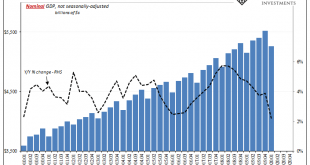

The numbers just don’t add up. Even if you treat this stuff on the most charitable of terms, dollar for dollar, way too much of the hole almost certainly remains unfilled. That’s the thing about “stimulus” talk; for one thing, people seem to be viewing it as some kind of addition without thinking it all the way through first. You have to begin by sizing up the gross economic deficit it is being haphazardly poured into – with an additional emphasis on...

Read More »“Tractable Epidemiological Models for Economic Analysis,” CEPR, 2020

CEPR Discussion Paper 14791, May 2020, with Martin Gonzalez-Eiras. PDF (local copy). We contrast the canonical epidemiological SIR model due to Kermack and McKendrick (1927) with more tractable alternatives that offer similar degrees of “realism” and flexibility. We provide results connecting the different models which can be exploited for calibration purposes. We use the expected spread of COVID-19 in the United States to exemplify our results.

Read More »FX Daily, April 22: Investors Catch Collective Breath, but Sentiment remains Fragile

Swiss Franc The Euro has risen by 0.09% to 1.0562 EUR/CHF and USD/CHF, April 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Risk-appetites appear to have stabilized for the moment. Most equity markets are higher. Japan and Malaysia were exceptions, but the MSCI Asia Pacific Index rose for the first time this week. In Europe, the Dow Jones Stoxx 600 is recouping about a third of yesterday’s loss. The S&P...

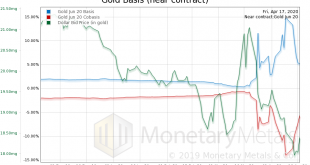

Read More »Crouching Silver, Hidden Oil Market Report 20 Apr

The price of gold has been up steadily for the last 30 days (with a few zigs and zags), now re-attaining the high it achieved prior to the big drop in March. Gold ended the week at $1,662. Alas, it’s not quite the same story in silver, whose price drop was bigger. Now its price blip is smaller. Silver ended the week at $15.19. One does not need to look to the gold-silver ratio, which is currently off the charts, to see that the world has gone mad. Silver, it has long...

Read More »“On the Optimal ‘Lockdown’ during an Epidemic,” CovEc, 2020

Covid Economics, April 2020, with Martin Gonzalez-Eiras. PDF. We embed a lockdown choice in a simplified epidemiological model and derive formulas for the optimal lockdown intensity and duration. The optimal policy reflects the rate of time preference, epidemiological factors, the hazard rate of vaccine discovery, learning effects in the health care sector, and the severity of output losses due to a lockdown. In our baseline specification a Covid-19 shock as currently experienced by the...

Read More »Virtual Seminars

IDEAS/RePEc’s Economics Virtual Seminar Calendar aggregates information. Some selected seminar series: Virtual macro seminar Princeton BCF HELP! Global virtual seminar series on FinTech Virtual digital economy seminar

Read More »“Corona und die Wirtschaft (Corona and the Economy),” Valor, 2020

Valor, 14 April 2020. PDF. Short interview on the implications of the Covid-19 shock for businesses, pensions, government finances, and asset markets. Longer online interview and video.

Read More »FX Daily, April 14: Equities are Firm but New Developments Needed or Risk Appetites may Become Satiated

Swiss Franc The Euro has fallen by 0.16% to 1.0538 EUR/CHF and USD/CHF, April 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Risk appetites have returned today after taking yesterday off. The MSCI Asia Pacific Index advanced every day last week, slipped yesterday, and jumped back today. Most of the national benchmark advanced at least 1.5%, and the Nikkei led the way with a 3% rally to reach its best level...

Read More »“On the Optimal ‘Lockdown’ during an Epidemic,” CEPR, 2020

CEPR Discussion Paper 14612, April 2020, with Martin Gonzalez-Eiras. PDF (local copy). We embed a lockdown choice in a simplified epidemiological model and derive formulas for the optimal lockdown intensity and duration. The optimal policy reflects the rate of time preference, epidemiological factors, the hazard rate of vaccine discovery, learning effects in the health care sector, and the severity of output losses due to a lockdown. In our baseline specification a Covid-19 shock as...

Read More »“On the Optimal ‘Lockdown’ during an Epidemic,” CEPR, 2020

CEPR Discussion Paper 14612, April 2020, with Martin Gonzalez-Eiras. PDF (local copy). We embed a lockdown choice in a simplified epidemiological model and derive formulas for the optimal lockdown intensity and duration. The optimal policy reflects the rate of time preference, epidemiological factors, the hazard rate of vaccine discovery, learning effects in the health care sector, and the severity of output losses due to a lockdown. In our baseline specification a Covid-19 shock as...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org