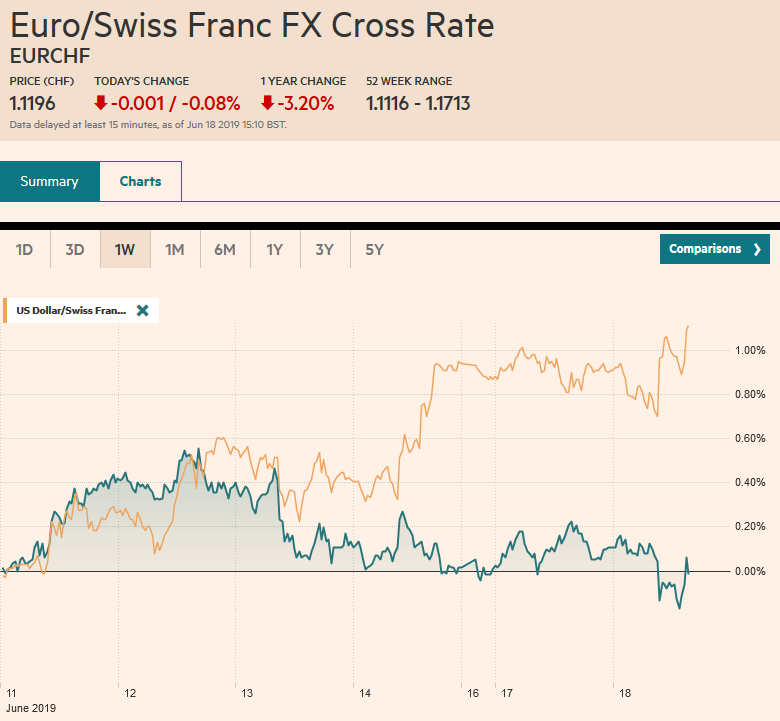

Swiss Franc The Euro has fallen by 0.08% at 1.1196 EUR/CHF and USD/CHF, June 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: ECB President Draghi underscoring the likely need for more stimulus broke the subdued tone as market participants took a “wait and see” stance ahead of tomorrow’s FOMC decision. Draghi’s comments sent the euro through .12 for the first time in two weeks and drove European bonds yields to new lows. Asian equity markets were mostly higher, with the exception of Japan. As order returned to Hong Kong, it was the Hang Seng that led the region with a little more than a 0.9% gain. European equities picked up after Draghi’s comments, and the

Topics:

Marc Chandler considers the following as important: 4) FX Trends, Brexit, China House Prices, ECB, Eurozone Consumer Price Index, Featured, Germany ZEW Current Conditions, newsletter, RBA, tic, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.08% at 1.1196 |

