In the latest tragic news from the world of finance, earlier today Zurich Insurance, the largest Swiss insurer which employs 55,000 people and provides general insurance and life insurance products in more than 170 countries, reported that Martin Senn, the company's former chief executive officer who stepped down in a December reshuffle, has committed suicide. He was 59. Senn had been a long-time employee of the insurer, serving as its chief executive for six years before stepping down in...

Read More »In Historic First, Singapore Shuts Local Private Bank Due To “Worst Gross Misconduct” Is Has Ever Seen

Following the demise of the thousand year-long tradition of Swiss banking secrecy, crushed virtually overnight by Barack Obama's demands to make the central European nation's banking industry transparent, one of the major consequences was the shift in money laundering from Geneva and Zurich to the latest and greatest "anonymous" banking and tax evasion hub located halfway around the world, namely Singapore. And overnight, we got the first shot across the bow of the city state's "Swiss banking...

Read More »Mind Control as a method to support the US Dollar

There is a paradox of capitalism, we’ve reached a point where those at the top, have an unlimited budget to maintain the status quo, increase their wealth, and develop an ever increasing sophisticated toolbox to manage empire and maintain their dominance. As we explain in Splitting Pennies – this is no where more obvious than Forex. The last 100 years we’ve seen capitalism evolve brightly. Industries that shouldn’t be industries, now employ millions of workers. Paradigm shift,...

Read More »Negative Rates: Jim Bianco Warns “The Risk Of An ‘Accident’ Is Very High”

In an interesting interview with Finanz und Wirtschaft, Bianco Research president Jim Bianco discusses a variety of topics such as negative interest rates turning the entire credit process upside down, bank balance sheets being even more complex and concentrated than before the financial crisis, energy loans being an accident waiting to happen, the markets having veto power over the Fed, and gold having more room to run. * * * Mr. Bianco, negative interest are causing a lot of stir at the...

Read More »“The Men Behind The Curtain Are Being Revealed” – CEO Says Real-World Pricing To Return To Gold & Silver Markets

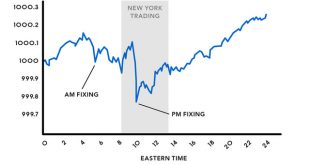

Submitted by Mac Slavo via SHTFPlan.com, Astute observers of financial markets, especially in the precious metals sector, have long argued that small concentrations of major market players have been manipulating asset prices. Last week those suspicions were confirmed when Deutsche Bank, one of the world’s leading financial institutions, not only admitted to regulators that they have been involved in the racket, but that they were prepared to turn over records implicating many of...

Read More »Billion Dollar Lawsuits Filed Following Deutsche Bank’s Admission Of Gold, Silver Rigging

Barely a day had passed since the historic admission of gold and silver price rigging by Deutsche bank, which as we reported on Thursday was settled with not only "valuable monetary consideration", but Deutsche's "cooperation in pursuing claims" against other members of the cartel, i.e., exposing the manipulation of other cartel members, and the class action lawsuits have begun. Overnight, two class action lawsuits seeking $1 billion in damages on behalf of Canadian gold and silver...

Read More »Every Single Bloody Market Is Manipulated … See For Yourself

Gold and Silver Are Manipulated Deutsche Bank admitted today that it participated with other big banks in manipulating gold and silver prices. In 2014, Switzerland’s financial regulator (FINMA) found “serious misconduct” and a “clear attempt to manipulate precious metals benchmarks” by UBS employees in precious metals trading, particularly with silver. Reuters reported: Swiss regulator FINMA said on Wednesday that it found a “clear attempt” to manipulate precious metals benchmarks during...

Read More »U.S. Futures Flat After Oil Erases Overnight Losses; Dollar In The Driver’s Seat

In another quiet overnight session, the biggest - and unexpected - macro news was the surprise monetary easing by Singapore which as previously reported moved to a 2008 crisis policy response when it adopted a "zero currency appreciation" stance as a result of its trade-based economy grinding to a halt. As Richard Breslow accurately put it, "If you need yet another stark example of the fantasy storytelling we amuse ourselves with, juxtapose today’s Monetary Authority of Singapore policy...

Read More »La chute de la Deutsche Bank se poursuit. Liliane Held-Khawam

La banque allemande qui peut causer le tsunami financier européen. Nous avons publié le 15 février 2016 un dossier intitulé « Deutsche Bank: Une arme de destruction massive de l’Allemagne« . Toute l’analyse qui y avait été faite reste bien évidemment d’actualité. La charge phénoménale en produits dérivés continuera de représenter un puissant détonateur… Gigantesque charge spéculative! Le sort de cet établissement est donc à suivre de près puisque nous pouvons raisonnablement supposer que...

Read More »Japan Stocks Plunge; Europe, U.S. Futures, Oil Lower Ahead Of Payrolls

For Japan, the post "Shanghai Summit" world is turning ugly, fast, because as a result of the sliding dollar, a key demand of China which has been delighted by the recent dovish words and actions of Janet Yellen, both Japan's and Europe's stock markets have been sacrificed at the whims of their suddenly soaring currencies. Which is why when Japanese stocks tumbled the most in 7 weeks, sinking 3.5%, to a one month low of 16,164 (after the Yen continued strengthening and the Tankan confidence...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org