Overview: US interest rates and the dollar turned higher following comments by the Fed's Vice Chairman Clarida, who appeared to throw his lot with the more hawkish members. The dollar recovered from weakness that had seen it fall to almost JPY108.70, its lowest level since late May, and lifted the euro to $1.19. Still, there has been little follow-through dollar or Treasury buying today. The euro and yen are marginally softer, but most other major currencies post...

Read More »Freedom Is Not Free You Have To Fight For It, The People Will Demand Decentralization

[unable to retrieve full-text content]Claudio begins his discussion with him taking a trip from Switzerland to Spain. On his travels he realized that the borders are open for cars and people were not asked for proof of vaccination. The people will begin to come together when they cannot function in everyday life because of inflation. People will look for decentralization because the globalist system does not work for the people. Freedom is not free you have to fight for it.

Read More »Freedom Is Not Free You Have To Fight For It, The People Will Demand Decentralization

Claudio begins his discussion with him taking a trip from Switzerland to Spain. On his travels he realized that the borders are open for cars and people were not asked for proof of vaccination. The people will begin to come together when they cannot function in everyday life because of inflation. People will look for decentralization because the globalist system does not work for the people. Freedom is not free you have to fight for it. All source links to the report can be found...

Read More »FX Daily, June 30: The Greenback is Firm into Quarter-End

Swiss Franc The Euro has fallen by 0.03% to 1.0959 EUR/CHF and USD/CHF, June 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The dollar is finishing the quarter on firm footing, gaining against most of the major currencies today. The euro is straddling the $1.1900 area, having begun the month above $1.22. Sterling has tested the $1.38 area. It had traded at a three-year high near $1.4250 at the start of the...

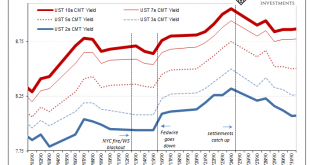

Read More »Three Things About Today’s UST Sell-off, Beginning With Fedwire

Three relatively quick observations surrounding today’s UST selloff. 1. The intensity. Reflation is the underlying short run basis, but there is ample reason to suspect quite a bit more than that alone given the unexpected interruption in Fedwire yesterday. At 12:43pm EST, most of FRBNY’s electronic services experienced an as-yet unexplained problem which interrupted service, including that of Fedwire. To this point, the New York branch has only confirmed the...

Read More »“The real danger comes from massive state dependence”

INTERVIEW WITH H.S.H. PRINCE MICHAEL OF LIECHTENSTEIN – Part I of II As we’re preparing to leave 2020 behind, a year that will most likely feature prominently in future history books, it is hard to look back on all that has happened without a sense of apprehension and uncertainty over what lies ahead. A lot has changed, economically, socially and politically, and those changes and challenges are unlikely to subside in the year to come. Whether they have paved the way for a darker...

Read More »Godfrey Bloom: “The great central banking experiment has failed.”

These days, most mainstream news reports are being monopolized by the pandemic, the covid vaccine and all the new rules and lockdowns that are being enforced across the Western world, and this near-obsessive focus comes at the expense of a lot other important developments. The last story that managed to “dethrone” covid from the headlines was the US Presidential election, and even that reporting was largely through the prism of the pandemic. And yet, the earth hasn’t actually stopped...

Read More »Second lockdown in Europe

Implications for precious metals investors As the long-awaited “second wave” of the corona pandemic sweeps through Europe, another round of severe restrictions, travel bans and rules that prevent the proper function of international business and trade threatens to once again disrupt all kinds of sectors, including the gold industry. Lockdown 2.0 Until only a couple of months ago, multiple heads of state, government officials and all kinds of experts were openly...

Read More »Second lockdown in Europe

Implications for precious metals investors As the long-awaited “second wave” of the corona pandemic sweeps through Europe, another round of severe restrictions, travel bans and rules that prevent the proper function of international business and trade threatens to once again disrupt all kinds of sectors, including the gold industry. Lockdown 2.0 Until only a couple of months ago, multiple heads of state, government officials and all kinds of experts were openly...

Read More »War on poverty, or just war on the poor?

As the dust is now begging to settle, both from the heights of the COVID panic and from the riots that shook the western world, we are starting to get an idea about where we stand after this unprecedented and tumultuous time. We are able to begin taking stock of the damage that was inflicted by the lockdowns and to evaluate the governmental efforts to help those affected and to provide support to the economy. More interestingly, we are finally in a position to see clearly who amongst...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org