EUR/CHF and USD/CHF, June 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

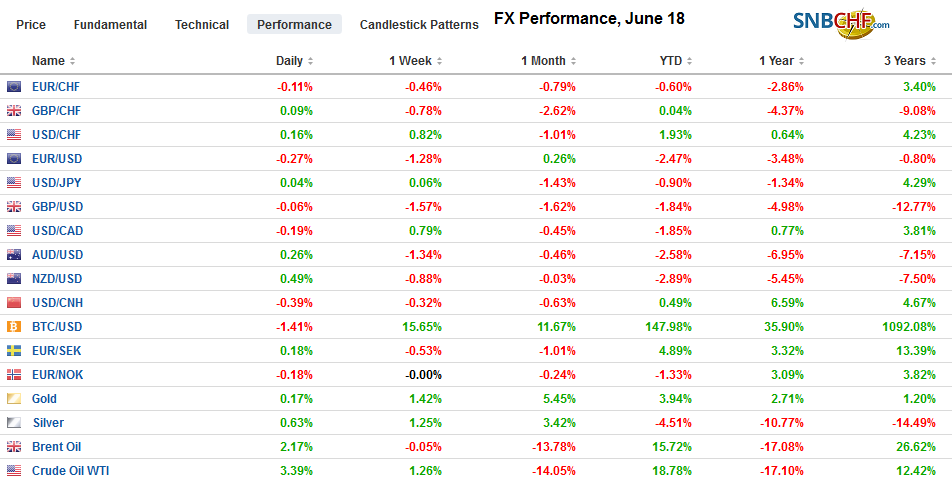

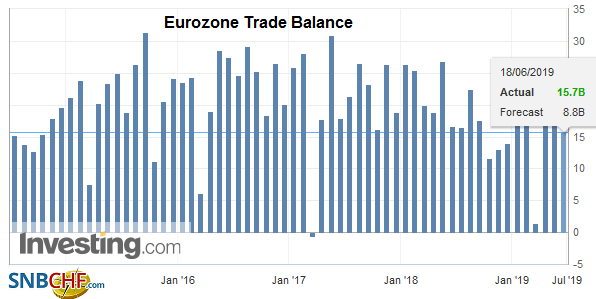

FX RatesOverview: ECB President Draghi underscoring the likely need for more stimulus broke the subdued tone as market participants took a “wait and see” stance ahead of tomorrow’s FOMC decision. Draghi’s comments sent the euro through $1.12 for the first time in two weeks and drove European bonds yields to new lows. Asian equity markets were mostly higher, with the exception of Japan. As order returned to Hong Kong, it was the Hang Seng that led the region with a little more than a 0.9% gain. European equities picked up after Draghi’s comments, and the Dow Jones Stoxx 600 was about 0.8% higher in late morning turnover, led by the interest-rate sensitive utilities sector and health care. Financials were struggling under the prospect of still lower rates. Despite concerns about the “doom-loop” of European banks exposure to their sovereign bonds, the rally in bonds has done little for bank shares. Consider that with today’s 10-13 bp decline in Italy’s benchmark 10-year yield, the bank shares are lower for the fourth session in the past five. Over the past month as Italy’s bond yield has fallen 50 bp, the bank share index is off roughly 11%. European benchmark yields outside of Italy are off around five to seven basis points with most hitting new record lows. US shares are trading higher, and the 10-year yield has slipped a couple basis points to nearly 2.05%. The dollar is firmer against most of the major currencies save the Japanese yen. The lower rates in the high-income countries are reigniting the yield hunt into emerging market and helping to lift the liquid, accessible and volatile currencies, like the South African rand and Turkish lira. East and central European currencies are being dragged lower by the euro. The Chinese yuan is practically unchanged (~CNY6.9265). |

FX Performance, June 18 |

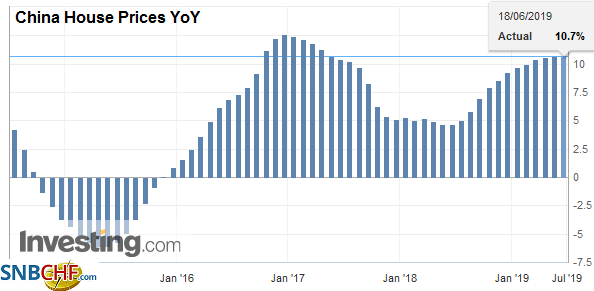

Asia PacificThe minutes from the Reserve Bank of Australia’s meeting earlier this month underscored the dovish bias. Additional stimulus was deemed “more likely than not.” The central bank appeared to call on the government (fiscal policy) to bolster efforts to support the labor market. It noted that mortgage arrears were back near 2010 highs, but not spurring systemic stress. Separately, Australian reported that its index of house prices fell 3% in Q1, which was a bit more than expected and takes prices down 7.4% year-over-year. It was the fourth consecutive quarter that the year-over-year rate contracted and it is doing so at an accelerated pace. In Q1 18, house prices had gained 6.8% year-over-year. In China, new house prices rose 0.71% in May for an 11.3% increase from a year ago. New houses prices have risen by an average of 0.62% in the first five months of 2019. In the same period a year ago, house prices averaged a monthly gain of 0.48%. China manages both supply and demand, and it appears that the rise in house prices may be more a function of supply constraints rather than robust demand. |

China House Prices YoY, May 2019(see more posts on China House Prices, ) Source: investing.com - Click to enlarge |

The dollar has held above JPY108 since last Monday. There is only a $530 mln option struck there that is set to expire today, and larger options there will expire in the coming days, including $2.7 bln tomorrow and $1.3 bln on Thursday. The first target of a break is JPY107.75, but our reading of the charts suggests an objective near JPY107. The dovish RBA minutes have sent the Australian dollar to new lows (~$0.6830) since the January 3 flash crash that saw it drop to around $0.6740, which is next important target. Previous support near $0.6865 may become resistance.

