being comparing to the absolutely lows last year saw that part of the index rise 11.1% year-over-year. Given that oil prices bottomed out on February 11, 2016, this is the last month where oil prices and thus energy inflation will be at its most extreme (except, of course, should WTI actually rise...

Read More »Bi-Weekly Economic Review

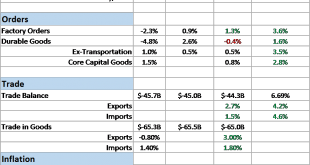

Economic Reports Scorecard The economic data since my last update has improved somewhat. It isn’t across the board and it isn’t huge but it must be acknowledged. As usual though there are positives and negatives, just with a slight emphasis on positive right now. Interestingly, the bond market has not responded to these slightly more positive readings with nominal and real yields almost exactly where they were in the...

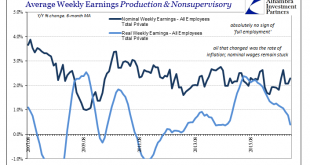

Read More »Real Wages Really Inconsistent

Real average weekly earnings for the private sector fell 0.6% year-over-year in January. It was the first contraction since December 2013 and the sharpest since October 2012. The reason for it is very simple; nominal wages remain stubbornly stagnant but now a rising CPI subtracts even more from them. Consumers receive no significant boost to their incomes, but are starting to pay more (in comparative terms) for things...

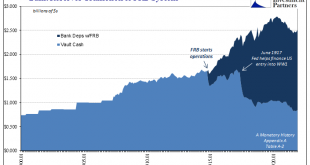

Read More »A New Frame Of Reference Is Really All That Is Necessary To Start With

In the middle of 1919, the United States was beset by a great many imbalances. Having just conducted a wartime economy, almost everything before then had been absorbed by the World War I effort. With fiscal restraint subsumed by national emergency, inflation was the central condition. Given that the Federal Reserve was by then merely a few years old, no one was quite sure what to do about it. Chairman of the Federal...

Read More »What Will Trump Do About The Central-Bank Cartel?

Submitted by Thorstein Polleit via The Mises Institute, The US is by far the biggest economy in the world. Its financial markets — be it equity, bonds or derivatives markets — are the largest and most liquid. The Greenback is the most important transaction currency. Many currencies in the world — be it the euro, the Chinese renminbi, the British pound or the Swiss franc — have actually been built upon the US dollar. The...

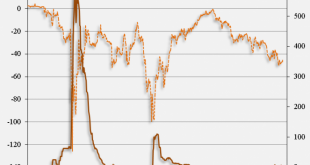

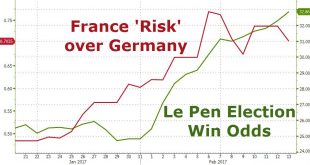

Read More »Here Are The Best Hedges Against A Le Pen Victory

On Friday, after it emerged that as part of Marine Le Pen’s strategic vision for France, should she win, is a return to the French franc as well as redenomination of some €1.7 billion in French (non-international law) bonds, both rating agencies and economists sounded the alarm, warning it would “amount to the largest sovereign default on record, nearly 10 times larger than the €200bn Greek debt restructuring in 2012,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org