– Palladium prices surge to new record high over $1,100/oz today – Palladium surges past record nominal price seen in 2001 after 55% surge in 2017– Best-performing precious metal and commodity of 2017 is palladium – Palladium prices top platinum prices for first time in 16 years– Strong Chinese car demand and switch from diesel to petrol cars sees demand surge– Supply crunch as six year supply deficit & 2017...

Read More »Gold Has Best Year Since 2010 With Near 14percent Gain In 2017

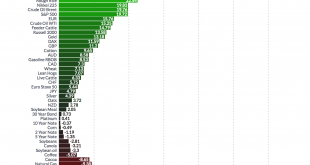

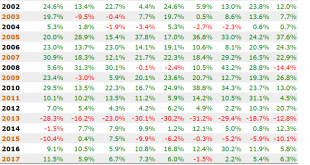

Gold Has Best Year Since 2010 With Near 14% Gain In 2017 – Gold posted second straight annual gain in USD in 2017– Gold in 2017: up 13.6% USD, up 2.7% GBP, down 1.4% EUR– 2017 is gold’s best year since 29.5% gain in 2010– Strong performance despite rate hikes and stock bubble – India’s gold imports surged 67% in 2017, Turkish, Chinese demand strong – Gold finished 2017 with longest rally since June 2016 – 2018:...

Read More »Happy 2nd Birthday Bail-in Tool! We Suggest Gold As The Perfect Gift

Happy 2nd Birthday Bail-in Tool! We Suggest Gold As The Perfect Gift – Two years since bail-in rules officially entered EU regulations– EU bail-in rules have wiped out billions for savers and and businesses, with more at risk– Future of many failing banks now rests on depositors who may no longer be protected by deposit insurance– Physical gold enables savers to stay out of banking system and reduce exposure to...

Read More »98,750,067,000,000 Reasons to Buy Gold in 2018

98,750,067,000,000 Reasons to Buy Gold in 2018 – World equity index market capitalization touching distance of $100 trillion dollars at beginning of December – Key indicators across global financial markets are looking decidedly bubble-like – Little indication that we are through the worst of the financial crisis that started in 2007 – Apparent lack of concern regarding the over-heated and overpriced markets – Since...

Read More »Gold, Bitcoin and the Blockchain Replaces the Banks – Realists Guide To The Future

Gold, Bitcoin and the Blockchain Replaces the Banks – Realists Guide To The Future – Futurist guide to 2028 shows a world of uncertainty and disruption– One scenario suggests cybersecurity attacks will result in bitcoin and blockchain’s dominance of financial systems– Cybersecurity threat will still loom large and wreak havoc. Gold, silver and other real assets will benefit.– Adoption of cryptocurrencies and blockchain...

Read More »New Rules For Cross-Border Cash and Gold Bullion Movements

New EU Rules For Cross-Border Cash, Gold Bullion Movements – War on cash continues and expands to affect non-criminals including gold owners– New definitions of “cash” to be drawn up by EU to include gold and precious metals – Claim cash and gold bullion “often used for criminal activities such as money laundering, or terrorist financing”– Legislation will allow authorities to seize assets from those ‘without a criminal...

Read More »‘Gold Strengthens Public Confidence In The Central Bank’ – Bundesbank

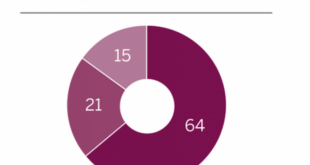

– ‘Availability of gold strengthens public confidence in the central bank’s balance sheet’ say Bundesbank – Bundesbank has Audited Reserves amounting to almost 3,400 tonnes, around 68% of Bundesbank’s reserve assets – Bank taken series of steps to increase transparency around Germany’s gold holdings – Germany has second largest gold holdings in the world; U.S. believed to be largest – Transparency important and all...

Read More »UK Pensions Risk – Time to Rebalance and Allocate to Cash and Gold

UK Pensions Risk – Time to Rebalance and Allocate to Cash and Gold – Value of Sterling and increased risks place pressure on pensioners both in UK and abroad – 500,000 British expats face ‘frozen’ pensions – 61% of UK Direct Benefit pension schemes have more money going out than coming in – OECD report finds ‘UK workers face the biggest retirement cliff edge in developed world’ – Combined pension deficit of FTSE 350...

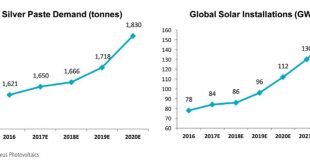

Read More »Silver’s Positive Fundamentals Due To Strong Demand In Key Growth Industries

Silver’s Positive Fundamentals Due To Strong Demand In Key Growth Industries – Increased efforts in green energy and advanced technology set to boosts silver’s demand – Four-year supply deficit set to increase due to fewer mine openings and discoveries – Bank manipulation may be why silver under performing – TD Securities and the Bank of Montreal expect silver to be best performing precious metal in 2018 – Growing...

Read More »Low Cost Gold In The Age Of QE, AI, Trump and War

Key topics in the video: – A bullion dealers view on ‘What will drive the markets in 2018?’– QE, inflation, Fed rates, debt bomb, China, populism, EU cohesion, Brexit, digital disruption, cashless society, demographics, Trump (war), Artificial intelligence (AI)– Solve global debt crisis with humongous amount of debt!?– Inflation – U.S. health insurance has increased 13% per annum since – How Artificial Intelligence...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org