Fruiting vegetables such as tomatoes are 17% cheaper – © Maksudkr | Dreamstime.com Swiss prices fell by 0.1% in November 2019, the sixth time in 12 months. But not everything is cheaper. Prices fell in December 2018 (-0.3%), January 2019 (-0.3), July (-0.5), September (-0.1), October (-0.2%) and November 2019 (-0.1). When combined with the low inflation experienced in the other 6 months the 12-month price drop is -0.1%. Not everything has gone down in price however....

Read More »Another month of falling prices in Switzerland

Swiss prices fell by 0.1% in November 2019, the sixth time in 12 months. But not everything is cheaper. Fruiting vegetables such as tomatoes are 17% cheaper – © Maksudkr | Dreamstime.comPrices fell in December 2018 (-0.3%), January 2019 (-0.3), July (-0.5), September (-0.1), October (-0.2%) and November 2019 (-0.1). When combined with the low inflation experienced in the other 6 months the 12-month price drop is -0.1%. Not everything has gone down in price however. Swiss inflation...

Read More »Downward Home Prices In The Downturn, Too

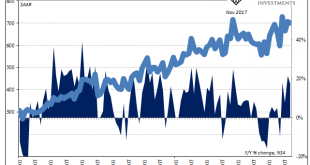

The Census Bureau reported today New Home Sales remained at a better than 700k SAAR in September following the big jump over the previous few months. Though the number was slightly lower last month than the month before, it wasn’t meaningfully less. As discussed yesterday, while that might seem the Fed’s rate cut psychology combined with the bond market’s pessimism (reducing the mortgage rate) is having a positive effect, I don’t see it that way. From yesterday:...

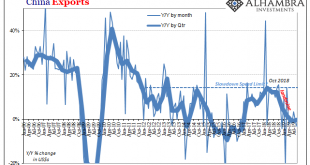

Read More »China’s Dollar Problem Puts the Sync In Globally Synchronized Downturn

Because the prevailing theory behind the global slowdown is “trade wars”, most if not all attention is focused on China. While the correct target, everyone is coming it at from the wrong direction. The world awaits a crash in Chinese exports engineered by US tariffs. It’s not happening, at least according to China’s official statistics. The reported numbers aren’t good by any stretch, but they aren’t perhaps as bad as imagined by the constant references to what we...

Read More »Deflation Is Everywhere—If You Know Where to Look, Report 18 Aug

At a shopping mall recently, we observed an interesting deal at Sketchers. If you buy two pairs of shoes, the second is 30% off. Sketchers has long offered deals like this (sometimes 50% off). This is a sign of deflation. Regular readers know to wait for the punchline. Manufacturer Gives Away Its Margins We do not refer merely to the fact that there is a discount. We are not simply arguing that Sketchers are sold cheaper—hence deflation. That is not our approach....

Read More »As Chinese Factory Deflation Sets In, A ‘Dovish’ Powell Leans on ‘Uncertainty’

It’s a clever bit of misdirection. In one of the last interviews he gave before passing away, Milton Friedman talked about the true strength of central banks. It wasn’t money and monetary policy, instead he admitted that what they’re really good at is PR. Maybe that’s why you really can’t tell the difference Greenspan to Bernanke to Yellen to Powell no matter what happens. Testifying before Congress today, in prepared...

Read More »Nonmonetary Cause of Lower Prices, Report 5 May

Over the past several weeks, we have debunked the idea that purchasing power—i.e. what a dollar can buy—is intrinsic to the currency itself. We have discussed a large non-monetary force that drives up prices. Governments at every level force producers to add useless ingredients, via regulation, taxation, labor law, environmentalism, etc. These are ingredients that the consumer does not value, and often does not even...

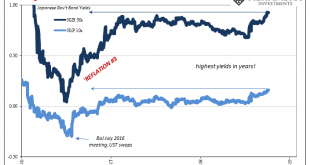

Read More »Lost In Translation

Since I don’t speak Japanese, I’m left to wonder if there is an intent to embellish the translation. Whoever is responsible for writing in English what is written by the Bank of Japan in Japanese, they are at times surely seeking out attention. However its monetary policy may be described in the original language, for us it has become so very clownish. At the end of last July, BoJ’s governing body made a split...

Read More »Fear Or Reflation Gold?

Gold is on fire, but why is it on fire? When the precious metals’ price falls, Stage 2, we have a pretty good idea what that means (collateral). But when it goes the other way, reflation or fear of deflation? Stage 1 or Stage 3? If it is Stage 1 reflation based on something like the Fed’s turnaround, then we would expect to find US$ markets trading in exactly the same way. Like 2017, when gold was last rising, there...

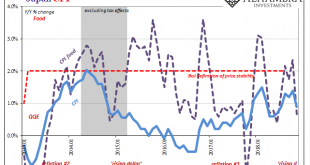

Read More »Insight Japan

As I wrote yesterday, “In the West, consumer prices overall are pushed around by oil. In the East, by food.” In neither case is inflation buoyed by “money printing.” Central banks both West and East are doing things, of course, but none of them amount to increasing the effective supply of money. Failure of inflation, more so economy, the predictable cost. In yesterday’s article the topic in the East was China. Today,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org