Overview: Concerns that a new mutation of the Covid virus has shaken the capital markets. Equities are off hard, and bonds have rallied. In the foreign exchange market, the Japanese yen and Swiss franc have rallied. While there may be a safe haven bid, there also appears to be an unwinding of positions that require the buying back of the funding currencies, which is also lifting the euro. The currencies levered from growth, the dollar-bloc and Scandis are weaker. Oil has been knocked back by around 6.7%, with January WTI trading near .Led by 2%+ losses in Japan, Hong Kong, and India, and 1%+ losses in South Korea, and Taiwan, the MSCI Asia Pacific Index has slumped to its lowest level since July. Europe's Stoxx 600 gapped lower and is off around 2.4%

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, COVID, Currency Movement, Featured, Hungary, Mexico, newsletter, South Korea, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Overview: Concerns that a new mutation of the Covid virus has shaken the capital markets. Equities are off hard, and bonds have rallied. In the foreign exchange market, the Japanese yen and Swiss franc have rallied. While there may be a safe haven bid, there also appears to be an unwinding of positions that require the buying back of the funding currencies, which is also lifting the euro. The currencies levered from growth, the dollar-bloc and Scandis are weaker. Oil has been knocked back by around 6.7%, with January WTI trading near $73.

Led by 2%+ losses in Japan, Hong Kong, and India, and 1%+ losses in South Korea, and Taiwan, the MSCI Asia Pacific Index has slumped to its lowest level since July. Europe's Stoxx 600 gapped lower and is off around 2.4% near midday. US futures are sharply lower (1.25%-2.5%). The US 10-year yield has dropped around 12 bp to nearly 1.50%. While UK Gilts have kept pace with US Treasuries, continental benchmark yields are off 6-8 bp. The US 2-year yield is about 15 bp lower (~0.49%), while European 2-year yields are mostly 2-5 bp lower. The 2-year Gilts yield has shed about 12 bp, as the market unwinds some of the chances of a rate hike next month.

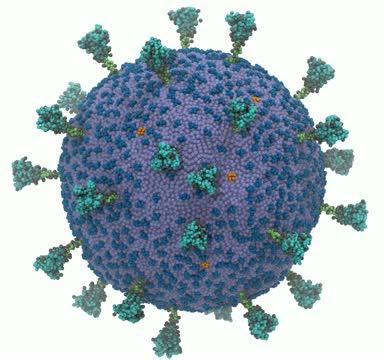

Key Development: A new variant of the Covid virus was found. It is thought to have the most mutations to date. The EU, UK, Israel, and Singapore have quickly banned travel from South Africa and five neighboring countries. This is coming on top of and is separate from the outbreak in Europe, where Germany has reported a record number of new cases and several other countries have introduced new restrictions. Almost a third of Shanghai flights were canceled as three local cases were found. US infections are also on the rise.

Asia Pacific

As widely expected, South Korea hiked its key 7-day repo rate by 25 bp to 1.0% yesterday. It follows a 25 bp hike in August. Consumer inflation rose 3.2% year-over-year in October, while the core rate rose 2.8%. Growth in Q3 was 4.0%. With today's roughly 0.3% decline, it brings this year's loss to almost 9%. Only the yen (~-9.4%) and the Thai baht (~-11%) have performed worse in the region.

Australia reported stronger than expected October retail sales. The 4.9% month-over-month surge was more than twice the Bloomberg median forecast (2.2%) and follows September's 1.3% gain. It underscores the recovery that is taking place. The preliminary PMI showed the recovery continuing into November. The composite rose to 55.0, its highest reading since June.

