Investec Switzerland. The Swiss Market Index (SMI) is set to post one of its largest falls since February this week as growing uncertainty around the result of Britain’s referendum on its membership of the 28-nation European Union bloc led to a global sell-off of company shares. © Evgenyi Gromov | Dreamstime.com Stocks around the world tumbled and demand for safe haven assets sent sovereign bond yields to record lows as new opinion polls fueled anxiety that the UK will vote to leave the European Union on 23rd June. The Swiss franc, which is often seen as a safe haven currency, has appreciated more than 2% since the start of the month, hitting a 2016 high against the euro on Tuesday this week. Yields on Switzerland’s 30-year government bonds dropped below zero for the first time on record. The anxiety around the Brexit vote has also influenced central-bankers who are holding off on policy changes. The Bank of Japan, The Swiss National Bank and the Federal Reserve all decided not to change interest rate policies this week. US Federal Reserve policy makers added that they are becoming less confident in their economic outlook, making the prospect of multiple rate hikes in 2016 less likely. In Switzerland, the Swiss Economic Institute (KOF) announced that it expects the Swiss economy to grow at 1% this year.

Topics:

Investec considers the following as important: Brexit, Brexit SMI, Brexit Swiss franc, Business & Economy, Editor's Choice

This could be interesting, too:

Investec writes The global brands artificially inflating their prices on Swiss versions of their websites

Investec writes Swiss car insurance premiums going up in 2025

Investec writes The Swiss houses that must be demolished

Investec writes Swiss rent cuts possible following fall in reference rate

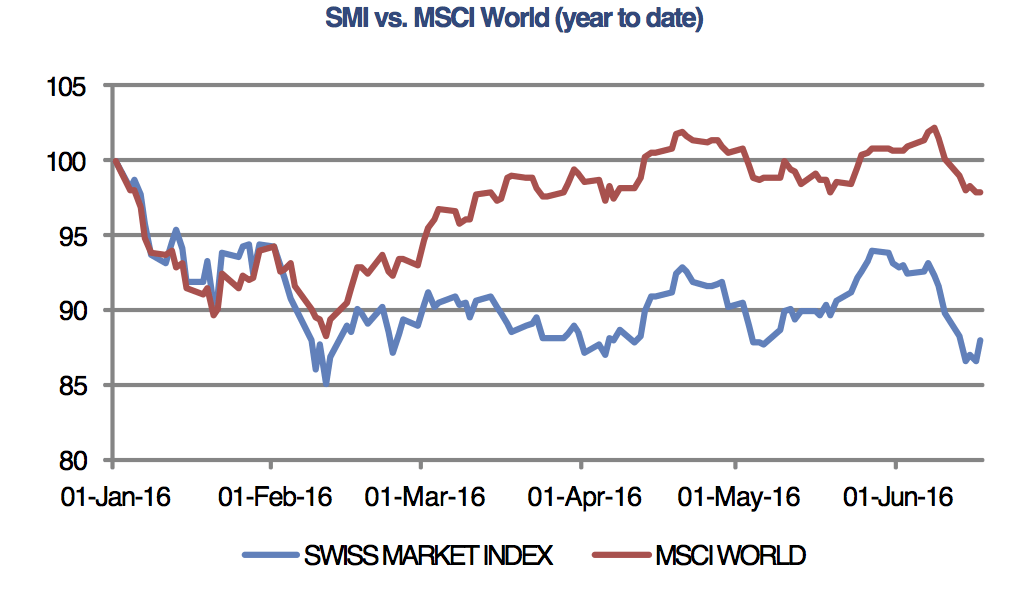

The Swiss Market Index (SMI) is set to post one of its largest falls since February this week as growing uncertainty around the result of Britain’s referendum on its membership of the 28-nation European Union bloc led to a global sell-off of company shares.

© Evgenyi Gromov | Dreamstime.com

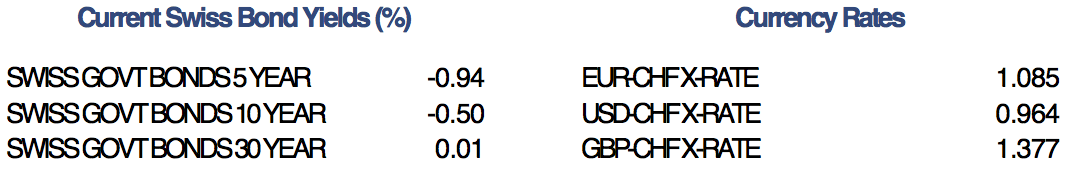

Stocks around the world tumbled and demand for safe haven assets sent sovereign bond yields to record lows as new opinion polls fueled anxiety that the UK will vote to leave the European Union on 23rd June. The Swiss franc, which is often seen as a safe haven currency, has appreciated more than 2% since the start of the month, hitting a 2016 high against the euro on Tuesday this week. Yields on Switzerland’s 30-year government bonds dropped below zero for the first time on record.

The anxiety around the Brexit vote has also influenced central-bankers who are holding off on policy changes. The Bank of Japan, The Swiss National Bank and the Federal Reserve all decided not to change interest rate policies this week. US Federal Reserve policy makers added that they are becoming less confident in their economic outlook, making the prospect of multiple rate hikes in 2016 less likely.

In Switzerland, the Swiss Economic Institute (KOF) announced that it expects the Swiss economy to grow at 1% this year. The institute’s report released yesterday cited the strong Swiss franc and the continuing weakness of the global economy as reasons for the modest figure. According to the Institute, weakening prospects for the global economy are likely to mute Swiss GDP growth rate in 2017 to 1.9%.

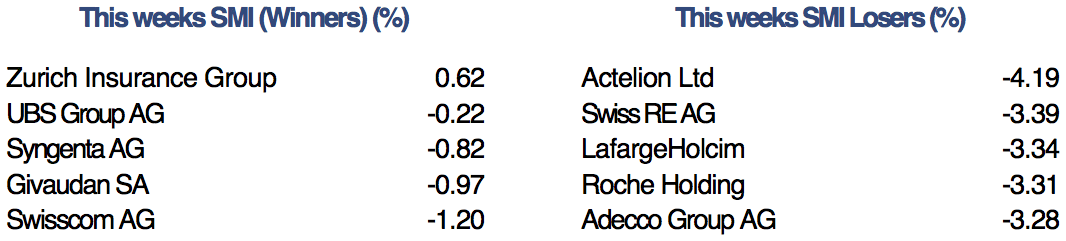

In company news, the risk of a “Brexit” vote along with fresh signs from central bankers that interest rates will stay lower for longer hit the banking sector particularly hard this week. The Swiss National Bank further warned that UBS and Credit Suisse will likely need to raise an extra 10 billion Swiss francs to meet new leverage requirements, adding further gloom to the sector’s outlook.