Overview: A pessimistic assessment offered by the CEO of Moderna shattered the fragile calm seen yesterday after the pre-weekend turmoil. Risk appetites shriveled, sending equity markets lower and the bond markets higher. Funding currencies rallied, with the euro and yen moving above last week's highs. The uncertainty weighs on sentiment and makes investors question what they previously were certain of. The MSCI Asia Pacific Index fell over 1% before the weekend...

Read More »Sentiment Remains Fragile

Overview: The fire that burnt through the capital markets before the weekend, triggered by the new Covid mutation, burned itself out in the Asian Pacific equity trading earlier today. A semblance of stability, albeit fragile and tentative, has emerged. Europe's Stoxx 600 is up about 1%, led by real estate, information technology, and energy. US index futures are trading higher, with the NASDAQ leading. Benchmark 10-year yields are firmer. The US 10-year Treasury...

Read More »Jobs (US) and Inflation (EMU) Highlight the Week Ahead

The new covid variant and quick imposition of travel restrictions on several countries in southern Africa have injected a new dynamic into the mix. It may take the better part of the next couple of weeks for scientists to get a handle on what the new mutation means and the efficacy of the current vaccination and pill regime.The initial net impact has been to reduce risk, as seen in the sharp sell-off of stocks. Emerging market currencies extended their losses. ...

Read More »Covid Strikes Back

Overview: Concerns that a new mutation of the Covid virus has shaken the capital markets. Equities are off hard, and bonds have rallied. In the foreign exchange market, the Japanese yen and Swiss franc have rallied. While there may be a safe haven bid, there also appears to be an unwinding of positions that require the buying back of the funding currencies, which is also lifting the euro. The currencies levered from growth, the dollar-bloc and Scandis are...

Read More »Big Week Begins Slowly

Overview: The global capital markets give little indication of the important economic and earnings data that lie ahead this week. There is an eerie calm. Equities in Asia were mixed. Japan and Hong Kong, and most small bourses were lower. Last week, the MSCI Asia Pacific Index gained almost 0.9%. Europe's Stoxx 600 is little changed after rising about 0.5% last week. US futures are firm. The S&P 500 and Dow Jones Industrials reached record-highs before the...

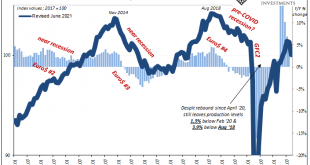

Read More »Far Longer And Deeper Than Just The Past Few Months

Hurricane Ida swept up the Gulf of Mexico and slammed into the Louisiana coastline on August 29. The storm would continue to wreak havoc even as it weakened the further inland it traversed. By September 1 and 2, the system was still causing damage and disruption into the Northeast of the United States. While absolutely tragic for those who suffered its blow, in economic terms this means that any weakness exhibited by whichever economic account during both August and...

Read More »Weekly Market Pulse: Perception vs Reality

It was the best of times, it was the worst of times… Charles Dickens, A Tale of Two Cities Some see the cup as half empty. Some see the cup as half full. I see the cup as too large. George Carlin The quote from Dickens above is one that just about everyone knows even if they don’t know where it comes from or haven’t read the book. But, as the ellipsis at the end indicates, there is quite a bit more to the line than the part everyone remembers. It was the best of...

Read More »Hard to Be Sterling

Overview: Energy prices pulled back late yesterday, but it offered little reprieve to the bond market where the 10-year benchmark yields in the US, UK, Sweden, and Switzerland reached new three-month highs. November WTI traded to almost $76.70 before reversing lower and leaving a potentially bearish shooting star candlestick in its wake. The US S&P 500 and NASDAQ gapped lower and did not recover, setting the stage for today’s drop in Asia. All the major...

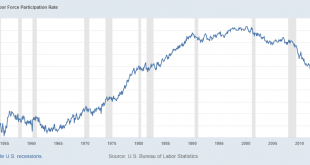

Read More »Weekly Market Pulse: Time For A Taper Tantrum?

The Fed meets this week and is widely expected to say that it is talking about maybe reducing bond purchases sometime later this year or maybe next year or at least, someday. Jerome Powell will hold a press conference at which he’ll tell us that markets have nothing to worry about because even if they taper QE, interest rates aren’t going up for a long, long time. That statement might have more credibility if the Fed had been right about just about anything over the...

Read More »Weekly Market Pulse: Time For A Taper Tantrum?

The Fed meets this week and is widely expected to say that it is talking about maybe reducing bond purchases sometime later this year or maybe next year or at least, someday. Jerome Powell will hold a press conference at which he’ll tell us that markets have nothing to worry about because even if they taper QE, interest rates aren’t going up for a long, long time. That statement might have more credibility if the Fed had been right about just about anything over the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org