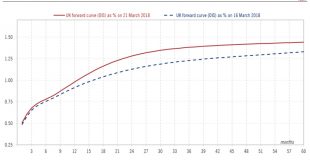

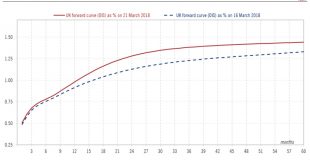

Recent positive developments in the United Kingdom may brush a supportive picture for sterling in the short term, but the long-term outlook remains cloudy at best.The transitional deal reached between the UK and the European Union (EU) on 20 March and the strong job market report on 21 March plead for a more positive short-term outlook for sterling than previously thought. We are therefore revising our projections upward for sterling over the next three, six and 12 months versus the USD....

Read More »British pound – Smoother transition, stronger sterling

Recent positive developments in the United Kingdom may brush a supportive picture for sterling in the short term, but the long-term outlook remains cloudy at best.The transitional deal reached between the UK and the European Union (EU) on 20 March and the strong job market report on 21 March plead for a more positive short-term outlook for sterling than previously thought. We are therefore revising our projections upward for sterling over the next three, six and 12 months versus the USD....

Read More »Banking 2.0 steht noch in den Sternen

Bild: Pixabay Schweizer Banken und Dienstleister sehen FinTech-Innovatoren nicht mehr als disruptiv an, sondern inzwischen als potentielle Partner – aber sie suchen immer noch Lösungen für Banking 2.0. Gleich mehrere Veranstaltungen versuchten darauf eine Antwort zu finden. Zum vierten Male veranstaltete SIX den Zürcher Hackathon (Wortschöpfung aus "Hack" und "Marathon") im Schiffsbau Zürich. 132...

Read More »5 Investmentthesen zum chinesischen “Jahr des Hundes”

Ein chinesischer Chow Chow Hund. Bild: Pixabay Das chinesische Neujahrsfest wird am 16. Februar 2018 nach dem "Jahr des Hahns" das "Jahr des Hundes" einleiten. Der Stratege Michael Power und die Portfoliomanager Greg Kuhnert sowie Archie Hart von Investec AM entwickelten für das neue Jahr fünf Thesen, welche für Investoren relevant sein könnten. Aus traditioneller Sichtweise ist das "Jahr des...

Read More »FX Weekly Preview: Recovering from Too Much of a Good Thing?

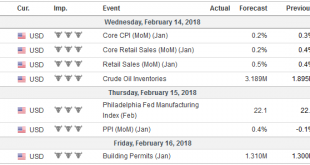

Too much of a good thing is bad. That, in a nutshell, is an important insight that Hyman Minsky offered about the financial sector, but has broader application. The low volatility that has been a characteristic of the capital markets for the past few years spurred financial innovation to profit from it. A broad range of financial instruments constructed to profit from continued low volatility, such as exchange-traded...

Read More »In Ökostrom investieren

Bild: Reinhard Sandbothe (Pixelio), Symbolbild Für die nächsten 12 Monate rechnet Paul Flood, Newton (BNY Mellon IM) sowohl in den Industriestaaten als auch in den rasant wachsenden Schwellenländern mit einem Anstieg der Investitionen, da die Kosten für saubere Technologien weiter zurückgehen. So können Investments in erneuerbare Energien stabile und nachhaltige Einnahmen generieren. Der Trend...

Read More »FX Daily, December 12: UK Front and Center, but Sterling is Laggard in Today’s Move Against the Dollar

Swiss Franc The Euro has fallen by 0.15% to 1.1651 CHF. EUR/CHF and USD/CHF, December 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Trends The US dollar is trading with a lower bias against most of the major and emerging market currencies. The upside surprise in Sweden’s inflation is helped the krona recover from its recent slide. It is the strongest of the majors, gaining...

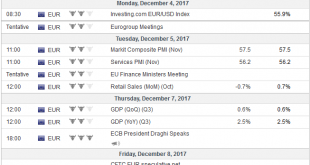

Read More »FX Daily, December 08: Brexit Talks Move to Stage II, While Greenback Remains Firm

Swiss Franc The Euro has fallen by 0.21% to 1.1679 CHF. EUR/CHF and USD/CHF, December 08(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Sufficient progress will be judged to have been made, and negotiations of the separation between the UK and EU will be allowed to enter the second stage. The formal decision will be made at next week’s EU summit. To be sure, “sufficient...

Read More »FX Weekly Preview: Politics may Continue to Overshadow Economics

The new monthly cycle of high frequency economic data has begun. The manufacturing PMI shows the synchronized global recovery is continuing. The service sector and composite PMI will be reported in the week ahead. They are unlikely altering the general expectation for robust growth in Q4. Even the disappointing US auto sales (17.35 mln seasonally-adjusted annual pace vs. expectations for 17.5 mln and 18.0 mln in...

Read More »Nachhaltige Fonds knacken 100 Milliarden-Franken-Grenze

Bild: Pixabay Nachhaltige Investmentfonds sind in der Schweiz in den letzten zehn Jahren doppelt so schnell gewachsen wie der Gesamtmarkt. Vor allem bei institutionellen Anlegern, aber auch bei jüngeren, gebildeten und meist weiblichen Privatanlegern werden sie beliebter. Das zeigt eine Studie des Instituts für Finanzdienstleistungen Zug IFZ der Hochschule Luzern. Nachhaltige Anlagen waren früher...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org