By Allan Flynn, Guest Post at BullionStar.com Five months have lapsed without decision, since London gold and silver benchmark-rigging class action lawsuits received a cool response in a Manhattan court. Transcripts from April hearings show, in the absence of direct evidence, the claims dissected by a “very skeptical” judge, and criticized by defendants for lack of facts suggesting collusion, among other things. Judge...

Read More »Credit Crisis in Waiting

Clowns in the Coliseum DUBLIN – The presidential debate began long after our bedtime, here in Ireland. So we got up this morning, rubbed our eyes, and watched the highlights. “Lowlights” is perhaps a better way to describe it: two rascals making public spectacles of themselves, arguing about things that mostly don’t matter… posing, posturing, pretending. If we had our druthers, both candidates would lose. That is...

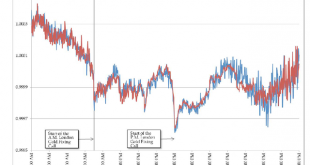

Read More »FX Weekly Preview: Next Week’s Two Bookends

Germany The start of next week will likely be driven by Deutsche Bank’s travails and dollar funding pressures, which may or may not be related. The end of the week features the US monthly jobs report. Despite being a noisy, high frequency time series subject to significant revisions, this report like none other can drive expectations of Fed policy. Deutsche Bank is faced with two challenges: its business and several...

Read More »Hanging by a Thread: “Very skeptical” judge – a former FBI/SEC official, eyes London Gold and Silver Fix lawsuits

By Allan Flynn, Guest Post at BullionStar.com Five months have lapsed without decision, since London gold and silver benchmark-rigging class action lawsuits received a cool response in a Manhattan court. Transcripts from April hearings show, in the absence of direct evidence, the claims dissected by a “very skeptical” judge, and criticized by defendants for lack of facts suggesting collusion, among other things. Judge Valerie E. Caproni, former white-collar...

Read More »Negative and the War On Cash, Part 2: “Closing The Escape Routes”

Submitted by Nicole Foss via The Automatic Earth blog, Part 1 Here. History teaches us that central authorities dislike escape routes, at least for the majority, and are therefore prone to closing them, so that control of a limited money supply can remain in the hands of the very few. In the 1930s, gold was the escape route, so gold was confiscated. As Alan Greenspan wrote in 1966: In the absence of the gold...

Read More »Jan Skoyles Appointed Research Executive At GoldCore

(Media Release - September 8, 2016 - Immediate Release) – Jan Skoyles - @Skoylesy has been appointed Research Executive at international gold specialist @GoldCore . As a recognized thought leader in the gold and fintech space, Jan will augment GoldCore’s research capabilities and will focus on the UK economy and gold’s role as an important diversification, payment and savings vehicle. As one of the world's largest and fastest growing gold bullion delivery...

Read More »Negative Rates and The War On Cash, Part 1: “There Is Nowhere To Go But Down”

[unable to retrieve full-text content]As momentum builds in the developing deflationary spiral, we are seeing increasingly desperate measures to keep the global credit ponzi scheme from its inevitable conclusion. Credit bubbles are dynamic — they must grow continually or implode — hence they require ever more money to be lent into existence.

Read More »Kriselnde Bankaktien: Fondstrends-Leser zuversichtlich

Bild: Karin Jung (pixelio) Die Aktien diverser Grossbanken haben ein schwieriges Jahr hinter sich. Wie eine Umfrage von Fondstrends aber zeigt, glaubt die Mehrheit der Befragten, dass wieder bessere Zeiten kommen werden. Der Aktienkurs der Credit Suisse hat sich innerhalb eines Jahres halbiert. Die Aktie der UBS handelt 30% tiefer als Ende August 2015. Die beiden Schweizer...

Read More »Politische Börsen

Henning Gebhardt, Global Head of Equities bei Deutsche Asset Management. Aktien sind natürlich nicht alternativlos. Aber immerhin eine gute Alternative in politisch unruhigen Zeiten. Kurspotenziale ergeben sich dabei unterhalb der Indexebene, so Henning Gebhardt, Global Head of Equities der Deutschen AM. Politische Risiken spielen in Anlageentscheidungenderzeit eine tragende Rolle....

Read More »Credit Suisse dropped from index as european markets feel pressure after bank stress tests

Investec Switzerland. SMI The Swiss Market Index is set to close slightly higher this week, outperforming global equities thanks to defensive heavyweights such as Nestlé and Novartis. Click to enlarge. Pessimism hit European shares at the beginning of the week as sliding oil prices and bank stress test results helped revive concerns over the strength of the recovery and stability of the financial...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org