The dollar was fraying the upper end of the range we anticipated against the yen, pushing against JPY115.50. The momentum looked to have been at risk of stalling when the news struck. The dollar was sold to almost JPY113.65. An option for $710 mln at JPY113.70 expires today. The price action appears to be stabilizing a bit in the European morning, and the greenback is hovering around JPY114.00. The trendline connecting the September and the previous two November lows comes in today near there today. The JPY114.50 area looks to offer initial resistance. The Australian dollar had been leaking through $0.7200, and the risk-off move sent it slightly through $0.7115, just above the low for the year set on August 20, closer to $0.7105. A break could spur a move toward $0.7050, which is the (38.2%) retracement of the Australian dollar's recovery since March 2020, when it hit a low near $0.5500. The $0.7140 area may provide the initial cap for the bounce. The Chinese yuan is a rock. It has hardly moved despite the broader developments. The greenback is slightly (less than 0.05%) firmer and still a little below CNY6.39. The PBOC set the dollar's reference rate at CNY6.3936, a touch above the CNY6.3934 median projection (Bloomberg survey).

Europe

Part of the limited reaction short-end of the European debt market derives from the fact that investors had not expected a change in ECB's monetary policy until the very end of next year, at the earliest. The surge in the delta strain had already emerged as a weight on the euro. We had put emphasis on the divergence with the US and saw it captured in the two-year interest rate differential between the US and Germany. The US premium had risen from around 90 bp in mid-September to 140 bp in the middle of this week. It has fallen back to about 128 bp today. Some observers had focused on the year-end adjustments of European banks and the shifting of liquidity through the cross-currency swap basis.

The new German coalition has been announced, and it will have its work cut out. A record number of new cases have been reported in Germany, and many countries are introducing new social restrictions. Portugal will try something a bit different. It is set to require people to work from home in early January for a week to avoid a spike in the virus after the holidays.

Hungary was more aggressive than expected yesterday. It raised its one-week deposit rate by 40 bp to 2.90%. Recall that on November 18, it had hiked the one-week deposit rate 70 bp to 2.50%. Two days earlier, it lifted the base rate 30 bp to 2.10%. The forint had fallen to a record low against the euro on November 23. The euro's high was just shy of HUF372, and it fell back to about HUF364.80 yesterday before jumping back to almost HUF369.50 today. It has steadied around HUF368 in the European morning.

The euro's downside momentum had begun easing as bids below $1.12 were being filled. The virus developments have spurred what appears to a be short-covering rally that has lifted the single currency through $1.1280, where a 460 mln euro option expires today. Nearby resistance is seen near $1.1300 and then last week's high near $1.1375. Sterling recorded a new low for the year near $1.3280 in late Asian turnover before finding support. It recovered to about $1.3335 so far. A move above yesterday's high (~$1.3355) could spur a move to $1.3400-$1.3425.

America

The dollar's rally has been fueled by the prospect of a divergence of monetary policy that favored the Fed over the ECB and BOJ. Indeed, since the November 10 surprise jump in the October CPI to above 6%, we had emphasized the likelihood that the Fed would have to taper quicker to give it the flexibility to lift rates earlier if needed. Since then, 4-5 Fed officials and several large banks have also underscored this possibility. However, this scenario is being called into question today, which is evident in the swaps markets and the Fed funds futures. The implied yield of the June 2022 Fed funds futures contract is 7.5 basis points lower, and the December 2022 contract implied yield is down 14.5 bp.

The US dollar rallied to CAD1.2775, its highest level since late September. It tests a downtrend line connecting the August (~CAD1.2950) and September (~CAD1.2900) highs. A convincing break of the trendline would signal a test on those earlier highs. We are inclined to see it hold but cannot be confident until CAD1.2720 yields. The Mexican peso was trampled before today amid concerns about the implications of President AMLO pulling Herrera's nomination for central bank head. Herrera is a seasoned hand, and although he worked closely with AMLO from the finance ministry, his appointment did not seem to jeopardize the independence of the central bank. Perhaps the market has been influenced by developments in Turkey, but the nomination of a less experienced and less known candidate has weighed on sentiment. The dollar, already bid, jumped to MXN22.1550, at its best level since September 2020. It has pulled back to around MXN21.83, which leaves it up around 1.2%. This would be the seventh consecutive decline in the peso. Support is seen around MXN21.60.

Tags: #USD,COVID,Currency Movement,Featured,Hungary,Mexico,newsletter,South Korea