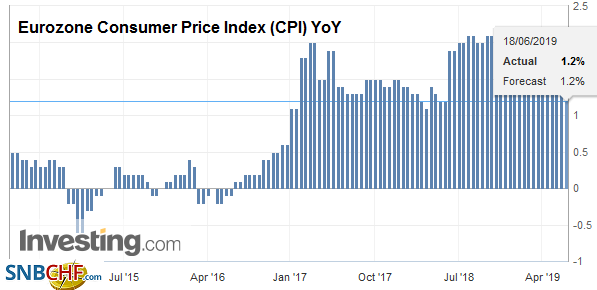

EuropeDraghi and a collapse in German investor confidence have stirred the foreign exchange and debt markets. The ECB President was more dovish than he seemed to be at the ECB meeting a fortnight ago. He warned that in the “absence of improvement” that inflation was headed toward its target, additional stimulus was necessary. Draghi suggested that if needed rates can be cut, with measures to mitigate some of the undesired consequences and that the limits around asset purchases could also be revisited. The news follows the Bundesbank’s warning yesterday that Europe’s biggest economy may have contracted in Q2. Although Draghi’s term does not end until October, there seems to be some hesitancy to lock in the next ECB President too much. |

Eurozone Trade Balance, April 2019(see more posts on Eurozone Trade Balance, ) Source: investing.com - Click to enlarge |

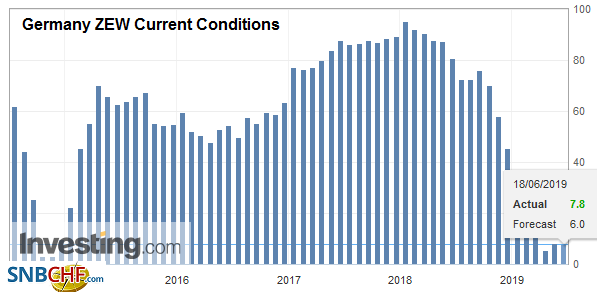

| Separately, Germany’s ZEW survey disappointed. The assessment of the current situation edged lower to 7.8 from 8.2. Between the start of last year through June this year, the current assessment has improved in only four months. This year there has been one increase, and that was in May. More disturbing was the collapse in the expectations component. It plunged from -2.1 to -21.1. It is the worst since last November, and it is lower than a year ago (-16.1). The optimists hope that the weak data will prompt Germany to reconsider its fiscal stance and may win its support for more measures by the ECB. That said, recently BBK President Weidmann has cautioned against deferring rate normalization. |

Germany ZEW Current Conditions, Jun 2019(see more posts on Germany ZEW Current Conditions, ) Source: investing.com - Click to enlarge |

| The selection of the next Tory leader in the UK moves into overdrive starting today. In the second round, candidates need to secure at least 33 MP votes, or they do not make it to the third round, which will be held tomorrow and the fourth round on Thursday. When two candidates remain, the rank and file will decide. Meanwhile, Prime Minister May’s push for GBP27 bln for education over the next three years is controversial, and Chancellor of the Exchequer Hammond has threatened to resign. |

Eurozone Consumer Price Index (CPI) YoY, May 2019(see more posts on Eurozone Consumer Price Index, ) Source: investing.com - Click to enlarge |

The euro has been sold below $1.12 and has found some bids near $1.1180. An option for 562 mln euros at $1.1150 expires today, and a 1.6 bln euro option at $1.12 will also be cut. Looking ahead, on Thursday, there are another 1.6 bln euros in a $1.1150 strike that will expire. In late April through May, the euro as seemed to carve a base around $1.11. Sterling extended its decline to near $1.25. It is its lowest level since the January 3 flash crash that may have seen $1.2440. A move now back above $1.2550 would help stabilize the tone. The euro approached GBP0.8975, the high since mid-January, but has backed off. Support is seen in the GBP0.8900-GBP0.8920 area.

