Nicolas Moreau verantwortet neu das Asset Management der Deutschen Bank. Die Nachfolge von Quintin Price ist geregelt. Der neue Mann kommt von einem grossen französischen Versicherungskonzern. Nicolas Moreau wird per 1. Oktober 2016 in den Vorstand der Deutschen Bank eintreten und dort die Vermögensverwaltung (Asset Management) verantworten. Moreau arbeitete zuvor für den...

Read More »Central Bank Wonderland is Complete and Now Open for Business — The Epocalypse Has Fully Begun

The following article by David Haggith was first published on the Great Recession Blog. Summer vacation is here, and the whole global family has arrived at Central-Bank Wonderland, the upside-down, inside-out world that banksters and their puppet politicians call “recovery.” Everyone is talking about it as wizened traders puzzle over how stocks and bonds soared, hand-in-hand, in face of the following list of economic...

Read More »S&P 500 To Open At All Time Highs After Japan Soars, Yen Plunges On JPY10 Trillion Stimulus

Last Thursday, when we reported that Ben Bernanke was to "secretly" meet with Kuroda and Abe this week (he is said to have already met with Japan's central bank head earlier today), we said that "something big was coming" out of Japan which had "helicopter money" on the agenda. And sure enough, after a dramatic victory for Abe in Japan's upper house elections which gave his party an even greater majority, Abe announced the first hints of helicopter money when Nikkei reported, and Abe...

Read More »SIBOR Forex Banking Fraud – another FX rate rigging scandal

Forex has been the big banks secret gold mine, supporting their other losing operations (like normal banking business, lending, etc.). To a large extent this has been unraveling, and this SIBOR lawsuit is another attack on their risk free profit center (FX). Read the entire lawsuit released by Elite E Services here in full. More than 50 unknown defendants and about 20 known FX banks are named in the case, submitted...

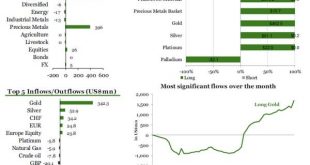

Read More »ETF Securities Reports Biggest One-Day Gold Inflow Since Financial Crisis

It never ceases to amaze how vastly different the investment styles of gold paper vs physical traders are: while we have documented previously how the latter tend to buy progressively more the lower the price (as traditional “buy low, buy more lower” investing would suggest), “investors” in gold paper-derivatives such as ETFs and ETPs are quite the opposite: in fact, they rarely buy until someone else is buying and...

Read More »Gold Surges 15% To £968 Per Ounce – BREXIT Creates EU Contagion Risk

Gold Surges 15% To £968 Per Ounce – BREXIT Creates EU Contagion Risk – Sterling and euro have fallen sharply on fx markets– Gold bullion surged 20% in sterling to £1,015/oz– Gold now 15% in higher in GBP at £967 per ounce– Gold 8% higher in EUR and 5% higher in USD– Stocks globally are down sharply – FTSE down 9%– European stocks down sharply– Euro Stoxx 50 Futures collapsed over 11% at the open– Bank shares are down 20% to 25%– Cameron has resigned – adding to uncertainty in markets–...

Read More »In Surprising Development NIRP Starts To Work, Pushing Rich Swiss Savers Out Of Cash Into Stocks

One of the rising laments against NIRP is that far from forcing savers to shift from cash and buy risky (or less risky) assets, it has done the opposite. Intuitively this makes sense: savers expecting a return on the cash they have saved over the years are forced to save even more in a world of ZIRP or NIRP, as instead of living off the interest, they have to build up even more prinicpal. Jeff Gundlach confirmed as...

Read More »The British Referendum And The Long Arm Of The Lawless

Submitted by Danielle DiMartino Booth via DiMartinoBooth.com, “Kings have long arms, many ears, and many eyes.” So read an English proverb dated back to the year of our Lord 1539. And thus was born an idiom that today translates to the very familiar Long Arm of the Law. It stands to reason that such a warning was born of feudal times when omnipotent and seemingly omnipresent monarchs personified the law, possessed...

Read More »Diversifikation bei Schwellenländern entscheidend

Henning Gebhardt, Global Head of Equities bei Deutsche Asset Management. In manchen Schwellenländern sind die Gewinnerwartungen wieder gestiegen. Henning Gebhardt, Global Head of Equities bei der Deutschen AM, findet die Vorschusslorbeeren angesichts der wirtschaftspolitischen Herausforderungen allerdings für übertrieben. Wer angesichts der stürmischen Frühlingsrally der...

Read More »Futures Flat, Gold Rises On Weaker Dollar As Traders Focus On OPEC, Payrolls

After yesterday's US and UK market holidays which resulted in a session of unchanged global stocks, US futures are largely where they left off Friday, up fractionally, and just under 2,100. Bonds fell as the Federal Reserve moves closer to raising interest rates amid signs inflation is picking up. Oil headed for its longest run of monthly gains in five years, while stocks declined in Europe. Treasuries retreated in the first full day of trading since Yellen said late Friday that the improving...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org