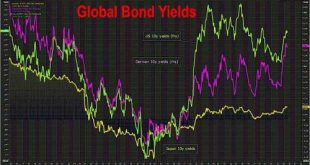

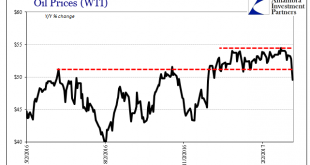

U.S. index futures point slightly lower open. Asian shares rose while stocks in Europe fell as energy producers got caught in a downdraft in oil prices and reversed an earlier gain after Goldman unexpectedly warned that WTI could slide below $40 absent "show and awe" from OPEC. The dollar rose, hitting a four-month high against the yen and bonds and top emerging market currencies were back under pressure on Tuesday, following last week’s hawkish rhetoric from central bankers. Nonetheless,...

Read More »Bi-Weekly Economic Review: The Return of Economic Ennui

The economic reports released since the last of these updates was generally not all that bad but the reports considered more important were disappointing. And it should be noted that economic reports lately have generally been worse than expected which, if you believe the market to be fairly efficient, is what really matters. The disappointing employment report and the generally less than expected tone of the reports...

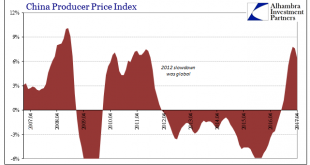

Read More »China Inflation Now, Too

We can add China to the list of locations where the near euphoria about inflation rates is rapidly falling apart. This is an important blow, as the Chinese economy has been counted on to lead the world out of this slump if through nothing other than its own sheer recklessness. “Stimulus” was all the rage one year ago, and for a time it seemed to be producing all the right effects. This was “reflation”, after all....

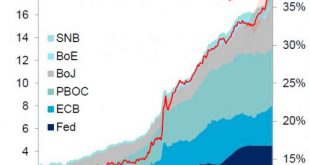

Read More »A Problem Emerges: Central Banks Injected A Record $1 Trillion In 2017… It’s Not Enough

Two weeks ago Bank of America caused a stir when it calculated that central banks (mostly the ECB & BoJ) have bought $1 trillion of financial assets just in the first four months of 2017, which amounts to $3.6 trillion annualized, “the largest CB buying on record.” Aggregate Balance Sheet Of Large Central Banks, 2000 - 2017 - Click to enlarge BofA’s Michael Hartnett noted that supersized central bank...

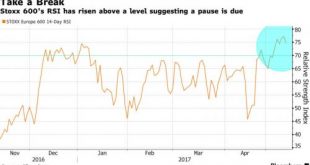

Read More »Europe, US Futures Slip Despite Brent Bouncing Back To $51

Asian stocks rose lifted by commodity names; European equities trade mostly lower but with little in the way of conviction or firm direction while the Italian banking index is at the highest level in a year following domestic earnings; S&P index futures are modestly in the red after the cash market closed at a record high Wednesday and investors prepared for earnings from retailers; we expect the now general vol selling program to promptly lift the S&P into new all time highs minutes...

Read More »Gold Bullion Coin Worth $4 Million, Stolen in Berlin Museum Heist

Gold Bullion Coin Worth $4 Million, Stolen in Berlin Museum Heist - Gold coin called ‘Million Dollar Gold Coin’ or ‘Big Maple Leaf’ stolen from Berlin museum early on Monday- World's purest gold coin and in the Guinness Book of Records for its purity of 99999 fine gold- Gold coin was legal tender, investment grade, bullion coin and only 5 other coins were minted- The other 'Million Dollar Gold Coin' is still available for sale by GoldCore safely stored in vaults in...

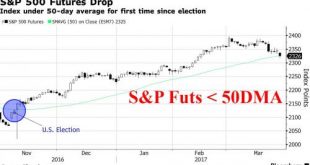

Read More »Global Stocks Slide, S&P Futures Tumble Below 50DMA As “Trump Trade” Collapses

Global stocks are lower across the board to start the week, as concerns about Trump's administration to pull off a material tax reform plan finally emerge, pressuring S&P futures some 20 points lower this morning, following European and Asian shares lower, while crude oil prices fall unable to find support in this weekend's OPEC meeting in Kuwait where a committee recommended to extend oil production cuts by another 6 months. Safe havens including the yen and bonds climbed as did gold,...

Read More »Time, The Biggest Risk

If there is still no current or present indication of rising economic fortunes, and there isn’t, then the “reflation” idea turns instead to what might be different this time as compared to the others. In 2013 and 2014, it was QE3 and particularly the intended effects (open ended and faster paced, a bigger commitment by the Fed to purportedly do whatever it took) upon expectations that supposedly set it apart from the...

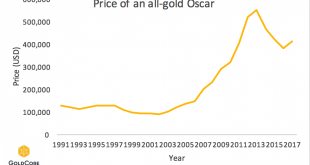

Read More »The Oscars – Gold Plated And Debased Like The Dollar

Submitted by Jan Skoyles via GoldCore.com, The Oscars – Worth Their Weight in Gold? 89th Oscars to air this weekend Oscars have been dipped in 24 karat gold since 1929 If the Oscars were made of solid gold they would weigh 330 ounces 330 ounces of gold is worth $408,210 at today’s prices (nearly €400k & £330k) Only some $630 worth of gold in Oscar statue Oscars cannot be sold due to regulations Steven Spielberg keeps his gold Oscar with the Academy for...

Read More »The Oscars – Gold Plated and Debased Like Dollar

The Oscars - Worth Their Weight in Gold? 89th Oscars to air this weekend Oscars have been dipped in 24 karat gold since 1929 If the Oscars were made of solid gold they would weigh 330 ounces 330 ounces of gold is worth $408,210 at today's prices (nearly €400k & £330k) Oscars cannot be sold, making them a tricky investment piece Steven Spielberg keeps his gold Oscar with the Academy for ‘safe-keeping’ Shows importance of owning gold in safest ways Price of gold has climbed from $20.67...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org