America

We caution against reading too much into the latest US Treasury data that shows China reduced its holding by $7.5 bln. In April, before Trump declared the end to the tariff truce, China sold about $10.1 bln in US bonds and notes and bought around $2.6 bln in bills. April was the second consecutive month of net sales, but it was preceded by a three-month accumulation. As a whole, foreign central banks sold about $27.5 bln of US Treasury bonds and notes (not including bills) in April (China accounted for a little more than a third. These are hardly even rounding errors given China’s current holdings of a nearly $1.113 trillion, more than any other country. China’s surged from about $845 bln in mid-2010 $1.314 trillion in July 2011. It has been above there (marginally) and has not been below roughly $1.05 trillion since and now is near the middle of the range. Moreover, a decline in Treasury holdings is not necessarily an aggressive act. Consider that Japan’s Treasury holdings, the second largest in the world, peaked in November 2014 near $1.241 trillion and now stand near $1.064 trillion.

Three other holdings caught our eye. Belgium, which hosts Euroclear, has sometimes been thought to hide Chinese reserves, so it Treasury holdings rise and fall sharply in 2013-2015. They bottomed in 2017 a little below $100 bln, but by January 2019 they had nearly doubled. They have pulled back in recent months and are now a little below $180 bln. Saudi Arabia’s Treasury holdings have risen sharply in recent years. According to US data, the Saudis owned practically no Treasuries as recently as 2003-2004. They rose to around $80 bln by mid-2009, where they hovered until 2014 when they began rising. Perhaps the weakness in oil prices in 2016 was behind the roughly $35 bln drop in Treasury holdings, but the accumulation quickly resumed, and in April a new record of $176.6 bln was registered. The UK’s Treasury holdings swung violently in the 2004-2011 period, but since then, they have been steadily climbing. At the end of 2011, they stood near $107 bln and peaked in March a little more than $317 bln before pulling back in April to about $301 bln. Part of the recent increase may reflect the building up of reserves to prepare for Brexit, but something more is going on In the last six months, UK reserves have risen by about $6.6 bln, while Treasury holdings have increased by around $37 bln. Maybe the negative yields associated with core European bonds spurred some reallocation.

Poor infrastructure led to a blackout in Brazilian 2009 and one in Venezuela earlier this year. The outage over the weekend that impacts tens of millions of people in Argentina, Uruguay, and Paraguay may have been simply another episode. An investigation is underway, which may take the better part of the next two weeks. While some Argentine officials are playing down the likelihood that it was a cyber-attack, as the trigger for the cascading effect appears to have been a transmission point between two power stations. Still, others refuse to rule it out. They wonder if it is coincidental that the NY Times had just revealed that the US had penetrated a Russian utility. Trump accused denied the report and simultaneously accused it of “virtual treason.” Russia press reported yesterday that it had identified attempts by the US to use cyber attacks on its infrastructure. The conspiracy theorists cannot link Russia to Argentina’s blackout, but it may have just been opportunistic, some suggest. Trump appears to like Argentina’s President Macri who faces voters in October after promising to address the electrical grid. A weaker Macri boosts the chances that Kirchner returns as Vice President under Fernandez (her former chief of cabinet ministries), who is leading in Macri in some polls. As a Senator, Kirchner enjoys immunity, and it is disputed whether she does if she were Vice President. As Macri is seen as a Trump ally, Kirchner is seen to be an ally of Putin.

The US reports May housing starts and permits figures. Small gains are expected, but they are not the focus the day ahead of the FOMC meeting. Yesterday’s Empire State manufacturing survey was shockingly poor with its biggest decline on record and a return to levels now seen since October 2016. The CME’s model suggests that the market is pricing in nearly a one-in-four chance of a cut tomorrow. It sees about a 66% chance (65.8%) of a 25 bp cut in July. The CME’s model finds about a 20% chance of a 50 bp move in July.

The broad US dollar gains are weighing on the Canadian dollar. The greenback is pushing above CAD1.3425, which has capped it over the past couple of sessions and is bumping against the (61.8%) retracement objective of this month’s down move. Above there, the CAD1.3485-CAD1.3500 beckons. The Mexican peso is trading firmly within the ranges that have dominated since the US tariff threat was suspended. Separately, the US has announced it is cutting aid to Guatemala, El Salvador, and Honduras until measures are taken to reduce the migrant flow. While on the one hand, it boosts the incentive structure for governments to take action, it also may add to the local misery that is part of the encouragement of people to leave.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Brexit,China House Prices,ECB,Eurozone Consumer Price Index,Featured,Germany ZEW Current Conditions,newsletter,RBA,tic