In Die Mittelländische Zeitung, a Swiss doctor criticizes Switzerland’s preparations and response to Covid-19. He points to Lack of preparation by political decision makers Misleading communication by federal health officials Their apparent lack of awareness of academic work on the topic Arrogance in Switzerland and the West vis-à-vis China and other far eastern countries Sensationalist scare mongering in the media Calls for systematic infection of groups that are less at risk Informative...

Read More »Deaths Per Capita versus Confirmed Cases Per Capita

Data from April 6, 2020. Iceland and Luxembourg have many more confirmed cases per capita than other countries (either because they have more cases or better information). Mortality per confirmed case is highest in Italy, Spain, France, Belgium, Netherlands, UK. Source: Author’s calculations based on Johns Hopkins data and World Bank data.

Read More »FX Daily, April 6: Glimmer of Hope Lifts Markets

Swiss Franc The Euro has risen by 0.01% to 1.0554 EUR/CHF and USD/CHF, April 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Reports suggesting that some of the hot spots for the virus contagion appear to be leveling off, and this is helping underpin risk appetites today. The curve seems to be flattening in Italy, Spain, and France. In the US, there are some early signs of leveling off in NY, and now, the...

Read More »“Wirtschaftspolitik angesichts von Covid-19: Lastenteilung, aber keine Preismanipulationen (Economic Policy Responses to Covid-19: Burden Sharing, But no Price Distortions),” ÖS, 2020

Ökonomenstimme, 3 April 2020. HTML. Shorter version published in NZZ. The aggregate Covid-19 shock calls for transfers of the type a pandemic insurance would have brought about. But we must not distort relative prices. They have to reflect scarcity, to provide incentives to overcome it. (This applies within countries but also across.)

Read More »“Preise müssen sich frei bilden können (Prices Must Reflect Scarcity),” NZZ, 2020

NZZ, 2 April 2020. PDF. The aggregate Covid-19 shock calls for transfers of the type a pandemic insurance would have brought about. But we must not distort relative prices. They have to reflect scarcity, to provide incentives to overcome it. (This applies within countries but also across.)

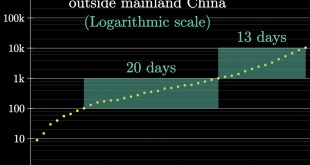

Read More »Corona’s Exponential Curve Slope Tracking, March 20

Exponential Growth and Corona The more mathematically versed folks under us have understood that it the slope (or steepness / derivation) of the Corona expansion curve is important. The following statistics is based on the Worldometer data, that rather shows the “first dimension”; we however, focus on the “second dimension”, the slope of the curve. This is far more useful, because for such exponential curve, the slope is key.The video explains the details....

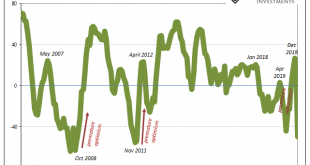

Read More »Stagnation Never Looked So Good: A Peak Ahead

Forward-looking data is starting to trickle in. Germany has been a main area of interest for us right from the beginning, and by beginning I mean Euro$ #4 rather than just COVID-19. What has happened to the German economy has ended up happening everywhere else, a true bellwether especially manufacturing and industry. The latest sentiment figures from ZEW as well as IFO are sobering. Taking the former first, it had been quite buoyant last year on the false...

Read More »Coronavirus: The Hammer and the Dance

An excellent article written by Tomas Pueyo and published on Medium. Summary of the article: Strong coronavirus measures today should only last a few weeks, there shouldn’t be a big peak of infections afterwards, and it can all be done for a reasonable cost to society, saving millions of lives along the way. If we don’t take these measures, tens of millions will be infected, many will die, along with anybody else that requires intensive care, because the healthcare system will have...

Read More »FX Daily, March 16: Monday Blues: Fed Moves Bigly and Stocks Slump

Swiss Franc The Euro has fallen by 0.01% to 1.0541 EUR/CHF and USD/CHF, March 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The Federal Reserve and central banks in the Asia Pacific region acted forcefully, but were unable to ease the consternation of investors. The Reserve Bank of New Zealand cut key rates by 75 bp. The Bank of Japan appears to have doubled its ETF purchase target to JPY12 trillion, and...

Read More »FX Daily, March 12: Trump Dump as Market Turns to ECB

Swiss Franc The Euro has fallen by 0.06% to 1.057 EUR/CHF and USD/CHF, March 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: After the Bank of England and the UK Treasury announced both monetary and fiscal support, the focus turns to the ECB, but the proximity of the US Congressional recess (next week) without strong fiscal measures being in place sucked the oxygen away from other issues. President Trump’s...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org